| « Back to article | Print this article |

Now, buy and sell mutual fund units online

Mutual fund industry is undergoing major revolutions to make it efficient, transparent and investor-friendly," says 25-year old Shipa Sinha, who invests almost 20 per cent of her salary in mutual fund units every year.

Shilpa works with a leading BPO company in Mumbai as a senior floor manager. She plans to retire by the time she turns 45 out of the returns she will earn from her MF investments.

Shilpa and lakhs of Indian investors like her are happy that finally they will be able to buy and sell MF units online just like they trade in equities from the cozy environs of their home or office.

And they can't be more thankful to the market regulator, Securities and Exchange Board of India, Sebi, for this.

After the abolition of entry load, Sebi has introduced trading in open-ended mutual fund through the National Stock Exchange (NSE). Bombay Stock Exchange is expected to follow suit today.

As per the framework issued by Sebi two weeks back, NSE, India's largest stock exchange on November 30 launched a platform to enable buying and redeeming (selling and converting MF units into cash) of MF units on the exchange.

This move will boost the Rs 7.23 trillion Indian MF industry after the set back it faced when Sebi banned entry loads.

The after effects of the ban were: distributors were not very keen to sell MFs, it was no more a lucrative proposition for them. But now with more than 2,00,000 terminals across the country the new platform will help expand the reach of the MF industry. Click on NEXT to find how online mutual fund trading works...

How does it work?

At present an investor can invest in open-ended MF either through a distributor of mutual fund or directly through mutual fund," says a fund manager. "Now with this new platform you can buy or redeem your open ended mutual fund on NSE through a broker or an online trading account just like you buy and sell stocks," he adds.

Significantly, your MF units will also be available in dematerialised form just like equities.

"Investors, who do not have a demat account need not worry. They can opt for physical delivery of units that is similar to what they were getting by investing through a distributor or directly with a fund house," he explains for the benefit of those who would want to know more about this new facility.

Now investor is really the king (or the queen, as the case may be). They have two options to invest in MFs:

- Online: Through the platform offered by the NSE and BSE.

- Offline: Through distributors or directly through MF houses.

Interestingly the current facility cuts down your paper work to the minimum. "If you opt for this medium of investment in MFs you will not have to fill a form. All you need is either an account with a broker or an online trading account," says the fund manager.

However, one must not confuse this with exchange-traded funds. Unlike exchange-traded funds these are your regular open-ended funds.Advantages: Trading time

In the offline mode investors are able to buy at the same-day net asset value, NAV, if they submit their form before 3 pm, which is the cut-off time for equity fund. Any delay in submitting the form leads to the investor's money being invested at the next day's NAV. So if an investor or a distributor whose office is far from the point of acceptance office, s/he will have to leave early to submit the form," says Kartik Vyas, a MF distributor who runs his business from Andheri, a suburb in north Mumbai.

In other words, with the online buying and selling of MF units investors now will have time till 2.59 pm to get the same day NAV as they can just pick their phones and call their broker to invest the stipulated amount or do it themselves if they have an online trading account.

Single demat account

"Investors with existing demat account will not have to open a new account," says Vyas. Now, investors can get a single demat statement that will give investor consolidated details of their stock holdings as well as MF units.

Know your client (KYC) compliance

As per the guidelines laid down by Sebi if an investor is investing lump sum amount of Rs 50,000, s/he has to be KYC compliant. As you all will vouch for it the procedure to get KYC compliance is tedious and time-consuming. Investors who are not KYC complaint will now not have to fill all the KYC forms again as demat accounts are already KYC compliant.

Investment efficiency

Now you can invest in open-ended funds by sitting in any corner of the world.

" Now I will be able to invest at my convenience through my online trading account and do not have to worry about submitting the forms. This way I will be able to cash in on the day when the NAV is down," says 36-year-old banker Andrew D'Silva, who travels frequently on account of work and has been going ga-ga over the new facility offered by NSE and BSE.Disadvantages: System is still at a nascent stage

One needs an Association of Mutual Funds of India, AMFI, certified broker to invest. "But very few brokers are AMFI certified," says the fund manager. So if your broker is not AMFI-certified you will have to wait to avail this offer till the time your broker gets this certification.

As a lot of issues related to online buying and selling of MF units are not clear for the fund houses they may take time to get registered with NSE.

"Also, whereas share prices are quoted in rupee-paise up to three decimal points, MF NAVs are quoted up to four decimal points. This could make a huge difference in returns especially when a big amount is involved," says Vyas talking about how the investors may lose money on their investments if the system does not evolve quickly or necessary changes are not made.

Facilities

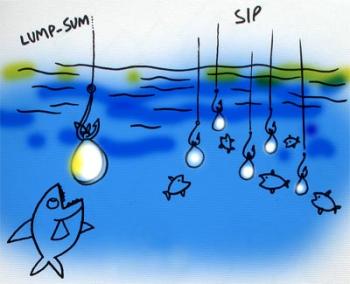

"Systematic investment plan (SIP) and systematic transfer plan (STP) is not offered as of now by this platform. An investor can only make a lump sum investment. It's not yet sure when these facilities will start," says Vyas adding that not many investors will opt for online trading in MF units as they have their SIPs and STPs running and would not like to disturb the equilibrium haphazardly.

Cost to the investor

The broker will charge investors a certain amount as brokerage. The brokerage will vary from broker to broker. The possibility of mis-selling cannot be ruled out.

Says Shrikant Subramanium, 24, a software engineer who regularly invests in MFs: "Sebi had banned entry load in order to prevent mis-selling and frequent churning of portfolios. Well brokers do charge brokerage both ways as in when you buy and sell through them. So this can definitely lead to mis-selling and unnecessary churning of the portfolio."

This is definitely a concern with most investors and they will have to be cautious about it.Who wins, who loses?

Although this is a good initiative by Sebi, not all share the same feeling. While Sebi's initiative will help cut down on investors' cost of buying MFs drastically the distributors are in for some rough weather.

The already bleeding MF distributors have suffered one more set back with the introduction of this platform.

"My income was already hit by Sebi banning the entry load. Now I will have to face competition from brokers who already have a huge client base. It's going to be very difficult for people like me," says Pradeep Joshi, a MF distributor.

To face competition from brokers, distributors need terminals, which they do not have. So in order to get a terminal they will have to register as sub-brokers with a broker who in turn is a member of either BSE or NSE. This is a problem for the distributor as they will then have to divulge all their clients' information leading them to lose business further.

Funds offered by NSE

This platform started with 30 equity and debt funds of UTI Mutual Fund. Birla Mutual Fund also has enrolled with NSE. Funds of Fidelity Mutual Fund will be offered from today. Other fund houses should register in coming months.