| « Back to article | Print this article |

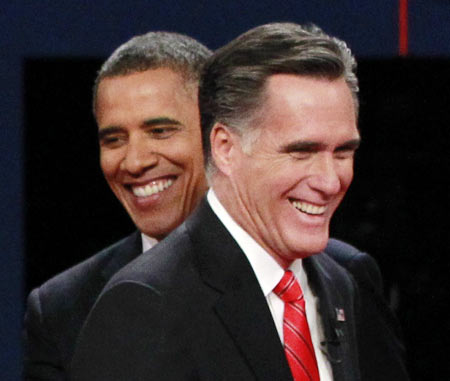

How Obama or Romney could affect your investments

For Indian equity investors, Obama's re-election would be a positive for their portfolios and surprise win for Romney might create lot of confidence in large economic business houses in the US. Typically, studies suggest that Democrat presidents are generally better for stock markets than their Republican counterparts, feels Narendar Lokwani of StockFundoo.com

Stock market is nothing but an aggregate or sum total of daily activities of millions of investors, traders and institutions who buy or sell on a given day as per prevalent sentiment, political and economic realities. Political situation in any country affects the stock market morale due to economic policies of particular parties and general elections have the potential of changing the course of economy of a country. And when the country in question is United States of America, the policies affect not only the domestic economy of USA, but the whole world, and especially countries like India which have strong business ties with US.

So, how will Obama vs Romney presidential race affect your portfolio? The answer lies in four-year presidential cycle theory, which is based on analysis of number of years of election data, and how it affects the economy and stock market returns in the years preceding and following the elections. As global markets are tightly integrated now, e.g. a bullish day in Dow Jones index often creates a gap up opening in Nifty the next morning. Similarly, results of US elections have significant potential of affecting Nifty returns as well.

Based on a number of studies done over past many decades by Yale Hirsch, creator of Stock Market Almanac, it is statistically proven that stock markets in USA follow a four year cycle, which closely follows the four- year election schedule.

StockFundoo.com provides insightful and in-depth capital markets analysis. Powered by fundamental deep value investing and technical analysis, we offer detailed stock analysis updated on a daily basis.

How Obama or Romney could affect your investments

In the first year of the presidential cycle, as a new president is elected or incumbent retains his seat, the stock market returns are typically weak. This is a toughest year for the economy and stock market, as new government tries to bring a balance between inflated election time promises and ground realities of the economy.

New president often realises that promises he made to electorate are difficult to implement, require a multi-year effort, or simply not doable. So, economy slows down, public perception and sentiment gets affected and resultant stock market returns are least attractive.

Average returns in the stock market for first year of presidential cycle are in the range of 5 to 7 per cent for the year.

How Obama or Romney could affect your investments

Second year of presidential cycle, marks a slow and gradual uptick in economy, as new president starts getting his promised policies in action by now. The economic and political decisions initiated in year one starts showing results by year two of this cycle.

If there was a bear market in stock market in first year, the second year will mark the bottoming of this bear market and hence is a good time to start buying equities at good value prices.

Average returns by stock market for second year of presidential cycle are in the range of 8 to 10 per cent for the year.

How Obama or Romney could affect your investments

Third year of presidential cycle is often strongly bullish. This is because the economy adjusts to the new policies by now, and visibility to industry heads is highest. There is stability in system by now, as there is considerable time before the next election approaches, so capital spend is highest in industry and government.

Government starts opening their coffers now for various public schemes as they are aware of the impending elections by next two years and hence extra money in the system creates a bullish year for economy and the stock market.

Average returns by stock market for third year of presidential cycle are in the range of 20 to 22 per cent for the year.

How Obama or Romney could affect your investments

Fourth year of presidential cycle is culmination of policies taken during the past four years. The year is moderately bullish as Industry realises that political scene might change in next year or so, so there is caution in air. However, public policies are at their lenient and there is considerable liquidity in the system to maintain the high stock market levels.

The markets are stable and at their four year highs at this point of time of four year cycle. Average returns by stock market for fourth year of presidential cycle are in the range of 8 to 10 per cent for the year.

This cycle repeats every four years of economy and by being aware of this cycle investors can benefit by timing their entry in equities market. Investors can carefully start investing in second year of presidential cycle when equities are at their lowest levels.

After a bullish year three and year four of the cycle, investors can slowly start taking profit off the table by end of year four of the cycle.

How Obama or Romney could affect your investments

Additional complexity in the cycle can come, when there is a regime change at the top. i.e. when a Republican candidate upsets the Democratic regime or vice versa. Like if Romney stages a victory over Obama, how will markets react? Or if the incumbent candidate is chosen for a second term, i.e. if Obama has a second term by defeating Romney, how will markets react?

Typically, studies suggest that Democrat presidents are generally better for stock markets than their Republican counterparts. The Republicans are pro-large business typically, however, stock market returns have been superior under Democrats historically. One reason could be due to pro-general public policies of Democrats, inducting liquidity through public schemes and favourable schemes for common public, which may induce feel good factor and stock market purchase by common retail investor.

How Obama or Romney could affect your investments

Historically, it is very tough to beat an incumbent party in US elections. Out of last 14 incumbent presidents which tried for a second term re-election, only four have failed. Hence statistically, it is far more probable for Obama to win this re-election than Romney being able to create an upset victory. Again, re-election of a given president is very positive for stock markets, because investors and industry captains are aware of existing economic and political policies.

Re-election of an incumbent president will not create any surprise factor or change in top level policies, hence paving way for a stable economic regime. Re-election of Democrat president for a second term have provided about 14 to 15 per cent gains in the first year of re-election itself.

Hence for an Indian equity investor, re-election of Obama would be a positive for your portfolios and surprise win for Romney might create lot of confidence in large economic business houses in the US, due to pro-business stance of Republicans, however may not be very positive for stock markets in the initial two years of the presidential cycle.