Photographs: Rediff Backyard Dhanashri Rane, Fundsupermart.com

Do you leave a good amount of your income in your savings account? Well, you must since a good cash position is very comforting. Besides, you need invest the idle cash wisely so that the investments mature in time to supplement your financial needs. One could also encash the portfolio to book profits or rebalance it for better yield. The ideal scenario would be managing your short-term savings and aligning it with your long-term investments.

Savings account returns

The savings rate currently stands at 4 per cent. Of all the investment instruments available, your savings account earns you the lowest returns. Not only that, but your interest returns are considered 'personal income' and subjected to tax! This brings down your returns even more.

The gain in value of your mutual funds and stocks are taxed @15 per cent for the short term but not in the long term. So, we do not recommend that you keep too much of your money in savings account. Instead, you should invest it to make greater capital gains!

Click NEXT for more

Disclaimer: This article is for information purpose only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products /investment products mentioned in this article or an attempt to influence the opinion or behavior of the investors /recipients. Any use of the information /any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.

Six tips to save for the rainy day

Savings for emergencies

However, you should always keep some money in savings for contingencies. A loved one may fall sick and need extended medical attention, a valuable item at home, like TV or refrigerator, might break down and need replacement, or you might even take a break from work.

In such a case if you have all your money in investments, you may find yourself short of cash. If your investments have been making money, you may of course liquidate a part of it to generate the cash that you need. However, you may find that your shortage of cash catches you at a time when all your investments have gone down.

Then, if you have to liquidate them it might cause you to lose even more money. So, it is not wise to invest all your savings completely in risky assets.

Click NEXT for more

Six tips to save for the rainy day

Rule of thumb

We recommend you to have at least 6 months living expense in a savings account. This way, even if you lose your job all of a sudden, you can hold out for 6 months before needing to liquidate your investments. Thus, an emergency fund equivalent protects you from any unforeseen and takes care of your immediate requirement.

Whenever something happens and you need to draw upon your savings, try to maintain up to 6 months living expense as soon as you can afterwards. Do not allow emergency cash to languish at less than 6 months living expenses for a long time.

Click NEXT for more

Six tips to save for the rainy day

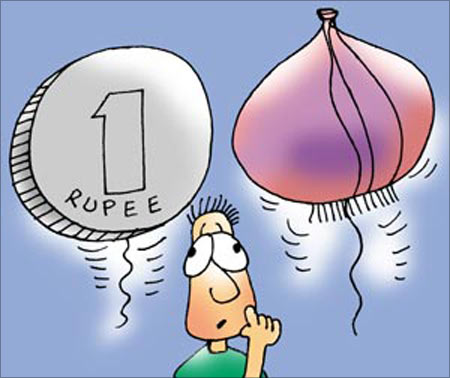

Inflation makes you poor

You may think, 'Is this really true?' It happens because more money is chasing the same set of goods. So, if you are buying one kilogram (kg) of onions at Rs 5 some time back, you might have to shell out more for the same today. Do you remember, in the late '90s, an incumbent government lost the elections in the state assembly owing to the extraneous price rise to Rs 60 per kg! This implies that the cost of living goes up with time. The government tries to maintain price levels by rationing (example: food items) and contains the prices by fixing a ceiling price or by duty cuts (example: kerosene, petrol prices).

Therefore, if your money is stashed away in a bank account or a fixed deposit, you are actually losing money every day! Unless the current return rate exceeds inflation, you are not making any positive returns on your investment. Also, inflation impacts not just your portfolio returns but also how much you are likely to save in the future, that is, the money left after all the expenses. As prices are high, there will be higher expenditure and hence, lesser savings.

You might be wondering how, does this impact my portfolio? We help you understand the effect of the above cycle on your portfolio. Suppose, your money is resting in your bank account and inflation is presently at 8 per cent.

When we say nominal rate, it is actually the interest rate available on a financial instrument. The nominal interest rate depends on the type of entity issuing the instrument, for example, bank or corporate, risk premium associated with the instrument and period of holding.

Real interest rate = [(1 + nominal interest rate) / (1 + inflation rate)] - 1 = (1.04/1.08) = - 3.70 per cent.

(- 4 per cent) is the approximate return from your savings account deposit which is calculated to remove the impact of inflation. Hence, instead of earning 4 per cent, you have actually lost 4 per cent!

Thus, you are earning negative on your portfolio in real terms. For long-term investment planning earning a negative return isn't really exciting or helpful. Therefore, you should bear in mind the inflation risk and ensure that an adequate corpus is available at your retirement. Your financial plans should maintain sufficiently high level of real return from the portfolio on a yearly basis.

Click NEXT for more

Six tips to save for the rainy day

Alternative to savings account

Considering that the savings account forms an important part of your finances, it is important that you gain most from your savings. Here, we discuss mutual fund types for your short-term investments.

Liquid, liquid plus, short term income funds, floater funds are different types of mutual funds which cater to investment horizon of less than a year. These funds typically invest in fixed income instruments having a maturity less than or equal to a year. Apart from fixed coupon papers, there are also floating rate papers which have a facility to reset the coupon rate periodically.

The returns depend on prevailing as well as anticipated rise/fall in interest rates and supply of money in the banking system. With higher short-term interest rates, you can get better returns from these funds.

Plus, the taxation for non-equity, non-liquid schemes of mutual funds for a period of holding of less than a year is as per your income slab. You can opt for dividend option which is subject to tax @13.51 per cent. In case of long-term, the tax is 10 per cent without indexation and 20 per cent with indexation so the net yield works out better than a fixed deposit for individuals who fall in 20 per cent and 30 per cent personal tax slab.

Because of tax arbitrage, ultra short term fund or liquid plus fund is the alternative product to savings account deposits. These funds invest in treasury bills issued by government as well as money market instruments issued by financial institutions and corporate such as certificates of deposits and commercial papers and hence, have low volatility. Although the corporate papers carry default risk, most fund managers have limited exposure to unrated or poor rated instruments.

Remember: It is always best to check a fund fact sheet before investing! You should always check the past performance of the fund (3-12 months) and the exit load while choosing to invest in it.

You can also systematically transfer from a liquid plan, every month, a certain amount towards equity investment. This way, you can earn decent returns from your short-term investments and also, allocate a part of your savings into equity on a regular basis. Systematic transfer plans ensure that the money which is already invested into debt mutual funds is re-directed into equity plan of the same fund house. So, you do not have to worry about the auto-debit facility and maintaining a healthy balance in your bank account for SIP deductions.

Comment

article