Photographs: Amit Dave/Reuters

Every year, India’s finance ministers face one of the most daunting economic challenges – presenting the annual Budget.

Over the years, these Budgets have ushered in reforms, doled out sops for the industry, common man and charted the course of the economy.

This year, the expectations are very high as this will be Modi government’s first Budget.

Prime Minister Narendra Modi won the mandate of the people with his development and reforms agenda. Will this Budget see his vision translate into reality?

Good economics makes for good politics, so it’s time to see if the Modi government lives up to the promise of delivering a Budget with reforms, sops and major initiatives to transform the Indian economy.

Of all the Budgets presented over the years, Chidambaram under the leadership of Manmohan Singh is hailed for presenting the dream Budget in 1997, which unveiled the roadmap for reforms and lowered tax rates.

We take you through the various Budgets presented during this decade and give you an opportunity to vote for the best budget!

on the Budgets from 2000 till 2013…

Here’s your chance to vote for the Best Budget of this decade!

Please click here for the Complete Coverage of Budget 2014 -15

Vote for the Best Budget of this decade!

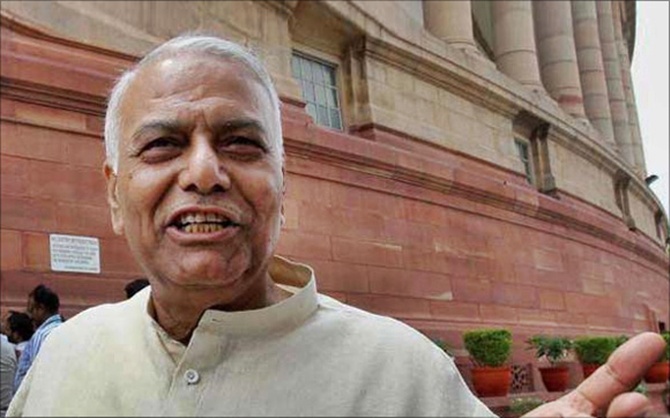

Image: Former finance minister Yashwant Sinha.Photographs: Reuters

Union Budget 2000 – 2001

Finance Minister: Yashwant Sinha

Highlights

Personal taxation

- Ten per cent income tax surcharge to continue.

- No changes in personal income tax rates and exemption limit.

- No change in service tax rates.

- Bonanza for computer-buyers: Sharp cuts in customs duty rates.

- Investment in second house eligible for capital gains exemption.

- A 20 % rebate extended to repayment of housing loans upto Rs 20,000 a year.

- Tax incentives available for housing sector extended for another two years upto 2003.

- No income tax on pension and family pension of gallantry award winners.

- Women tax payers to get an additional tax rebate of Rs 5,000.

- Tax rebate for senior citizens raised to Rs 15,000 from Rs 10,000.

Corporate taxes

- Surcharge on non corporate taxable income over Rs 150,000 raised from ten per cent to 15 per cent.

- Approval of tax authorities not needed for Voluntary Retirement Schemes or VRS.

- Hundred per cent deduction for corporate donations for development of sports.

- Hundred per cent tax deductions for setting up vocational training institutes in rural areas.

- Tax deductions increased for higher education loans.

- Govt equity in all non-strategic PSUs to be brought down to 26 per cent and below.

- Govt eases tax norms for venture capitalists.

- Govt to 'consider' recapitalisation of weak banks.

- Access of Indian companies to foreign portfolio investment made more flexible.

- Tax regime liberalised and SEBI to be made single-point nodal agency for guidelines.

- Plan outlay for central PSUs in power sector raised from Rs 76.26 billion to Rs 91.94 billion.

- Automatic route for overseas investment by Indian corporates liberalised.

- Indian firms to get more flexibility for undertaking capital account transactions especially for acquisitions for business abroad in the knowledge-based sectors.

Other key measures

- Key medical items like oxygen, gloves, etc, exempted from excise.

- 2.5 million dwelling units to be provided in rural areas.

- India Awas Yojana to provide more than 1.2 million houses for the people below poverty line. Rs 15.01 billion provided for this.

- Assistance to construct 100,000 houses for families below annual income Rs 32,000.

- National Housing Bank to provide refinance for construction of 150,000 houses under Golden Jubilee Rural Housing Finance Scheme.

- Rs 1 billion additonal equaity support to HUDCO for building 900,000 houses.

- A new group insurance scheme Janashree Bima Yojana to be introduced to provide social security. The insurance cover will be Rs 20,000 in case of natural death, Rs 50,000 in case of accidental death or permanent disability and Rs 25,000 for partial permanent disability.

...

Please click here for the Complete Coverage of Budget 2014 -15

Vote for the Best Budget of this decade!

Photographs: Reuters

Union Budget 2001-2002

Finance Minister: Yashwant Sinha

Highlights

Taxation

- No change in Direct tax rates

- All surcharges on corporate and non-corporate taxes except for calamity relief abolished

- One by six schemes extended to all Urban areas

- TDS extended to commission and brokerage incomes

- Wind Fall income - lotteries, games shows-at 30 per cent

- All companies to file a mandatory return

- No tax exemptions on interest paid on ECBs

- No tax gains if invested in Primary issues

- Dividend tax reduced to 10 per cent

- 20 year Tax holiday for core infrastructure

- 10 years tax holiday for infra in airports

- 15 years tax holiday for telecom projects

- Interest exemption on housing loans raised to Rs 150,000

- Foreign telecast channels to be taxed

Indirect taxes

- Rate structure rationalised: One CENVAT rate of 16 per cent and one special excise duty of 16 per cent introduced

- Services Tax net widen

- 10 per cent surcharge on Customs Duty abolished

- Peak Custom Duty down to 35 per cent

- Customs Duty on select and IT products down to 15 per cent

- Second hand car customs duty at 180 per cent

- Customs Duty on cement and clinkers down to 25 per cent

- Duty on Gold reduced to Rs 250 per 10 grams

- Peak Customs Duty to be reduced to 20 per cent in 3 years

- FIIs can invest up to 49% in Domestic Companies

- Move towards Capital Account Convertibility

- FIIs can invest up to 49% in Domestic Companies

- Domestic Companies can invest 10 times their export earnings or 100 million abroad

- RBI to issue guidelines for companies

- FDI in NBFC upto 100% thru automatic route

Divestment

- Rs 120-billion target - Divestment of 12 PSUs to be completed this years; including VSNL, Air-India and Maruti

- Rs 50 billion set aside for outlay for infrastructure and social sectors

- Second-hand car imports liberalised

- Prices decontrolled: Urea Prices to be decontrolled by 2006

- Decontrol of Sugar; Future and Options to be introduced

Please click here for the Complete Coverage of Budget 2014 -15

Vote for the Best Budget of this decade!

Photographs: Reuters

Union Budget 2002 – 2003

Finance Minister: Yashwant Sinha

Highlights

Direct Taxes

- Tax rates remained unchanged except in case of foreign companies where rate reduced from 48 to 40 per cent. The 2 per cent earthquake surcharge replaced by a 5 per cent general surcharge.

- Taxes borne by the employer in respect of perquisites will not be grossed up.

- Dividend income, which bore a tax of 10 per cent in the hands of distributing companies and mutual funds, will now be taxed in hands of recipients

- Instead of being fully tax-free, profits of units in export processing zones and software technology parks will be tax-free to the extent of 90 per cent.

- Specified Individuals and Hindu Undivided Families will have to withhold tax at source.

Indirect Taxes

- Peak rate of customs duty reduced from 35 per cent to 30 per cent.

- Customs duty on the baggage of persons transferring residence to India reduced, and exemption limit raised.

- A further list of ten new services notified under the provisions of service tax.

- More items will be taxed at the CENVAT rate of 16 per cent.

- Special Excise Duty of 8 per cent abolished on all except 8 items.

- Nine new items will bear CENVAT on the basis of the Maximum Retail Prices.

- Revised central Excise Rules, 2002 and CENVAT Credit Rules, 2002 enacted.

Other measures

- Sectoral caps removed on FII investments; now the share of foreign portfolio investors in the equity of companies can be raised to any limit set by their boards.

- Dereservation of over 50 items from SSI list.

- Foreign banks allowed to set-up subsidiaries in India; hitherto they could only open branches.

- NRIs' non-convertible accounts abolished; they will now be allowed to repatriate their Indian rupee earnings in respect of rent, pensions, interest etc.

- Price control on petroleum products will go.

...

Please click here for the Complete Coverage of Budget 2014 -15

Vote for the Best Budget of this decade!

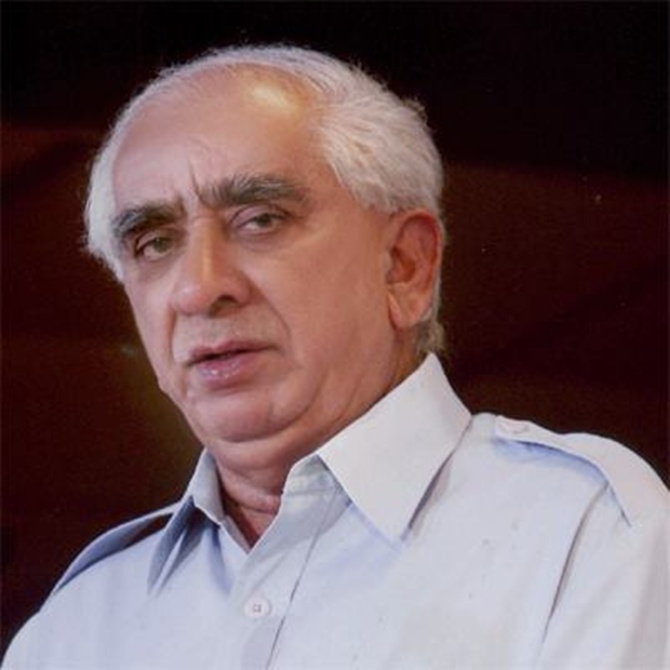

Image: Jaswant SinghPhotographs: Courtesy, Jaswant Singh's Facebook

Union Budget 2003 – 2004

Finance Minister: Jaswant Singh

Highlights

Personal taxation

- Standard deduction of 40% or Rs 30,000 whichever is less for salary till Rs 5 lakh, above Rs 5 lakh, 20,000.

- PF, small saving rates reduced by 1%.

- 5% surcharge on individual IT, income above Rs 8,50,000 to pay 10% surcharge.

- Under a new health insurance scheme, an individual would have to pay one rupee per day as premium for 365 days, Rs 1.50 per day for a family of five and Rs two per day for a family of seven including dependents and will be eligible for a benefit of Rs 30,000 in case of hospitalisation. In the event of death, the family would get Rs 25,000.

- Income tax and corporate tax rates remain same.

- Five per cent surcharge levied last year for country's security halved to 2.5%, while for individuals there will be no surcharge.

- Individuals with income of over Rs 8.5 lakh to pay 10% surcharge towards security of the country.

Key measures

- Government to maintain tax concessions on housing interest loans.

- Government to give tax rebate of Rs 12,000 per child for education.

- Standard tax deduction rate boosted to 40 per cent of salary up to Rs 500,000.

- Senior citizens' income up to Rs 153,000 to be fully tax exempt.

- India to continue proactive policy of pre-paying high-cost external debt.

- India to buy back high-interest government bonds from banks.

- States to swap all loans with interest rates of more than 13 per cent by 2004-05. States' debt swap to cut interest costs by Rs 810 billion.

- Tax holiday for domestic, satellite telecom firms for 1 year.

- Outsourcing PAN process, only 2% IT returns to be scrutinized.

- Electronic filing of individual IT returns, one page form from April 1.

- 3-tier excise structure 8, 16 and 24.

- Tyres, soft drinks excise cut from 32% to 24%.

- Excise duty on biscuits/boiled sweets down from 16% to 8%.

FDI

- Overseas investment limit for corporates hiked to 100% of net worth.

- FDI in private banks increased from 49% to 74%, voting right limitations to be amended.

- Rs 1.50 additional excise duty per litre to be imposed on light speed diesel.

...

Please click here for the Complete Coverage of Budget 2014 -15

Vote for the Best Budget of this decade!

Image: P ChidambaramPhotographs: Reuters

Union Budget 2004 – 2005

Finance Minister: P Chidambaram

Highlights

Taxation

- I-T exemption limit raised to Rs 100,000

- 1.4 crore tax assessees to go out of the net as a result.

- No change in tax slabs, says FM

- Section 80(DD) and Section 80 (U) will be given to persons suffering from autism, cerebral palsy and multiple disability.

- Contributions to Contributory Pension Scheme exempted form tax. Terminal Tax to be paid at the time of receipt.

- Loopholes in gift tax exemption to be plugged.

For corporates

- Encouragement to the automobile sector. Industry to be provided 150 per cent exemption for in-house research and development.

- Rural hospitals with 100 beds to be get 80(I)(B) concessions.

- Capital Gains Tax revamped on securities. Long-term capital gains tax abolished.

- Tonnage tax introduced for shipping industry but will have option to pay either tonnage tax or corporate tax.

- Equity related Mutual Fund will continue to be exempt from Dividend Tax.

- TDS and TCS being extended to more activities.

- Companies doing research on bio-technology to get 100 per cent tax exemption for ten years.

Indirect taxes

- Peak rate of Customs Duty to continue at 20 per cent.

- The concession of tax exemption of new industries in J and K extended by one more year to April one, 2005.

- Reduction in customs duty in non-alloy steel from 15 per cent to ten per cent, excise duty raised from eight per cent to 12 per cent.

- Number of concessions on excise duty for agriculture.

- Tractors will be fully exempted from excise duty against existing 16 per cent.

- Dairy machinery also fully exempted. Spades and shovels also fully exempted.

- Health sector to be provided a number of concessions.

- In the health sector, braille, braille typewriters, braille computers fully exempted from customs duties.

- All ambulances to be exempt from customs duty.

- Diagnostic kits for all types of epidemics exempted from Income-Tax.

- Proposed to levy excise duty on contact lens in a bid to promote CENTVAT.

- Complete exemption of excise duty on crutches and wheel chairs.

- All types of hepatitis kits will be exempt from duty.

- Full exemption of excise duty for computers.

Other Highlights

- No change in existing interest rates on small savings. But senior citizens to get a new savings scheme with a rate of 9 per cent.

- Government would ensure that a child remains in school for at least eight years and does not go hungry.

- The Government will ensure that adequate funds are made available for universalisation of primary education for all children.

- It proposes to launch new food for work programme to step up employment in rural areas. Rs 6,000 crore is provided under various schemes and more funds would be made available if needed.

- Rs 3,500 crore subsidy for Antodaya scheme under which, foodgrains would be provided for the poorest of the poor.

- Micro finance to be stepped up. Micro enterprises by self help groups to be encouraged.

- Work has started on the national employment guarantee programme to provide 100 days work for one member of family.

- Proposed to increase allocation for checking AIDS and other epidemics from Rs 6,000 crore (Rs 60 billion) to over Rs 7,000 crore (Rs 70 billion).

- Airports, sea ports and tourism would be the focus of growth in the infrastructure sector.

- Investment Commission will be established to make India an attractive destination for investment.

...

Please click here for the Complete Coverage of Budget 2014 -15

Vote for the Best Budget of this decade!

Photographs: Reuters

Union Budget 2005 – 2006

Finance Minister: P Chidambaram

Highlights:

Personal taxation

- Income upto Rs 1,00,000 per annum exempted from tax

- Income between Rs 1-1.5 lakh to be taxed at 10%

- Rs 1.5-2.5 lakh income to be taxed at 20%

- Income above Rs 2.5 lakh to be taxed at 30%

- Exemption level for women at Rs 1.25 lakh

- Exemption level for senior citizens at Rs 1.5 lakh

- Consolidated limit of Rs 1 lakh of saving to be deducted from income before calculating tax

- Standard deduction removed from tax structure

- 0.01 per cent tax on withdrawal of over Rs 10,000 in cash from banks on a single days

Indirect taxes

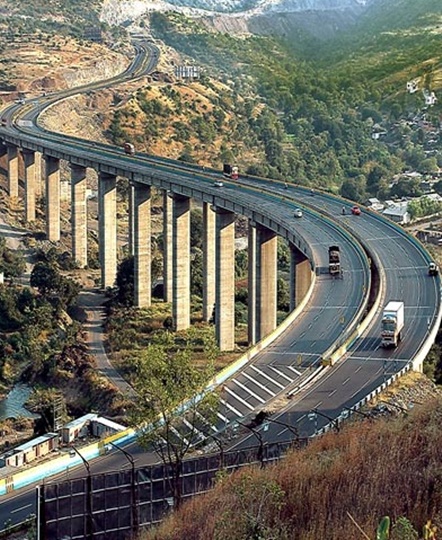

- Govt proposes 50 paise per litre cess on petrol and diesel to fund highways

- Customs duty on crude petroleum to be cut to 5% from 10%

- LPG for domestic consumption and subsidised kerosene not to attract customs and excise duties

- Customs duty on motor spirit, high speed diesel and other petroleum products to be lowered to 10% from 15-20%

- Specific rate on cigarettes to be increased by about 20 per cent

- Other tobacco products, including gutka, chewing tobacco, saunf and pan masala to attract 10% surcharge on ad valorem basis

- Fringe Benefits Tax of 30 per cent on benefits collectively enjoyed by employees

- Transport services for workers and staff and canteen services in an office, factory exempted from tax

- Peak customs duty for non-agricultural products to be reduced to 15 per cent from 20 per cent

- Re 1 per kg surcharge on tea to be abolished, Re 1 per kg excise duty on refined edible oils and Rs 1.25 per kg on vanaspati to be removed

- Matches made by mechanised and semi-mechanised sector to pay 12 pc excise duty against the present 16%

- Securities transaction tax hiked to 0.02 per cent on all categories of trade

- Excise duty on imitation jewellery to be cut to 8% from 16%

- 2% excise duty on branded jewellery, unbranded exempted

- Customs duty on specified capital goods and all inputs for manufacture of IT Agreement bound items to be removed

- Countervailing duty of 4 pc on imports of IT agreement bound items, IT software will be exempt

- Customs duties on cut flower to be raised from 30% to 60%, Customs duty on cloves to be lowered to 35%

- Customs duty on all other agricultural goods to be same, Customs duty on most textile machinery reduced to 10% from 20%

- Customs duties on primary and secondary metals to be cut to 10% from 15%

- Customs duty on polyester and nylon chips, textile fibres, yarns and intermediates, fabrics and garments to be cut to 15% from 20%

- Service tax to remain at 10%

- Domestic companies to pay 30% corporate income tax and 10% surcharge

- No change in the tax regime for foreign companies

- Polyester filament yarn, tyres and air conditioners to attract 16% CENVAT against the present 24%

- CENVAT on motors cars and aerated drinks remain unchanged at 24%

- Customs duty on 9 specified machinery used in pharma and biotechnology sectors to be cut to 5%

- Exemption from tax on agreements to acquire aircraft to aircraft engines on lease to be extended to September 30, 2005.

...

Please click here for the Complete Coverage of Budget 2014 -15

Vote for the Best Budget of this decade!

Photographs: Reuters

Union Budget 2006 – 2007

Finance Minister: P Chidambaram

Highlights

Personal taxation

- No changes in the rates of personal income tax, which will remain as they are currently.

- No change in corporate income tax rate.

- No new taxes on income.

- One by six scheme for filing of income tax returns has been abolished.

Indirect taxes

- Services tax net to be increased which include ATM operations, maintenance and management, share transfers, registration, international air travel excluding economy class, sponsorship other sports events, auctioneers, ship management and travel on cruise.

- 25 per cent across the board increase in securities transaction tax.

- Cooperative lending banks and rural development banks to be exempted from taxes under Section 80(B).

- Fixed deposits in scheduled commercial banks with at least five year maturity will get tax exemption for savings under section 80C of Income Tax Act.

- The Rs 10,000 exemption limit for investment in pension funds under Section 80CCC has been removed but these investments would be brought under Sec.80C subject to a ceiling of Rs 1 lakh.

- Donations to only religious institutions will be exempted from tax.

- Minimum alternative tax on corporates increased from 7.5 per cent to 10 per cent.

- More transactions to come under PAN.

- Constituency allowances of MLAs to be treated as

- constituency allowances of MPs for income tax purposes.

- Banking cash transaction tax introduced last year will

- continue. In one bank branch in Chandni Chowk, laundering to the tune of Rs 1,500 crore was detected.

- Fringe Benefit Tax modified. Threshold limits raised, but FBT will remain as it is justified for ensuring horizontal equity.

- Minimum alternative tax on corporates increased from 7.5 per cent to 10 per cent.

...

Please click here for the Complete Coverage of Budget 2014 -15

Vote for the Best Budget of this decade!

Photographs: Reuters

Union Budget 2007–2008

Finance Minister: P Chidambaram

Highlights:

Personal Taxation

- While Chidambaram kept income tax limit unchanged, he increased the threshold limit by Rs 10,000 giving every assessee a relief of Rs 1,000.

- Deduction in respect of medical insurance under Section 80 (D) increased to Rs 15,000 and Rs 20,000 for senior citizens.

- Exemption limit for women was increased to Rs 145,000 and for senior citizens to Rs 195,000.

- Dividend distribution tax raised from 12.5 to 15 per cent.

- ESOPs to be brought under FBT.

- Expenditure on samples and free distribution items to be exempted from fringe benefit tax.

- Withdrawals by central and state governments exempted from Banking Cash Transaction Tax. The limit for individuals and HUF raised from Rs 25,000 to Rs 50,000.

- Two lakh people to benefit out of service tax exemption. Govt to lose Rs 800 crore as a result.

Indirect taxes

- Corporate tax: No surcharge for firms with a taxable income of Rs 1 crore (Rs 10 million) or less.

- Tax free bonds to be issued by state-owned urban local bodies.

- Five year tax holiday for two, three, four star hotels and convention centres with a seating capacity of 3,000 in NCT of Delhi, Gurgaon, Ghaziabad, Faridabad and Gautam

- Minimum Alternate Tax being extended.

- Peak customs duty rate on non-agricultural items reduced from 12.5 to ten per cent.

- All coking coal fully exempted from duty.

- Duties on seconds and defective reduced from 20 to ten per cent.

- Customs duty on polyster to be reduced from ten per cent to 7.5 per cent.

- Duty on pet food reduced from 30 per cent to 20 per cent.

- Duty on sunflower oil to be reduced by 15 per cent.

- Duty reduced on watch dials and movements and umbrella parts from 12.5 to five per cent.

- Import duty of 15 specified machinery to be reduced from 7.5 per cent to five per cent.

Other highlights

- Three per cent import duty to be levied on private importers of aircraft including helicopters.

- No change in general CENVAT rate.

- Ad valorem duty on petrol and diesel to be brought down from eight to six per cent.

- Excise duty for plywood reduced from 16 per cent to eight per cent.

- Food mixes to be fully exempted from excise duty.

- Excise duty for plywood reduced from 16 per cent to eight per cent.

- Bio-diesel to be fully exempted from excise duty.

- Water purification devices, small and big, fully exempted from excise. Specific rates of excise duty on cigarettes increased.

...

Please click here for the Complete Coverage of Budget 2014 -15

Vote for the Best Budget of this decade!

Photographs: Reuters

Union Budget 2008 – 2009

Finance Minister: P Chidambaram

Highlights

Personal taxation

- Changes in I-T slab. Threshold of exemption for all Income Tax assesses raised from from Rs 1,10,000 to Rs 1,50,000.

- Every income tax assessees to get relief of minimum of Rs 4,000.

- No change in rate of surcharge.

- New tax slabs will be: 10 per cent for Rs 150,000 to Rs 300,000, 20 per cent for Rs 300,000 to Rs 500,000 and 30 per cent above Rs 500,000.

- For women, the income tax limit goes up from Rs 1.45 lakh to Rs 1.80 lakh. In case of senior women citizens, it increases from Rs 1.95 lakh to Rs 2.25 lakh.

- Fresh facilities, encouragement to sports and guest houses exempted from Fringe Benefit Tax.

Indirect taxes

- No change in corporate income tax.

- No change in peak rate of customs duty for non

- Customs duty on specified life saving drugs reduced from ten per cent to five per cent.

- Special Countervailing Duty on power imports.

- Customs duty on specified sports goods machinery down from 7.5 per cent to five per cent.

- Duty withdrawn on naptha for production of polymers.

- Duty on crude and unrefined sulphur reduced from five to 2 per cent to help raise domestic fertiliser production.

- General Centvat on all goods to be reduced from 16 per cent to 14 per cent. Excise duty reduced from 16 per cent to eight per cent on all pharmaceutical goods manufacture.

- Excise duty on small cars reduced to 12 per cent from 16 per cent and hybrid cars to 14 per cent.

- Excise duty reduced from 16 to 8 per cent on water purification items.

- Duty on non filter cigarettes to be raised.

- Asset management service under mutual funds, services by stock exchanges to be brought under Services Tax net.

- Threshold for small service providers raised from Rs eight lakh to Rs 10 lakh.

Other highlights

- Five year tax holiday for setting up hospitals in tier II and tier III regions for providing healthcare in rural areas from April 1, 2008.

- Five year tax holiday for promoting cultural tourism.

- Short-term capital gains increases to 15 per cent.

- Commodities Transaction Tax to be introduced on the lines of Securities Transaction Tax.

- Banking cash transaction tax withdrawn from April one, 2009.

- Rs 500 crore for corpus fund to subsidise all women Self Help Groups for LIC cover for permanent disability.

- Agricultural loans given by scheduled commercial banks, regional rural banks and cooperative credit institutions up to March 31, 2007 and due for December 31 that year will be covered under the waiver scheme to address the problem of indebtedness.

...

Please click here for the Complete Coverage of Budget 2014 -15

Vote for the Best Budget of this decade!

Image: Pranab Mukherjee before presenting the Budget.Photographs: Reuters

Interim Union Budget 2009 – 2010

Finance Minister: Pranab Mukherjee

Highlights of the Interim Budget 2009-10:

The Gross Domestic Product increased by 7.5 per cent, 9.5 per cent, 9.7 percent and 9 per cent in the first four years from fiscal year 2004-05 to 2007-08 recording a sustained growth of over 9 per cent for three consecutive years for the first time. The growth drivers for the period were agriculture, services, manufacturing along with trade and construction.

Fiscal deficit down from 4.5 per cent in 2003-04 to 2.7 per cent in 2007-08 and Revenue deficit from 3.6 per cent to 1.1 per cent in 2007-08.

The domestic investment rate as a proportion of GDP increased from 27.6 per cent in 2003-04 to 39 per cent in 2007-08. Gross Domestic savings rate shot up from 29.8 per cent to 37.7 per cent during this period.

The Gross capital formation in agriculture as a proportion of agriculture GDP increased from 11.1 per cent in 2003-04 to 14.2 per cent in 2007-08.

The tax to GDP ratio increased from 9.2 per cent in 2003-04 to 12.5 per cent in 2007-08.

Annual growth rate of agriculture rose to 3.7 per cent during 2003-04 to 2007-08. The foodgrain production recorded an increase of 10 million tonnes each year during this period and touched an all time high of 230 million tonnes in 2007-08.

While manufacturing sector recorded growth of 9.5 per cent per annum in the period 2004-05 to 2007-08, communication and construction sectors grew at the rate of 26 per cent and 13.5 per cent per annum, respectively.

Exports grew at an annual average growth rate of 26.4 per cent in US dollar terms in the period 2004-05 to 2007-08. Foreign trade increased from 23.7 per cent of GDP in 2003-04 to 35.5 per cent in 2007-08.

...

Please click here for the Complete Coverage of Budget 2014 -15

Vote for the Best Budget of this decade!

Photographs: Reuters

Union Budget 2010- 2011

Finance Minister: Pranab Mukherjee

Highlights

Personal taxation

- Income up to Rs 1.6 lakh - nil Income above Rs 1.6 lakh and up to Rs 5 lakh - 10 per cent

- Income above Rs 5 lakh and up to Rs 8 lakh - 20 per cent

- Income above Rs 8 lakh - 30 per cent.

- Income Tax department ready with two-page Saral-2 return forms for individual salaried assesses.

- New tax rates would offer relief to 60 per cent of tax-payers.

Other highlights

- Corporate surcharge down from 10 per cent to 7.5 per cent.

- Govt to raise Rs 25,000 cr this year to meet cap expenditure requirements

- Minimum alternate tax increases from 15 per cent to 18 per cent.

- Service tax remains unchanged at 10 per cent.

- Partial roll back of central excise duty from 8 per cent to 10 per cent.

- Duty on petrol and diesel hiked to 7.5 per cent.

- Excise duty on large cars, SUVs increased to 22 per cent.

- Cigarettes, liquor and non-smoking tobacco to be expensive.

- Duty on crude oil back to 5 per cent.

- Interests on late payment of taxes hiked to 18 per cent.

- Section 80C limit hiked by Rs 20,000.

- Excise duty on cement and steel increases.

- Gold prices increased from Rs.200 per ten gram to Rs.300.

- Rs 1,900 crore allocated for Unique Identification Authority of India.

Rs 1,73,552 crore provided for infrastructure. - GST and DTC can be introduced in April 2011

...

Please click here for the Complete Coverage of Budget 2014 -15

Vote for the Best Budget of this decade!

Photographs: Reuters

Union Budget: 2011-2012

Finance Minister: Pranab Mukherjee

Highlights

Personal taxation

- More modernization of the taxation system is being mooted. A new form called 'Sugam' will make it easier for small tax payers to file their returns.

- A miniscule hike of Rs 20,000 in the exemption limit for tax payers has been introduced. The older citizens can feel happy as the finance minister has decrease the income tax "senior citizen" definition from age 65 to age 60 thus giving a big benefit to those born between 1946-1951.

- And for those who survive all the hardships of life and live to be over 80 they get a higher limit!

- Deduction of Rs 20,000 for infrastructure bonds has been retained.

- Loan limit has been enhanced to Rs 25 Lakh for housing under priority sector lending. Interest subsidy (subvention) of 1% on housing loan has been liberalized. People in the lower financial spectrum to get benefit from Mortgage Risk Guarantee Fund.

Corporate tax

- Bringing some cheer to the industry, Finance Minister Pranab Mukherjee on Monday lowered the surcharge tax limit on corporate tax to 5 per cent from 7.5 per cent, even while marginally raising the Minimum Alternate Tax.

- The government retained the corporate tax at 30 per cent, to be paid by domestic firms earning total income of over Rs 1 crore a year.

- It increased the Minimum Alternate Tax (MAT) to 18.5 per cent from 18 per cent on book profits.

- With a view to providing incentive for Indian companies to repatriate money from offshore subsidiaries, the minister also proposed a lower rate of 15 per cent tax on dividends received by an Indian company from its foreign subsidiary.

Other highlights

- Continuing the focus on divesting government stakes in public sector undertakings, the finance minister has proposed to look at raising Rs 40,000 crore (Rs 400 billion) from divestment in 11-12.

- Higher allotment uinder Rashtriya Krishi Vikas Yojana of Rs 7,860 crore could see more support for the agriculture sector.

- Special focus on vegetables in the form of Rs 300 crore for Vegetable initiative. Agriculture credit too raised to Rs 475,000 crore.

- Rs 214,000 crore has been allotted for infrastructure for 2011-12. An increase of over 23% over the last year.

- A higher allotment of funds in the form of over 24% hike as compared to last year for the education sector.

...

Please click here for the Complete Coverage of Budget 2014 -15

Vote for the Best Budget of this decade!

Photographs: Reuters

Union Budget 2012-2013

Finance Minister: Pranab Mukherjee

Highlights:

Personal taxation

- Tax burden for individuals to come down: Income tax exemption limit raised from Rs 1,80,000 to Rs 2,00,000; 10 per cent tax for 2-5 lakh income; 20 per cent for 5-10 lakh and 30 per cent beyond Rs 10 lakh;

- Savings bank account interest up to Rs 10,000 exempted from tax.

Indirect taxes

- Many services and goods to cost more

- No change in corporate tax rate, but standard rate of excise duty, as also service tax rates, raised from 10 per cent to 12 per #162 No change in peak customs duty of 10 per cent on non-agri goods.

- Large cars, imported bicycles, cigarettes, bidis and some imported jewellery to cost more; branded silver jewellery may get cheaper.

- Boost for capital markets: Securities Transaction Tax on cash delivery reduced by 25 per cent to 0.1 %

- A new Rajiv Gandhi Equity Saving Scheme to allow income tax deduction to retail investors in stocks.

Other highlights

- Capital boost to financial and infrastructure sectors: Rs 15,888 crore to be provided for capitalisation of public sector banks and financial institutions

- Fight against black money: White paper on black money in current session of Parliament; Introduction of compulsory reporting requirement for assets held abroad; tax collection at source on high-value cash purchase of bullion, jewellery, immovable property and trading in coal, lignite and iron ore.

- Greater scrutiny of closely-held companies for funds; Taxation of unexplained money, credits, investments, expenses at highest rate of 30 per cent irrespective of income slab.

- Tax relief for stressed sectors: Sectors like agriculture, infrastructure, mining, railways, roads, civil aviation, manufacturing, health and nutrition, and environment to get duty relief; Turnover limit for compulsory tax audit for SMEs raised from Rs 60 lakh to Rs 1 crore.

- Farming for growth: Target for agricultural credit raised to Rs 5,75,000 crore; Interest subvention for short-term crop loans to farmers at 7 per cent interest continues; additional 3 per cent for prompt paying farmers.

...

Please click here for the Complete Coverage of Budget 2014 -15

Vote for the Best Budget of this decade!

Photographs: Reuters

Union Budget 2013 -2014

Finance Minister: P Chidambaram

Highlights

Personal taxation

- No case to revise either the slabs or the rates of Personal Income Tax. Even a moderate increase in the threshold exemption will put hundreds of thousands of Tax Payers outside Tax Net.

- However, relief for Tax Payers in the first bracket of Rs 2 lakhs to Rs 5 lakhs. A tax credit of Rs 2000 to every person with total income upto Rs 5 lakhs.

Direct taxes

- Surcharge of 10 percent on persons (other than companies) whose taxable income exceed Rs 1 crore to augment revenues.

- Increase surcharge from 5 to 10 percent on domestic companies whose taxable income exceed Rs 10 crore.

- In case of foreign companies who pay a higher rate of corporate tax, surcharge to increase from 2 to 5 percent, if the taxabale income exceeds Rs 10 crore.

- In all other cases such as dividend distribution tax or tax on distributed income, current surcharge increased from 5 to 10 percent.

- Additional surcharges to be in force for only one year. Education cess to continue at 3 percent.

- Contributions made to schemes of Central and State Governments similar to Central Government Health Scheme, eligible for section 80D of the Income tax Act.

- Donations made to National Children Fund eligible for 100 percent deduction.

- Investment allowance at the rate of 15 percent to manufacturing companies that invest more than Rs 100 crore in plant and machinery during the period 1.4.2013 to 31.3.2015.

- Concessional rate of tax of 15 percent on dividend received by an Indian company from its foreign subsidiary proposed to continue for one more year.

- Securitisation Trust to be exempted from Income Tax. Tax to be levied at specified rates only at the time of distribution of income for companies, individual or HUF etc. No further tax on income received by investors from the Trust.

- TDS at the rate of 1 percent on the value of the transfer of immovable properties where consideration exceeds Rs 50 lakhs. Agricultural land to be exempted.

- A final withholding tax at the rate of 20 percent on profits distributed by unlisted companies to shareholders through buyback of shares.

- Proposal to introduce Commodity Transaction Tax (CTT) in a limited way.

- No change in the normal rates of 12 percent for excise duty and service tax.

- No change in the peak rate of basic customs duty of 10 perent for non-agricultural products.

Customs

- Period of concession available for specified part of electric and hybrid vehicles extended upto 31 March 2015.

- Duty on specified machinery for manufacture of leather and leather goods including footwear reduced from 7.5 to 5 percent.

- Duty on pre-forms precious and semi-precious stones reduced from 10 to 2 perent.

- Export duty on de-oiled rice bran oil cake withdrawn.

- Duty of 10 percent on export of unprocessed ilmenite and 5 percent on export on ungraded ilmenite.

- Concessions to air craft maintenaince, repair and overhaul (MRO) industry.

- Duty on Set Top Boxes increased from 5 to10 percent.

- Duty on imported luxury goods such as high end motor vehicles, motor cycles, yachts and similar vessels increased.

- Duty free gold limit increased to Rs 50,000 in case of male passenger and Rs 1,00,000 in case of a female passenger subject to conditions.

Excise duty

- Relief to readymade garment industry. In case of cotton, zero excise duty at fibre stage also. In case of spun yarn made of man made fibre, duty of 12 percent at the fibre stage.

- Handmade carpets and textile floor coverings of coir and jute totally exempted from excise duty.

- To provide relief to ship building industry, ships and vessels exempted from excise duty. No CVD on imported ships and vessels.

- Specific excise duty on cigarettes increased by about 18 percent. Similar increase on cigars, cheroots and cigarillos.14

- Excise duty on SUVs increased from 27 to 30 percent. Not applicable for SUVs registered as taxies.

- Excise duty on marble increased from Rs 30 per square meter to Rs 60 per square meter.

- Proposals to levy 4 percent excise duty on silver manufactured from smelting zinc or lead.

- Duty on mobile phones priced at more than Rs 2000 raised to 6 percent.

MRP based assessment in respect of branded medicaments of Ayurveda, Unani, Siddha, Homeopathy and bio-chemic systems of medicine to reduce valuation disputes.

Service Tax

- Maintain stability in tax regime.

- Vocational courses offered by institutes affiliated to the State Council of Vocational

- Training and testing activities in relation to agricultural produce also included in the negative list for service tax.

- Exemption of Service Tax on copyright on cinematography limited to films exhibited in cinema halls.

- Proposals to levy Service Tax on all air conditioned restaurant.

- For homes and flats with a carpet area of 2,000 sq.ft. or more or of a value of Rs 1 crore or more, which are high-end constructions, where the component of services is greater, rate of abatement reduced from from 75 to 70 percent.

- Out of nearly 17 lakh registered assesses under Service Tax only 7 lakhs file returns regularly. Need to motivate them to file returns and pay tax dues. A onetime scheme called 'Voluntary Compliance Encouragement Scheme' proposed to be introduced. Defaulter may avail of the scheme on condition that he files truthful declaration of Service Tax dues since 1st October 2007.

- Tax proposals on Direct Taxes side estimated to yield to Rs 13,300 crore and on the Indirect Tax side Rs 4,700 crore.

...

Please click here for the Complete Coverage of Budget 2014 -15

Vote for the Best Budget of this decade!

Photographs: Reuters

Interim Union Budget – 2014

Finance Minister P Chidambaram presented the Interim Budget for 2014-15 in February this year.

Highlights:

- Income tax rates kept unchanged.

- 10 pc surcharge on 'super-rich' having annual income above Rs 1 crore to continue

- 5 pc surcharge on corporates with turnover of Rs 10 cr

- Foodgrain production estimated at 263 million tonnes in 2013-14

- Fiscal deficit at 4.6 pc in 2013-14 and 4.1 pc next year, revenue deficit at 3 pc in 2013-14

- Current Account Deficit to be USD 45 bn as against USD 88 bn in 2012-13

- Excise duty on small cars, motorcycles and commercial vehicles cut from 12 to 8 pc

- Excise duty on SUVs cut from 30 to 24 pc

- Large and mid-segment cars from 27-24 pc to 24-20 pc

- Excise duty on mobile handset to be 6 pc on CENVAT credit to encourage domestic production

- Excise duty cut on capital goods, non consumer durables cut from 12 to 10 per cent

- Moratorium on interest on student loans taken before March 31, 2009; to benefit 9 lakh borrowers

- USD 15 bn addition to forex exchange in 2013-14

- Disinvestment target for FY14 cut to Rs 16,027 cr versus Rs 40,000 cr; next year govt eyeing Rs 36,925 cr

- Lowers residual stake sale target to Rs 3,000 cr from Rs 14,000 cr for this fiscal

- Govt obtains information in 67 cases of illegal offshore accounts of Indians

- Govt's net borrowing in next fiscal to be Rs 4.57 lakh cr

- Plan expenditure cut by Rs 79,790 cr for current fiscal

- Allocates Rs 1,000 cr more to Nirbhaya Fund;

- CCI cleared 296 projects worth Rs 6.6 lakh cr by end Jan

- GDP to grow by at least 5.2 pc in Q3 and Q4 in 2013-14

- Plan expenditure for 2014-15 at Rs 5.55 lakh cr and non-plan at Rs 12.08 lakh cr

- Govt to infuse Rs 11,200 cr in PSU banks next fiscal

Please click here for the Complete Coverage of Budget 2014 -15

article