|

|

| Help | |

| You are here: Rediff Home » India » Business » Special » Features |

|

| ||||||||||||||||||||||||||||||||||||||||||||

|

| ||||||||||||||||||||||||||||||||||||||||||||

The stockmarket has been showing signs of weakness. Should this worry participants in equity through unit-linked insurance plans? The product is best for generating wealth over periods not less than 10 years. There is also enough evidence to show that equity outperforms other assets over the long term and can give annualised returns of 15-20 per cent.

The volatility that equity markets are experiencing now is not unusual for this asset market. Sashi Krishnan, CIO, Bajaj Allianz Life Insurance, says, "For Ulips, which target consistent long-term performance, the time horizon of the investment portfolio plays a significant role. Since the portfolio is managed with a long-term perspective, the hindrance of short-term swings in the market is countered to a great extent."

Existing holders. If you are holding Ulips with full exposure to equity, you should stay invested that way till maturity is around five years away. Ulips allow you to switch your corpus to non-equity options like debt or balanced funds. So, if you want to move some of your gains, you may do so.

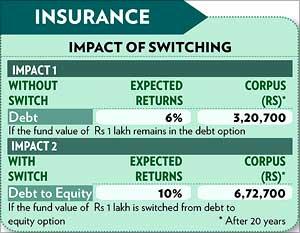

If you have been putting your premiums into the debt fund option, now is the time to move into equity. You can do this in two ways, by moving the entire corpus in one go or by transferring smaller amounts at regular intervals.

New buyers. Consider investing in a Ulip for the right reasons. Weak or strong market conditions should never make you begin saving in any asset class or financial product. Ulips are ideally used to create wealth to meet long-term financial objectives with the fallback option of using the cash to pay for exigencies.

The equity fund option is the best option, so go for a fund that takes 100 per cent exposure to stocks. The other way to go about it is to put the premium into a debt or a balanced fund and then switch to equity when you feel that market is strengthening. The problem with this is that you will have to time the market, which you should ideally avoid.

What to do. A good approach for a new or existing Ulip-holder is to stay in the equity fund for most of the policy term. Gains of more than 20 per cent in any year may be shifted into the debt or balanced funds.

What to do. A good approach for a new or existing Ulip-holder is to stay in the equity fund for most of the policy term. Gains of more than 20 per cent in any year may be shifted into the debt or balanced funds.

Markets move in cycles and there could be three or four opportunities of extraordinary returns in a 15-20-year holding period.

And when you start restructuring your fund options, ensure that optimum balance is maintained between returns and life coverage in your Ulip.

Lowering the sum assured to maximise returns may leave you short of the life cover that your family needs.

Finally, uncertain market conditions, as are being seen now, should never be the cue for making full exits from Ulips. The costs in most Ulips are front-loaded and, hence, it is important to make them run their full course.

More Specials

Powered by

|

|

| © 2008 Rediff.com India Limited. All Rights Reserved. Disclaimer | Feedback |