| « Back to article | Print this article |

7 things you need to know about the new cheque books

We had earlier reported that your old cheque books may become invalid, come January 1, 2013.

But what is different or should be different in your new, regulation compliant cheque book?

Most of the new features have been introduced to make the cheque payments a more secure and universalized mode of payment.

The idea according to RBI was triggered by growing use of multi-city and payable-at-par cheques at any branch of a bank, increasing popularity of Speed Clearing for local processing of outstation cheques andhence, implementation of grid based Cheque Truncation System (CTS) for image-based cheque processing

We give you a lowdown on the changes.

1. The IFSC and MICR codes, predictably are a must on every cheque leaflet.

2. All cheques shall carry a standardised watermark, with the words "CTS-INDIA" which can be seen when held against any light source. This would make it difficult for any fraudster to photocopy or print an instrument.

3. Bank's logo shall be printed in ultra-violet (UV) ink. The logo will be captured by / visible in UV enabled scanners / lamps.

4. Background of cheques shall be kept as clutter free as possible for improving quality and clarity of images.

5. No changes / corrections should be carried out on the cheques (other than for date validation purposes, if required). For any change in the payee's name, amount in figures or amount in words, etc., fresh cheque forms should be used by customers.

6. "payable at par at all branches of the bank in India" text will be at the bottom of all the cheques.

7. There should also be words 'please sign above this line' at the right bottom corner of the cheque. The customers will also be required to use a darker ink for their signatures on the cheque so that the signatures are scan-able.

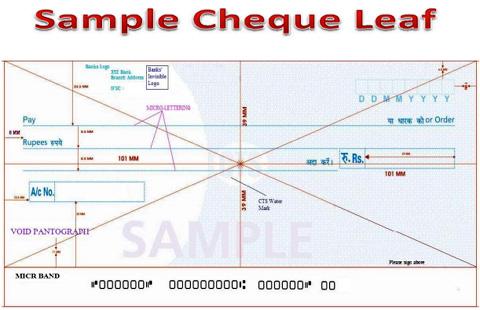

You can see the image above for the sample layout of the cheque leaflet as mandated by RBI.

However, most of the specification in there are technical and are more specifically intended for the Banks rather than the consumers.

As far as an average consumer is concerned, the above checklist would be more than sufficient to establish the validity of the cheques.

All that an aware consumer is required to do is to spend a couple of seconds checking the cheque.