| « Back to article | Print this article |

So smart, you don't need to go to the bank anymore!

A smartphone is all you need for most of your banking-related services says Ankit Sharma.

The last decade has been a decade of revolution in the banking sector, there has been a vast change in how people operate their account, and also the way bank offers services.

Internet banking has vastly picked up, almost all the nationalised banks now offer internet banking facilities to their consumers.

Consumers can perform almost all transactions at the tap of a phone.

An even further advancement over Internet banking has been the advent of mobile banking.

Now, a person can do all major banking transactions using his friendly smartphone.

The popularity of smartphones garnered further impetus to mobile banking or preferably known as m-banking.

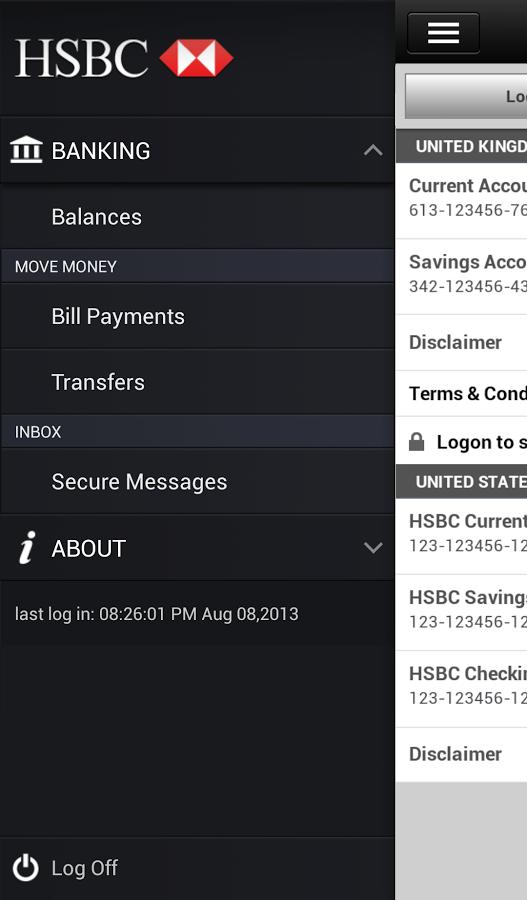

Google's Android phones and Apple's iPhone have enabled banks to release Apps on mobile phones using which the customer can carry out various banking operations.

More and more banks are coming up with their mobile applications; of which few major players include State Bank of India, ICICI Bank, Axis Bank, Allahabad Bank, Union Bank of India, IndusInd Bank, Bank of Baroda, etc.

Courtesy:

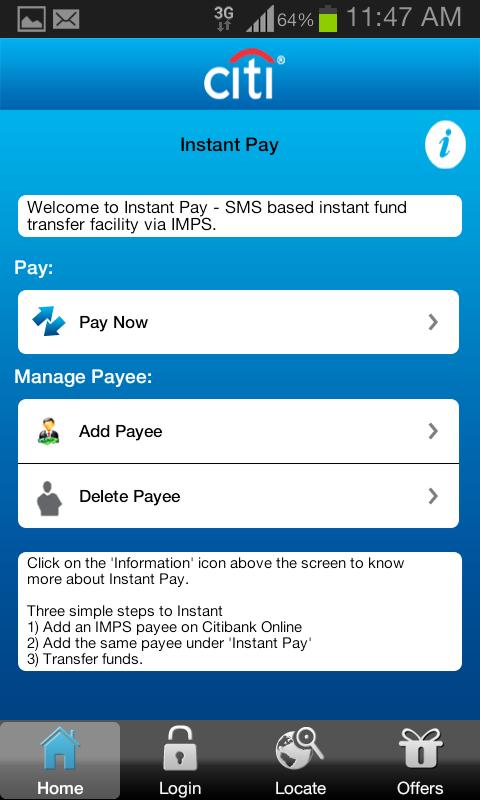

Interbank Mobile Payment Service (IMPS)

It is a round the clock electronic funds transfer service owned by National Payments Corporation of India (NPCI).

This enables the customer to make remittances through the phone, just using his/her mobile phone number once the number is registered with the application and the server.

Currently 36 commercial banks provide this service to their customers.

Pay bills

Online bill payment gives the user the facility to pay various bills of the likes of Electricity, Gas, Insurance premiums, and mobile and fixed telephone bills.

This also allows the customer to donate for various NGOs, temples etc for charity purposes. Almost all the major service providers under each head are covered in the app.

Buy tickets

Customers can also purchase tickets using the application. The customer's bank account is linked to the application and tickets to bus, and movie, train, airlines, etc. can be purchased instantly, and delivered electronically to the customer.

Pay credit card bills

Customers can link their credit cards to their bank accounts via these applications to pay their monthly credit card dues. This service comes useful as the payment can be made easily without the hassle of dropping a cheque into the dropbox every time.

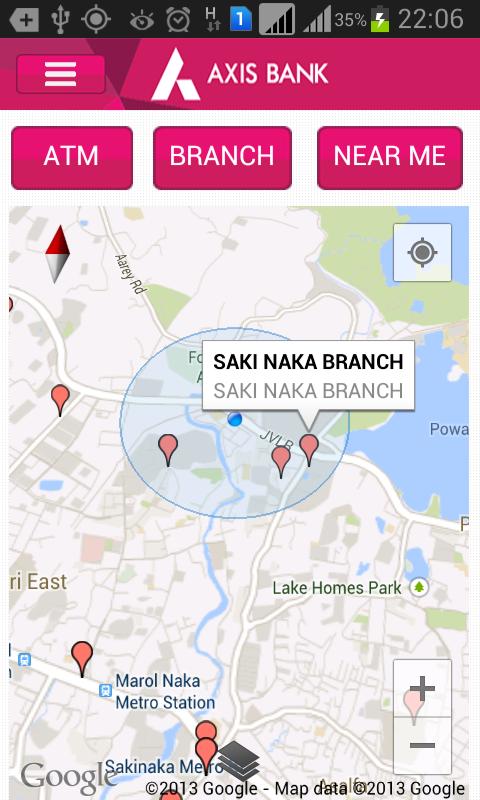

These smartphone apps also provide facilities like locating branches or nearest ATM, a catalogue of discounts, mobile shopping, etc. Then there are a few multi platform applications also offering Demat facilities if linked with the account.

Security Concerns

The level of security with these applications is expected to be quite decent given the fat that they work only on mobile phone numbers registered with the bank.

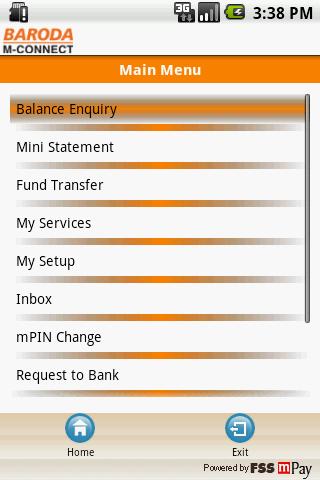

To run the application for the first time, a one time registration of the mobile device is needed. The process includes receiving One Time Authentication Code (OTAC) from the server end, which would only be sent to the registered mobile number. The process is followed by choosing a 6 digit mobile personal identification number (mPIN), which is used every time to run the application and make a transaction.

To add an account, the application also requires the user to add full bank account number, debit card number, expiry date, to make it more secure. Once the account is added, any of the services can be availed using the mPIN every time the transaction has to take place.