|

|

| Help | |

| You are here: Rediff Home » India » Business » Personal Finance » Manage your Money |

|

| |||||||||||||||||||||||

|

| |||||||||||||||||||||||

Traditionally, Indians have had a fascination for physical assets and when they can afford them, they can't seem to get enough of them. That explains why real estate and gold usually figure high in the 'must-invest' list for a lot of Indian investors.

At Personalfn, we maintain that both these assets do have an important role to play in an investor's portfolio. However, the allocation to these assets needs to be rationalised in line with the investor's risk appetite and investment objectives.

To be sure, there are a variety of assets that investors must include in their portfolios as each asset in a particular allocation serves an important objective. The operative words over here are 'in a particular allocation'.

Having more than one asset in your portfolio can be a bonus, but it usually takes an adversity (like a sharp fall in stock markets) to draw the investor's attention to this fact. Assets have varying cycles; put simply, these are the ups and downs in the assets' fortunes.

Click here to download the Money Simplified issue - Real Estate & You

The good news is that all asset cycles rarely coincide. This means that if stock markets are witnessing a surge (which is sustained and not just short bursts), then it is unlikely that debt markets, gold and property will also witness a boom at the same time. Likewise when stock markets witnessed a prolonged depression, it is improbable that all other asset classes will simultaneously experience a downturn.

While in theory at least, it is possible that all asset classes are witnessing the same cycle at the same time, in practice this is a rare phenomenon (surprisingly, that rare phenomenon is what we have been witnessing over the last few years!).

The reason for this 'disparity' in performance is that various assets are governed by different factors and these factors rarely have the same impact on all assets. So inflation, which can be a negative for stocks in the short-term, could actually lead to a rise in gold prices; this is so because gold is a hedge against inflation and increased buying in it during inflationary times could see a surge in gold prices.

What does this tell the investor? Prudent investing demands that you are invested across several assets in a manner that is best suited to meeting your long-term needs. Of course the advantage of having different assets in the portfolio is that a decline in any one of them can at least be partially set off by the presence of other assets, which are not witnessing the same trend (in this case a decline). This is better known as diversification and is the cornerstone of prudent investing.

As an investor if you have an affinity for physical assets like gold and real estate, which makes these assets account for a disproportionate portion of your portfolio, then it is time for you to take a closer look at your portfolio. This is because if there is a downturn in either of these assets (i.e. gold or real estate), you may not have enough assets (at least not in the necessary proportion) to 'backup' your portfolio.

That is why it is important that investors invest in line with their asset allocation. Typically, your asset allocation should be a reflection of your risk profile and investment objectives. And within your asset allocation plan, one asset that you should definitely consider owning is real estate.

At Personalfn, we maintain that you must have enough property for:

- your own residence and business, if any, and,

- to give away as inheritance

Typically, for most individuals property must account for roughly 50 per cent of assets. Owning anything significantly higher than that can prove self-defeating, as it will expose you to the uncertainties of the sector without adequate backup.

To reiterate, adequate backup should be in the form of other assets (equities, debt and gold) with allocations to each asset in line with your risk profile. Moreover, if you have let's say a 25-Yr investment horizon then an over exposure to property may not work in your favour; over such tenures we expect the stock market to deliver better returns.

To give you an idea, let us consider Kumar, a 30-yr male who is married and has no children. According to the Personalfn's Asset Allocation Review, this is how his asset allocation should appear:

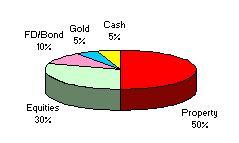

Kumar's Asset Allocation:

Since Kumar is recently married and in time, plans to start a family he must consider buying a property on priority.

Personalfn's Asset Allocation Review recommends that Kumar must aim at having 50 per cent of his money in real estate. He should invest in stocks/equity funds (30 per cent of assets) as equities can add considerable value over the long-term. He must invest in fixed deposits/bonds (10 per cent) for stability; in gold (5 per cent) as a hedge against inflation and keep 5 per cent in a savings bank account to meet emergencies.

While this is our estimate for Kumar, it is not too different for individuals in other life stages. For instance an individual (in the 45-55 year old age group) who is married with children must also aim to have no more than 50 per cent of his assets in property.

It is however important to note that in present times at least when one buys a property, it is very likely that it will account for a lot more than 50 per cent of the total value of ones assets. In such instances it does not mean that you do not buy your first residential property because you will exceed the 50 per cent mark; what the Allocator tells you is the ideal allocation for you is this and that over time you must reach it.

So, when you buy a property in Mumbai, probably property will account for lets say 80 per cent of your assets. In such instances the incremental monies you invest should be in other assets (equity, debt, gold) so that over time their share improves and you reach your ideal allocation.

So while it is pertinent to invest in property, individuals must curb their enthusiasm for it to ensure that their investments in real estate are always aligned to a well-defined and well-balanced asset allocation plan.

Of course, drawing up an asset allocation plan is not that simple. That is where an experienced and competent financial planner comes into the picture. At Personalfn, we always urge investors to hire the services of a professional financial planner who can help them devise a well-balanced asset allocation plan with a defined allocation for property across various life stages.

Here's an eye opener for those of you who are gung-ho on property currently - even property markets have a cycle. In current times investors in property almost give you the sense that there is nothing like a cycle in property prices. And at Personalfn we meet many such investors.

All we do is remind them that the average property price in India declined steadily over the period 1995 - 2003 i.e. over an eight-year long period property prices actually fell!

By Personalfn.com, a financial planning initiative. It can be reached at info@personalfn.com. Personalfn.com also publishes a free-to-download financial planning guide, Money Simplified. To get a copy of the latest issue -- Real Estate & You - please click here.

More Personal Finance

|

|

| © 2007 Rediff.com India Limited. All Rights Reserved. Disclaimer | Feedback |