Photographs: Rediff Archives Manjunath Gaddi, Fundsupermart.co.in

This article introduces you to a unique themed fund. This fund will not only provide you with global diversification but also let you profit from rising food prices.

The increase in the prices of food items continues to be a persistent problem for the economy. The political turmoil in North Africa and Middle East has already raised the crude oil prices which will again lead to higher fuel prices. All these factors are leading to increased cost of living and people would have to pay more from their pockets. Thus, inflation is a cause of concern to everyone, the policy makers, the common man and investors too.

Inflation impacts in following ways:

- Increases your livelihood expenses thereby, reducing the investment money available with you

- Also, eats into the 'real' returns earned by your investments. Real returns are the returns earned by your investments minus the rate of inflation. So, on a given date having a certain rate of return on your investments means a higher inflation rate would give way to lower real returns

- High levels of inflation generally forces the central bank of that country (RBI, in our case) to hike interest rates which impacts equities and debt assets

Disclaimer: This article is for information purpose only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products /investment products mentioned in this article or an attempt to influence the opinion or behavior of the investors /recipients.

Any use of the information /any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.

How to profit from rising food inflation

Food inflation: A cause of concern

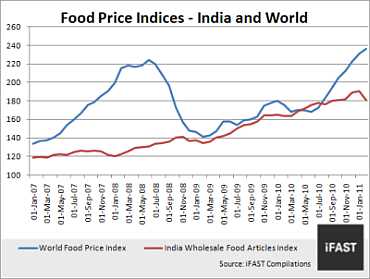

One of the contributors to high inflation in India is the persistent rise in the prices of food articles. However, food inflation is not localised to India but is impacting the whole world. The chart alongside, shows the rate of food price increase across the world, as seen by the sharp rise in the FAO Food Price Index published by the UN Food and Agriculture department and the rise is much higher in comparison to that of India.

Food inflation: An opportunity to profit

There are very few products available in India that could help an investor profit from food inflation. Here, either you will have to use commodity futures from the commodity exchanges or you can consider DWS Global Agribusiness Offshore fund.

How to profit from rising food inflation

DWS Global Agribusiness Offshore fund

The DWS Global Agribusiness Offshore fund (offshore fund) is an overseas Fund of Funds (FoFs) which invests into DWS Invest Global Agribusiness Fund (underlying fund). The offshore fund is managed in India by Aniket Inamdar and Kumaresh Ramakrishnan and the underlying fund is managed by Dr Oliver Kratz.

The offshore fund was incepted in India on May 14, 2010. The underlying fund does not have a benchmark. However, in India the fund has MSCI World Index as the benchmark following SEBI norms which state every fund to have a benchmark.

Investment theme

The fund's agriculture oriented theme is based on investing in businesses that service and earn profits from increasing global population, rising income of the people (especially in the developing world) and limited land/water resources. All these factors will help companies orient themselves towards the agriculture sector to earn profits in the long run.

This underlying fund does not seek to profit by investing into futures of food commodities, as this would increase food prices and can be the cause of socio, economic and political crisis across the world. However, the fund seeks to profit from the increase in the share prices of agriculture related companies. The fund will invest in companies that profit from the agriculture sector, that is, right from seed and fertiliser manufacturer to supermarkets.

How to profit from rising food inflation

Performance

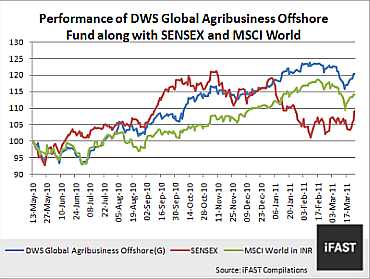

Although, the offshore fund has a history of less than one year, it has already outperformed SENSEX and MSCI World Index (in INR) by good margin.

As on March 25, 2011, this fund has given 20.3 per cent since its inception, while SENSEX and MSCI World Index have given 9 per cent and 14 per cent since the fund's inception.

The chart alongside shows the performance of the fund against the performance of SENSEX and MSCI World.

How to profit from rising food inflation

Portfolio composition

As on January 31, 2011, the underlying fund has allocation of more than 56 per cent in companies incorporated in US, Switzerland, Brazil and Canada. India does not figure in the top 10 countries.

Syngenta, Monsanto, Archer Daniel Midland, Viterra and Bunge are the top five companies that this fund has invested into with these five companies accounting for 28.5 per cent of the portfolio.

Monsanto is a seed producer, Syngenta is a herbicide / an insecticide company, Archer Daniel Midland, Bunge and Viterra are food grain procurers, transporters and processers.

How to profit from rising food inflation

Conclusion

One can consider investing in this fund considering two perspectives: 'theme based diversification' and 'geographical diversification'.

The fund is based on the agricultural theme, which is unique in India with none of the domestic funds offering a similar theme. Additionally, the agriculture theme is expected to do well on a global scale in the future considering the increasing problems in living conditions.

The current increase in food prices will increase the cash flows of companies in the agriculture space and ultimately, increase in profits. This would benefit the investors investing in this fund and the agricultural space.

In terms of geographical diversification, the fund is investing into companies related to agriculture across the world. Since, India does not figure out in the top 10 countries, the investor in this fund will also accrue diversification benefits. This is seen in the level of correlation between the daily fund returns and that of SENSEX.

The fund's daily returns have 25.7 per cent correlation with the SENSEX's daily returns whereas domestic equity fund has a higher degree of correlation with the SENSEX's movements.

Comment

article