Photographs: Danny Moloshok/Reuters Ankit Sharma, Rupeetimes.com

Even in this electronic age cheques are still the preferred mode of payment and banking transactions. Naturally, cheque frauds are rising too. But you can easily prevent them.

Monetary transactions by means of an instrument called 'cheque' have been in practice since a long time now. With the advent of electronic payment systems, there have been many mode of payments made available to you. But payment through cheques still continues to be a major mode of transaction for most people.

Fraudulent cases by hackers and spammers are on a rapid rise these days and cheque frauds don't lag behind. Particularly because of the fact that customers still prefer using cheques, one of the major reasons being that it offers a tangible record of the transaction but cheque frauds are also increasing.

Types of cheque frauds

Fraud in a cheque is mainly done when the cheque is:

- Altered

- Counterfeited

- Forged

Courtesy

How to prevent cheque frauds

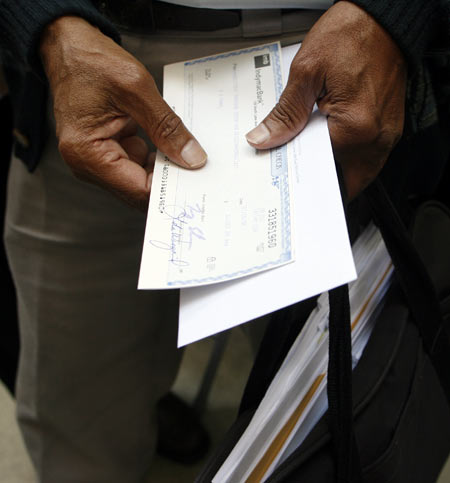

Image: A man holds a cheque after withdrawing money from an IndyMac Bank branch under federal management at the company's corporate headquarters in Pasadena, California July 14, 2008. Regulators seized Pasadena-based IndyMac on Friday after a bank run in which customers withdrew $1.3 billion of deposits over 11 business days, as worries about the company's survival grew, regulators said.Photographs: Danny Moloshok/Reuters

- Altered cheques are those which are initially issued properly by the account holder but later on some items (like the name of the payee or amount) are altered.

- Counterfeited cheques are those which are illegitimately written and signed by somebody other than the account holder.

- Forged cheques are those in which the signature of the account holder is forged by some other party.

How to prevent cheque frauds

Image: A man holds cheque books and an envelope as he waits for an IndyMac Bank branch to open under federal management at the company's corporate headquarters, so he can withdraw his money, in Pasadena, California July 14, 2008. Regulators seized Pasadena-based IndyMac on Friday after a bank run in which customers withdrew $1.3 billion of deposits over 11 business days, as worries about the company's survival grew, regulators said.Photographs: Danny Moloshok/Reuters

Tips to prevent cheque frauds while dealing with individuals/organisations

- In case of self/bearer cheques, the customer is advised to be careful while writing the amount on the cheque. The most common mistake people commit unknowingly is leaving some space on the left side while mentioning the amount on the cheque which makes their cheque vulnerable to fraudulent activities.

- Cunning fraudsters may make use of this empty space and add an extra digit before the original amount. To prevent this, it is advised that the customer write the amount from the extreme left in the space provided. The same advice must be considered while writing the 'amount in words.'

- A vertical line should be drawn after the amount is written so that nobody can add a digit/word later.

- Also, a transparent sticker should be put above the digits so as to avoid any tampering later.

- In a one to one case, when the sender knows the beneficiary and his name, then it is best advisable to opt for an account payee cheque.

- Crossing the cheque with the term 'account payee only' adds a sense of security to the cheque. Terms like 'or bearer/or order' should be crossed out in the cheques.

- Marking the cheque as 'non negotiable' will also make it unusable by any third party other than the payee.

How to prevent cheque frauds

Image: A merchant, who buys and sells gold, writes a cheque to a customer selling his gold jewels in Nice November 23, 2011. The global financial crisis has pushed people to sell gold family jewels to get back money.Photographs: Eric Gaillard/Reuters

- In case the customer is dealing with organisations wherein he has to make payments by cheque, many a times it is required for the customer to sign post dated cheques (PDCs). For example, if the customer is signing a PDC for processing fees of a loan, then he should ensure that s/he names the cheque in the name of the bank and the loan type for which processing fee is sought.

- In case the upper limit of processing fee is known, then s/he can mention 'not more than Rs (the upper limit)'. This puts a ceiling on the amount that can be withdrawn using the cheque.

- Precautions must be taken both by the bank treating the cheque as well as the customer signing it in order to prevent the rise of frauds. The government is also taking steps in this regard. Overwriting of any kind in a cheque is now not permissible under government orders, even if it has been countersigned by the customer. If all entities involved in the process show equal vigilance, then the rising number of frauds can definitely be put to check.

Comment

article