| « Back to article | Print this article |

Health insurance: 9 most commonly asked questions

With all those intricate terms and jargons, health insurance is anything but simple. Here are answers to the nine most frequently asked questions.

Health Insurance provides financial coverage for a medical contingency arising due to illness or injury. Also known as mediclaim, health insurance acts a saviour of the day when your loved ones fall prey to mishaps. It is as crucial to have health insurance in your portfolio as life insurance.

With all those intricate terms and jargons, health insurance is anything but simple. Naturally, the buyer tends to get confused while buying health insurance plans. The best way to bust the confusion is to ask questions. The rhyme to remember is, ‘Buyer’s Task is to Ask’. Here we have handpicked the nine most commonly questions regarding health insurance.

Take a quick look!

I have a pre-existing condition. Can I buy health insurance?

Yes, you can get a health cover even if you already have a pre-existing condition. But the catch to it is that you’ll have to bear a waiting period (which is usually four years) before the plan starts covering your pre-existing condition. For the first four years, the plan continues to give you a health cover excluding the pre-existing conditions and the related complications arising thereof.

I want to switch to a new insurer as I am getting a better deal. Do I have to bear the waiting periods all over again?

When you switch from your insurer to a new insurer, you get to retain the waiting period benefits. Simply put, you do not need to bear the waiting periods all over again. This feature is better known as insurance portability. So if you are looking to take a leap, you better take it.

Health insurance: 9 most commonly asked questions

Do I get any tax benefits on health insurance?

Oh yes! Health insurance lets you to save big on your taxes.

Under section 80D of the income tax act, the premium paid for a health insurance plan is deductible from the taxable income. The upper cap on this deductible amount is Rs 15,000 and is stretchable up to Rs 20,000 for senior citizens.

So, when you buy a health insurance plan, you can enjoy a total deduction of Rs 35,000.

What if I buy a health insurance plan and find out it’s not right for me?

Every product comes with a guarantee. Why should health insurance be any different? If you buy a policy and discover after reading the fine print that it doesn’t go quite well with your needs, you can return the policy and get your money back after some nominal deductions.

The buyer gets a time period of 15 days to check out her/his plan thoroughly and cancel it if s/he deems it necessary. This period is better known as free look period or cooling period.

Health insurance: 9 most commonly asked questions

How do I go about buying a health insurance plan?

Most of the buyers are solely concerned about premium and coverage while getting a health plan. But there’s much more to look out for in a health insurance plan than just these two factors. To make the most out of your plan, you should proceed with care in four simple steps.

Start with the meat of the plan. See what the plan covers. Make sure you don’t miss out on the imperative features in your plan such as cashless hospitalisation, pre and post hospitalisation, maternity benefit, pre-existing coverage, domiciliary hospitalisation and ambulance charges.

Move on to the finer details. Look out for the value added features offered in your plan such as lifelong renewability, daily cash benefits, 24x7 medical consultation, free health check-ups, medical concierge benefits, restore benefits, etcetera. Also, note how wide and robust the network of participating hospitals is.

Check out the riders and benefits. There are numerous add-ons that can make plain coverage more valuable such as hospital cash benefit, personal accident rider and critical illness rider.

And finally come to the exclusions. The most common ones are hearing and vision aids, cosmetic surgery, outpatient treatment, dental treatment, AIDS/HIV, non-allopathic treatment, pregnancy related expenses, etc.

How does the insurer decide my premium?

There are several factors that your insurer considers to set a premium for getting you insured. These are:

- Younger individuals get insured for less than their older counterparts

- The more extensive the cover, higher the premium

- A smoker has to shell out a higher premium than a non-smoker

- An individual with a medical history has to pay higher to get insured

- A plan with riders and benefits costs higher than a simple vanilla plan

Some professionals get to enjoy special discounts on premium while some others (such as mine workers and sports enthusiasts) end up incurring a higher cost

Health insurance: 9 most commonly asked questions

What are the dos and don’ts of health insurance?

Dos |

Don’ts

|

Do add riders and benefits At a nominal additional premium, they add substantial value to your cover Do opt for co-pay and deductibles It’s a sure key to reduce the premium Do make sure the insurance company can be trusted upon Get to know the insurer’s claim settlement ratio before zeroing in Do shop around Getting and comparing quotes is the best way to end up with the right insurance plan

| Do not be underinsured Remember, low cover is no better than no cover Do not ignore the fine print The clauses given in the fine print are so little and so many but you should not skip them Do not let your policy lapse Pay your premium religiously to get the most out of your plan Do not lie Never withhold any crucial medical fact at the time of buying the plan

|

Health insurance: 9 most commonly asked questions

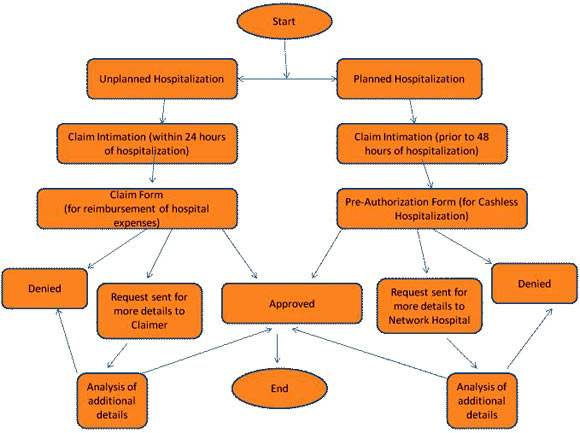

How do I go about making a claim?

We have consolidated the whole health claim game in the flow chart above.

How to get the best health insurance plan?

The best way to get the right health insurance plan is to get and compare quotes at online insurance comparison portals. When you compare quotes, you get the widest possible coverage at the lowest possible premium. Moreover, buying insurance online saves you time, money and effort.