| « Back to article | Print this article |

Six best mutual funds for the long term

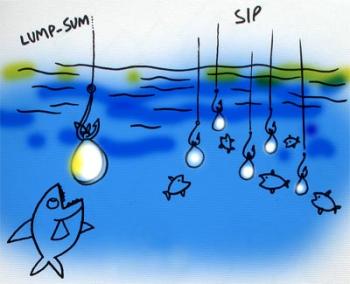

Investing in mutual funds is all about following the basics, keeping it simple and persisting with your investments. In the last decade, mutual funds have been the single biggest vehicle of transporting retail investor's savings into stocks and debt instruments.

Discipline and commitment are the buss words while investing in mutual funds through systematic investment plans (SIPs).

We at investment-mantra.in look at 6 mutual funds which you as an investor can consider for fulfilling your long term goals:

1. HDFC Prudence Fund: Balanced fund for all investor

HDFC Prudence Fund, an open ended balanced scheme from HDFC Mutual Fund for couple of reasons: Mostly importantly because it is an excellent fund in 'Balanced Funds' category which can be considered by investors especially who are first timers in equity markets.

The fund came into existence on February 01, 1994 and aims to provide periodic returns and capital appreciation over a long period of time, from a judicious mix of equity and debt investments, with the aim to prevent/ minimise any capital erosion.

Investments in the scheme comprises both in debt and equities. The fund would invest in debt instruments such as government securities, money market instruments, securitised debt, corporate debentures and bonds, preference shares, quasi government bonds, and in equity shares.

Click NEXT to read more

Courtesy: www.investment-mantra.in

Note: Please consult a personal finance expert before making any investment decsion based on this arrticle. Any use of the information /any investment and investment related decisions of the investors/recipients are at their sole discretion and risk.

Six best mutual funds for the long term

In the long term, the mix between debt instruments and equity instruments is targeted between 60:40 and 40:60 respectively.

SIP returns on the fund have been pretty impressive. Annualised return of 24.45 per cent since inception has been impressive. In addition, fund has give a return of 8.64 per cent, 29.54 per cent, 20.40 per cent, 27.41 per cent, 26.09 per cent over 1 year, 3 year, 5 year, 10 year, 15 year period respectively.

After a dismal performance in 2007 and 2008, this fund is back with a bang.

An annualised return of around 25 per cent over the past 10 years indicates an impressive showing. The fund has capitalised on equity market gains and outperformed the benchmark index (Crisil Balanced Fund Index) with a sizable margin.

Click NEXT to read moreSix best mutual funds for the long term

It has generated nearly twice the benchmark index returns for various periods analysed (three months to five years) -- much higher than its peers. During the downturn of 2008, the fund lost 43 per cent of its net asset value (NAV) from January 2008 (market peak) till March 2009, compared to 34 per cent of the Crisil Balanced Fund Index and 51 per cent of the S&P CNX Nifty.

The fund's performance vis-a-vis its peers clearly stands out during the market recovery phase after March 2009.

Till date, the fund's NAV multiplied 2.5 times (122 per cent gain) from its lowest point in March 2009, while the benchmark index returned 52 per cent and the S&P CNX Nifty gained 77 per cent.

HDFC Prudence has termed out to be a quality fund over years investing in good quality business, remain diversified and staying clear of rich valued investments. Allocation to equity has been more than 70 per cent in debt; fund invests mainly in debentures of the financial sector.

Click NEXT to read moreSix best mutual funds for the long term

2. Franklin India Bluechip Fund: Long term capital appreciation with low downside risk

Franklin India Bluechip Fund is one of the oldest diversified equity schemes in India and among the largest as well. Launched in December 1993, Franklin India Bluechip Fund today ranks amongst the top 10 diversified equity schemes by size, with average assets under management of over Rs 3,000 crore. Its size clearly reflects its popularity among equity investors. Over one-, three- and five-year timeframes, the fund has outperformed its benchmark, the BSE Sensex.

The fund's large-cap focus may pay off in the current market environment as such stocks have better earnings visibility and limited volatility. After the slowdown of 2008-09, large-caps from the Sensex, Nifty and BSE-100 baskets have done better than the broader market.

In accordance with its name 'Bluechip', the scheme is focused on bluechip companies with a little exposure to midcaps and absolutely no exposure to high risk small-cap counters. The fund's portfolio is thus a bundle of prominent large-cap stocks, such as Bharti Airtel, Infosys, ICICI Bank, Reliance Industries, Grasim, HDFC Bank among prominent names.

Click NEXT to read more

Six best mutual funds for the long te

During its existence for over a decade, Franklin India Bluechip Fund has had periodic spurts of outstanding performances during 1997-99 and then again from 2002-04 when it outperformed the market indices by healthy margins.

However, barring these periodic bouts, Franklin India Bluechip has been a consistent performer with returns aligned to those of the broader market indices.

In fact, the fund is one of the funds that believes strongly in the traditional philosophy of long-term investment in highly liquid and large companies and is thus suitable for investors with low risk appetite.

For instance, in 2006 and 2007, the two years of fantastic rally witnessed in the equity market, when many other diversified equity schemes have had startling performances, Franklin India Bluechip failed to impress its investors with returns that were highly correlated to the movements in the BSE Sensex.

The fund's abstinence from some of the high performing sectors such as real estate and infrastructure then could be construed as one of the reasons for the fund's abysmal performance. However, the very same investment strategy proved to be a boon in the following year when the market meltdown trashed the equity market by more than 50 percentage points.

Franklin India Bluechip, however, succeeded in curtailing its fall to about 48 per cent in that year. In 2009 again, the fund delivered about 85 per cent gains for that year, once again aligned approximately to those of the Sensex at about 81 per cent.

Click NEXT to read moreSix best mutual funds for the long term

The fund seeks to invest in companies that are well managed; generate high return on capital and demonstrate the ability to deliver sustainable growth. It avoids momentum stocks (characterised by high volatility, valuation and governance risks).

The fund remains cautious on infrastructure sector due to lack of transparency and absence of compelling valuations while is positive on consumption and investment themes which are likely to remain main drivers of the Indian economy over the medium term.

The fund manager avoids short term performance comparisons -- history is replete with examples highlighting the pitfalls of the approach. Invest in line with financial goals and risk appetite.

Franklin India Bluechip Fund (FIBF) is a good choice for investors who want market-beating returns over the long term without taking undue risk.

One of its defining qualities is that the fund manager does not believe in the momentum game, and so does not venture into the mid-cap space to deliver superior returns even during bullish markets.

The fund's merit lies in protecting the downside and the ability to participate in market rallies earlier than others. FIBF is benchmarked against the BSE Sensex and has beaten the latter by quite a margin since its inception in 1993.

Investors can consider adding the fund to their core portfolio based on its strong focus on large-cap stocks. Franklin India Bluechip Fund has the potential to bring stability to the overall portfolio and deliver stable long-term returns.

Click NEXT to read moreSix best mutual funds for the long term

3. HDFC Equity Fund: Multi-cap fund to bank upon

HDFC Equity Fund has followed a consistent strategy in its existence of over 15 years. It is predominantly a large-cap oriented, actively managed, diversified equity fund.

One good point is that focus of the fund has always remained on investing in good quality and strong companies. The fund has a clear bias towards growth investing giving good economic growth that India is experiencing. However while investing in growth, the fund doesn't want to overpay the growth and seeks to move out of growing companies when they become very expensive.

Fund limits exposure in mid-cap stocks to one- third of the portfolio.

Click NEXT to read moreSix best mutual funds for the long term

HDFC Equity is over-weight on banking, public sector banks in specific. It is also over-weight on oil companies. The fund is under-weight on global cyclical.

Investment in securitised debt, if undertaken, will not exceed 20 per cent of the net assets of the scheme.

The scheme may also invest upto 25 per cent of net assets of the scheme in derivatives such as futures & options and such other derivative instruments as may be introduced from time to time for the purpose of hedging and portfolio balancing and other uses as may be permitted under the regulations.

Having been a part of the mutual fund industry for more than one and a half decade, HDFC Equity definitely boasts a long experience having faced both the bullish and the bearish phases in its 16-year-long journey.

The fund has not only successfully beaten its benchmark indices and cushioned its fall during the dotcom bubble of year 2000-01, but also made a steadfast recovery in the immediate following years of 2002-03.

From June 19, 2003, this fund has been managed by Prashant Jain and since then it has managed to be in the top league. Jain's enduring association with this fund has ensured stability and consistency in investment style and performance.

Click NEXT to read moreSix best mutual funds for the long term

At HDFC AMC, Jain also manages equity funds like Top 200, Prudence and Infrastructure that have managed to beat category returns over the long run with ease. Such performance and also the investor's confidence in these funds indicate the astuteness of the fund manager.

The fund follows a multi-cap approach in selecting stocks. However, since its inception it has predominantly been oriented towards large-cap funds. Such allocation has helped the fund in consistently outperforming its category over the long run, except for 2007 when the mid-cap stocks lead the market rally.

The fund was initiated on January 01, 1995 has certainly earned our approval. Despite hitting the occasional roadblock, it is one of the most dependable funds around.

The fund manager sticks to his guns and focuses on value and not on the direction of price movement. This may provide short term pain to investors but investor should stick to their investments. Though at one time a very bold offering with less than 20 stocks, it now sports around 60 as the size of the fund has increased. Head-turning performances and decent downside capabilities are tough to ignore and mark of this fund.

This fund can definitely be considered as part of your core mutual fund portfolio and will add stability for sure. Thus, investors with a moderate risk appetite can take long-term exposure to this fund through SIP.

Click NEXT to read moreSix best mutual funds for the long term

4. HDFC Top 200 Fund: A stalwart worth considering

HDFC Top 200 Fund has followed a consistent strategy in its existence of over 15 years. It is predominantly a large-cap oriented, actively managed, diversified mutual fund.

Fund's good point is that focus of the fund has always remained on investing in good quality and strong companies. The fund has a clear bias towards growth investing giving the good economic growth that India is experiencing. However while investing in growth, the fund doesn't want to overpay growth and seeks to move out of growing companies when they become very expensive.

Fund limits exposure in mid-cap stocks to one- third of the portfolio.

Click NEXT to read moreSix best mutual funds for the long term

Fund performance has been nothing but impressive. It's best suited for low risk-averse investors who want steady yet near guarantee returns. The fund has beaten its benchmark in all the years except in 2006. With a return of around 27 per cent since launch, it has proved it is dependable and consistent.

In the year 1999, the fund disappointed due to its high exposure to FMCG and healthcare in technology dominated rally. Again in 2006, it was the high exposure to defensives pulled it down.

In 2007, energy stocks were offloaded even when the going was good while exposure to financials did not impact as much as metals and construction, where the fund's exposure was low.

But in the market crash of 2008, HDFC Top 200 proved its mettle and lost around 45 per cent only, which was 11 per cent less than its benchmark and 8 per cent less than its category.

In 2009, the fund was back with a bang and established its clout among the best performing funds by outperforming the category by 14 percent. Performance was boosted by high exposure to banking and autos. Stocks like State Bank of India did the trick.

Click NEXT to read moreSix best mutual funds for the long term

Fund manager believes to invest in good quality businesses, keep away from richly valued investments to the extent feasible and remain diversified.

The fund maintains a diversified portfolio of predominantly large cap stocks. It invests in fundamentally strong companies for longer horizon and does not take high cash exposure.

Fund is one of favourites for its solid long-term record and skilled management. The fund is a stalwart in its league with return of 27 per cent year on year.

Prashant Jain, the fund manager since June 19, 2003 has been at the helm of affairs for straight 9 years, which is a perfect instance of what a good fund manager can accomplish for a mutual fund.

In addition HDFC Top 200 comes from a fund house which is known for its process driven approach to investments. Given the consistent good returns over a long period of time, investors should not give this a miss if it suits their risk and return appetite.

Is the fund part of your mutual fund portfolio? If not, go for HDFC Top 200. It can seriously be considered to satisfy your long term goals.

Click NEXT to read moreSix best mutual funds for the long term

5. ICICI Prudential Focused Blue-chip Equity Fund: Aggression to the fore

ICICI Prudential Focused Equity Fund, an open-ended equity scheme was launched in May 2008 with an aim to generate long-term total capital appreciation by investing in equity and equity related securities of about 20 large-cap companies.

The scheme, without having any sector bias, seeks to capture the best opportunities that are available in the universe of "large and well established companies".

ICICI Prudential Focused Blue-chip Equity Fund follows the bottom-up approach to identify stocks that are available at a bargain price and have a promising potential for long-term growth. The fund focuses on fact that diversification is needed to reduce risk but too much diversification can result in diminishing returns.

Click NEXT to read moreSix best mutual funds for the long term

So the fund tries to strike a balance between minimum risk and maximum returns. The fund invests in large established companies which are relatively stable and strives to grow investor's wealth in long run.

Since the launch of this fund, financial services has been the most favoured sector for the fund, with an average exposure of almost 23 per cent at present. This is followed by the information technology and oil and gas sectors to which the fund had an average exposure of 14 per cent and 13 per cent, respectively currently.

The fund has been substantially overweight on financial sector as compared to its benchmark. In fact, the exposure to the sector has been more than twice as compared to the constituents of the S&P CNX Nifty.

The fund began with the investment objective of investing in just about 20 stocks till the time it attained at least Rs 1,000 crore of AUM. Though it has crossed the threshold AUM, the fund is still following the strategy.

Click NEXT to read moreSix best mutual funds for the long term

The fund has retained nearly 40 per cent of its total investments for over two years. These include stocks like ICICI Bank, ITC Bhel, L&T and Infosys Technologies to name a few which the fund could manage to pocket at fairly discounted rates in 2008.

Similarly, the fund was also proactive in investing in some of the fine bluechips in 2009 at attractive valuations. These include stocks like Bajaj Auto, Axis Bank, Bank of Baroda, Punjab National Bank, Hindustan Zinc.

Currently ITC is the top holding with 7.36 per cent followed by ONGC and PNB with 6.97 per cent and 6.17 per cent respectively.

Fund currently has 87.68 per cent allocation to equity, 7.18 per cent of others/unlisted and cash/call accounts for 5.16 per cent.

ICICI Prudential Focused Blue-chip Equity delivered 91 per cent returns in 2009 as against 76 per cent returns by its benchmark index -- the Nifty. Since its inception in May 2008, the scheme has enriched its investors by more than 60 per cent (absolute) gains, that is, every Rs 100 invested in this scheme in May 2008 is worth more than Rs 160 today.

Click NEXT to read moreSix best mutual funds for the long term

The fund is benchmarked to the S&P CNX Nifty Index and has delivered an annualised return of 56 per cent over the last two years, as compared to 44 per cent returns by the benchmark and peer group respectively, during the same period.

An analysis of the month-on-month performance vis-a-vis the benchmark (S&P CNX Nifty) reveals the fund has beaten the benchmark 68 per cent of the times (22 out of 33 months) vis-a-vis 53 percent of the times by peers (17 out of 33 months). After the market recovery in May 2009, the fund has given an annualised return of 39 per cent vis-a-vis 28 per cent by the benchmark.

Since inception, the fund has outperformed its peers and its benchmark -- a really impressive performance.

The fund was initiated in May 2008 which was one of the challenging years of equity markets. However, those who dared to invest in this large cap equity fund must have been a happier lot. Withstanding the initial subdued response, the scheme now boost of assets of size of over Rs 1600 crore and has handsomely rewarded its investors over this period of two and a half years.

This fund can definitely be considered as part of your core mutual fund portfolio inclined towards providing a large cap flavour and committed to long term capital appreciation from investments in handpicked large cap stocks.

Do consider this 'aggressive large cap mutual fund' while evaluating various mutual funds for your portfolio and SIP your way to achieve your long term goals.

Click NEXT to read moreSix best mutual funds for the long term

6. UTI Dividend Yield Mutual Fund: Excellent navigator through bad times

UTI Dividend Yield Fund's excellent long-term track record to deliver steady returns with ability to limit the downside makes us introduce this excellent fund from UTI AMC to our investment-mantra.in readers. Over one-, three- and five-year time frames, the fund has managed to outpace its benchmark -- BSE 100.

UTI Dividend Yield Fund is positioned as a conservatively managed equity fund. The fund portfolio primarily comprise of stocks which are high dividend yielding (on historical basis) or potential high dividend yielding stocks. The fund has a good mix of companies across various sectors.

The fund is well suited for investors with medium to low risk profile and with a long term investment horizon. The fund aims to distribute regular dividends to its investors.

This diversified large-mid cap oriented fund with conservative-style of funds management is suitable for all equity investors.

Click NEXT to read more

Six best mutual funds for the long term

Smart bottom up stock picking and sector allocation has always worked for the fund. The fund invests in companies with strong balance sheets, cheap valuations, high dividend yield etc. lowering the probability of loss in adverse market conditions.

During periods when markets correct significantly, the fund manages to contain downsides much better than its benchmark. During early 2007, in the protracted correction of 2008-09 and even in the recent fall over the last few months, UTI Dividend Yield managed to contain erosion in its NAV to the tune of 2 to 14 percentage points better than the BSE-100.

When markets are on an upswing, such as those witnessed in late 2007 and in the rally that started from March 2009, the fund managed to match the returns of its benchmark.

Its impressive performance in 2007 of 71 per cent put it ahead of the Sensex which managed 47 per cent and multi-cap category average of 60 per cent.

Click NEXT to read moreSix best mutual funds for the long term

The fund moved into deposits and cash to the tune of nearly 30 per cent of its portfolio during the heavy market fall of 2008-09, which mitigated the erosion in its NAV. Its fall in 2008 was less than that of the Sensex as well as the category averages (multi cap and dividend yield) helped by a substantial allocation to debt and cash.

Even during periods of upswings in the markets, the fund remains invested in equity only to the tune of about 90-92 per cent, suggesting a conservative approach.

Banks and software have always figured among the top sectors held by the fund. In late 2009 and early 2010, the fund had significant exposure to automobile and consumer non-durable sectors, which helped it gain from the substantial rallies that these sectors witnessed.

Click NEXT to read moreSix best mutual funds for the long term

Cement, oil and gas and fertilizers -- sectors that typically have stocks that offer high dividend yields -- besides mid-cap stocks in these sectors figure in the portfolio. With about 50 stocks in its portfolio, UTI Dividend Yield provides ample diversification.

Some important highlights of the fund:

- UTI Dividend predominantly takes exposure to large-cap stocks, while also taking relatively higher dividend yielding stocks from the mid-cap pack.

- The fund contains downsides well during market falls and manages to deliver as much as its benchmark when markets race ahead. It is, therefore, more suitable for conservative investors.

- The fund would be an ideal choice during periods marked by high volatility such as the present one.

- Investors can consider accumulating units through SIPs to average costs

- This fund is best for investors who want decent returns with good downside protection