Photographs: Rediff Archive Nikhil Kothari, Fundsupermart.com

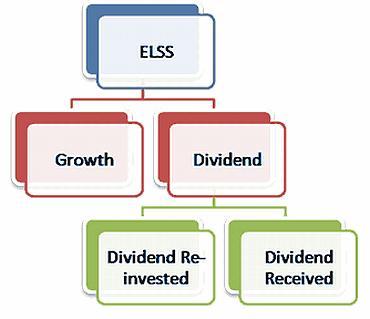

Equity linked saving scheme (ELSS) is an equity mutual fund that qualifies for tax deduction and has a lock-in period of there years. According to Section 80 C of Income Tax Act 1961, investor can deduct the amount invested in ELSS from their gross total income for the financial year, subject to a maximum limit of Rs 1 lakh.

Simply put, if you fall in highest tax bracket, you can save up to Rs 30,900 by investing in ELSS! For more details, read on...

Features & advantages of ELSS

ELSS scheme invest around 80% to 100% in equity-linked instruments and has a lock-in for three years which means, one can withdraw money only after three years from the date of investment. The minimum investment in ELSS scheme can be as low as Rs 500.

- Key advantages of ELSS:

- Save tax on initial investment

- Receive tax-free dividend

- Get tax-free capital gains

- 3 year lock-in period; less compared to other products under section 80 C

Disclaimer:

This document is for information purpose only. This document and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products /investment products mentioned in this article or an attempt to influence the opinion or behaviour of the investors /recipients. Any use of the information /any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.

Want to save tax? Time to opt for ELSS

The blessing in disguise for ELSS is that the investor's money stays for long term due to the lock-in period. Therefore, the fund manager can take bets on stocks in which he has conviction over long term.

As long-term holding period is one of the basic principles for investment in equities, the lock-in period aids in the fund management process and the fund manager can deliver better returns owing to defined time period of the cash flows in the fund.

Though returns from ELSS are not fixed, they tend to surpass returns from all other categories over long term because of the equity element. Secondly, investor can withdraw after three years in ELSS whereas Public Provident Fund (PPF) and National Saving Scheme (NSS) have lock-in for 15 and 6 years respectively.

The capital appreciation and dividend from ELSS are also tax-free as compared to NSC and fixed deposits, where interest is added to your gross total income and is taxed as per marginal tax bracket (highest being 30%).

Want to save tax? Time to opt for ELSS

In New Pension Scheme, the maximum exposure to equity is only 50% for an individual who is below 35 years old whereas ELSS allows individual to invest 100% into equities.

As per the current draft of Direct Tax Code, the investment in ELSS before 1 April 2012 will continue to enjoy tax deduction. Post implementation of the Direct Tax Code, ELSS will not fall under section 80 C but, any capital appreciation on these funds would not be taxed.

Selecting ELSS scheme

There are in total 48 ELSS schemes from 41 mutual fund houses. Though there are numerous options, we highlight our top 5 recommended ELSS based on our in-house mutual fund research methodology.

- Fidelity Tax Advantage Fund

- HDFC Tax Saver Fund

- Religare Tax Plan

- Reliance Tax Saver

- Sundaram Tax Saver Fund

Conclusion

Overall, we believe ELSS is a good investment vehicle to save tax as well as compound investment over long term. Investors can gain from the expected appreciation in equity markets over long term. We suggest investors who have not yet done their tax planning for the current financial year, to invest in staggered manner over next four months as this will help them to save tax as well as create wealth over long term.

Comment

article