|

|

| Help | |

| You are here: Rediff Home » India » Business » Personal Finance » Manage your Money |

|

| ||

| |||||||||||||||||||||||

|

| |||||||||||||||||||||||

The word 'investment' means different things to different people. Some see it as a serious affair, for some it is one form of entertainment, for some it is a risky business, for some it brings the memories of some of the stock market crashes, for some it just means buying government sponsored schemes.

Investment assumes a much bigger role than what is mentioned above. It serves the purpose of bridging the gap in our cash flows. Some of our cash flows have certain patterns whereas some are random; some occur at a regular short term intervals, some are one-off, still some occur at regular long term intervals; some can be defined in terms of time, for some it would not be possible.

Most of us have a regular monthly income - some of the expenses are also monthly. The gap between the two, hence, becomes our monthly savings.

Lets understand our expenses:

Some of the major expenses that we encounter in life cannot be funded out of our regular monthly income � an individual has two options:

The two options vary on different parameters. Firstly, the order of the inflow(s) and outflow(s) - for a loan, its buy now, pay later; whereas in case of an investment, it is pay now and buy later. The difference does not stop here.

In case of a loan - till now in a regulated or fixed interest rate environment, one always could prepare the cash flow statement or get it from the bank or financier. In case of investments, due to the uncertainty of the future returns, especially when it comes to the stock market, one generally wonders whether one will be able to make enough to meet one's requirements at a time in future.

And the equation looks something like: "pay now and you may be able to buy later". And that's a great degree of uncertainty. On one hand, one is putting off instant gratification and on the other hand, there is an uncertainty whether the gratification would ever come.

Investment - The bigger picture

It is this uncertainty that needs to be addressed. And for that the understanding of investment has to consider a bigger picture rather the investment alone.

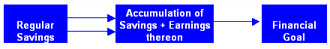

Lets say, there is a financial goal at a future date. An investor can start accumulating for the goal from now on.

The regular savings are spread over a period of time whereas the major goal may need to use all the accumulation at one instant. As can be seen from the above diagram, the financial resources for meeting the financial goals have come from two sources: Profession and Investment.

Things to ponder...

- One chooses the profession based on certain parameters; viz., education, experience, skills, hobby or at times inheritance. Some or most of these are not present when it comes to investments.

- One spends around 10 to 12 hours of a normal day towards profession, however, does not get even 10 minutes to spend on investments.

- It takes decades to garner wealth through your profession, one wonders why many people expect to get rich overnight through their investments - a field largely unknown to the investor on account of lack of either time or resources or skills.

- In profession, when one comes across a situation he/she does not know how to tackle, one generally goes to someone who would have been through similar situation before - someone who is at a senior position in a similar profession or a consultant or an expert in the respective field. However, when it comes to advice for investments, one has seen many investors taking it from just about anyone.

What can be attributed to the failure of any investment plan given this scenario - is it the poor quality of advice or poor quality of the advisor or poor selection of the advice/advisor by the investor himself /herself?

It's the combination of the above that necessitates the need for an investment advisor. An investment advisor can take over some or all of the following jobs that an investor may not be in a position to do himself / herself:

- Understanding the investors' concerns, fears, goals and aspirations;

- Understanding the myriad of investment options available;

- Marrying the investor's needs to the options;

- The vagaries of the securities markets;

- Reduction in tax-liability or enhancing post-tax returns;

- Management of risks associated with various investment options without sacrificing the returns;

- Construction and regular monitoring of the portfolio considering the above;

- Administration jobs related to the portfolio construction, monitoring, rebalancing;

An investor would be better off concentrating on the job on hand than to spend a lot of time towards investments (spending time would anyways be difficult); leaving the investments in the hands of an able advisor.

The author works with a leading mutual fund company. The views expressed are his personal views.

For more on mutual funds, log on to www.easymf.com

|

|

| © 2007 Rediff.com India Limited. All Rights Reserved. Disclaimer | Feedback |