| « Back to article | Print this article |

Get your favourite degree. Cost no hurdle!

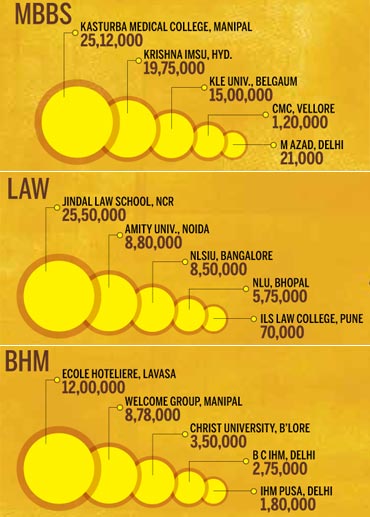

Higher education is getting expensive by each academic year. Earlier this year, the Maharashtra government

approved a proposal of two-fold hike in the medical education fee in all government-run and aided medical colleges,

raising the amount from Rs 18,000 to Rs 45,000 a year. IIM-C's course fee was hiked to Rs 9 lakh from Rs 7 lakh in

2009 and up to Rs 13.5 lakh in 2010.

Law studies aren't cheap either. LLB at Jindal Law School can set you back by Rs 25 lakh (For details, view box: Programmes/Fee). Scholarships remain the best way to meet these costs, but they are few and far between. Loans

appear to be the most popular route.

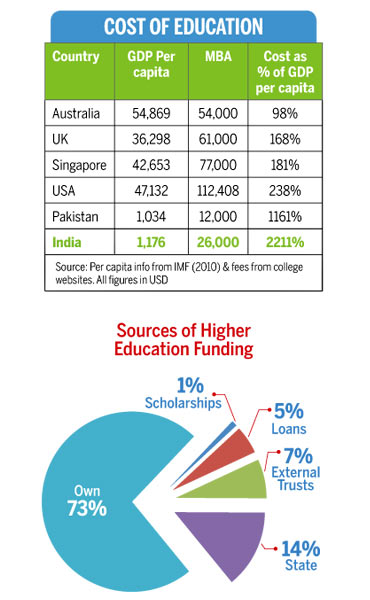

But there are access and availability issues. Investments focused on education are just appearing on the horizon.

Careers360 takes a look at each of these means of funding that elusive degree that you have always dreamed of. A

combination of all the three would be the way to go in the coming years as the State progressively withdraws from

funding higher studies.

Get your favourite degree. Cost no hurdle!

Get your study credit

A bank loan could help you pursue your dream course. However, the high interest rates and the cumbersome process could come as a dampener. But don't be disheartened. Read on to find out how to get the best deal.

Rising cost of study does not imply you are denied access to a chosen programme. Most banks are into lending of education loans. In fact, study loans are categorised as priority sector lending for public sector banks. But again, it does not mean that lending institutions are quick to disburse loans to all kinds for all programmes and for all institutions. It is a rationed product as Harsh Roongta, CEO apnapaisa.com describes it.

Though banks/lending institutions don't disclose details like the total education loan component from their overall

portfolio, the loan amount disbursed, the number of default cases occurred or the number of applications rejected, a recent study by Parthenon Group states that the number of student loans in India is low in comparison to other countries. The US-based education advisory firm, in its report 'Financing Indian Higher Education,' says that lack of awareness, complexity of the application process, high interest rates and short repayment period are the reasons for low disbursement rate.

It is another matter that most loan providers choose not to advertise about this product offering.

"In the US the average interest rates vary between 3.5 percent and 7 percent and the repayment period can be anywhere between 5-30 years," says Karan Khemka, partner and head, Parthenon Group.

"The interest rates are a bit high for educational loans," echoes student Vaibhav Shinde, 25, who took Rs 5 lakh loan at 10.25 percent interest rate.

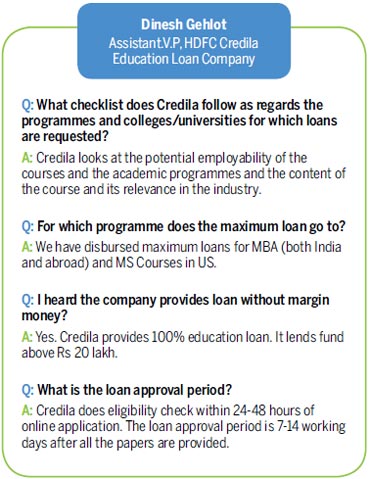

Even the most flexible education loan company, Credila, has repayment period of 7-10 years.

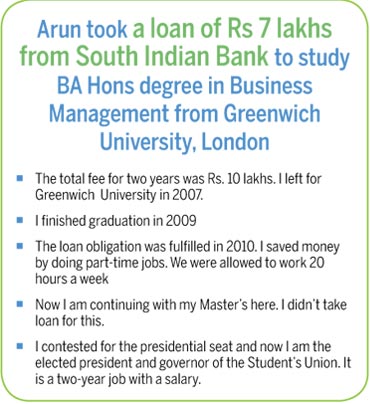

It was dream come true for 24-year-old Arun Thukral when he secured admission at London's Greenwich University to

pursue International Business, a two-year programme. For a boy of Hisar, Haryana, belonging to a business family from a rustic area, who grew up with determination and fragmented English, the joy knew no bounds when his loan was sanctioned.

"I took a loan of Rs 7 lakh," he speaks in impeccable English now, a fluency acquired through hard practice in preparation of going overseas. "The loan procurement procedure was tough, he admits, adding in the same breath that he's paid off the entire amount in 2010, during the study tenure, keeping part-time jobs.

Get your favourite degree. Cost no hurdle!

Will your study loan be approved?

Arun, now the president of the Greenwich University's student union holds a salaried job, which has a two-year tenure, and is ecstatic to have realised his ambition. It is a life he had always hoped for, away from Hisar.

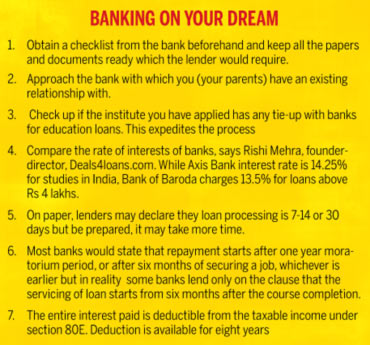

If you too want to join a bandwagon akin to his, then ensure you are enrolling in an established institution, like IIM, IIT, XLRI, NIFT and/or institutions which are recognised by a government body like AICTE, UGC, AIBMS, ICMR.

Then the loan approval is easy. Loan sanction is easy for professional courses such as engineering, medical, agriculture, veterinary, law, dental, management, ICWA, CA and CFA. There isn't much hassle on the regular degree or diploma courses either provided it is approved by ministries. For instance, aeronautical, pilot training, shipping, approved by Director General of Civil Aviation/Shipping will receive quick approval.

What remains out of purview of consideration are private colleges which don't have very good placement records. It

gets the lenders worrying about the repayment ability of the student and hence the hesitation.

While it is easy for the banks to establish the veracity of home institutions, overseas colleges may be seen with a bit of trepidation. Or may be not.

Get your favourite degree. Cost no hurdle!

As Arun notices, banks don't really get into checking the college rankings. As per Surcuhi Wagh of nextLeap, a firm which advises US-bound students, banks informally check the reputation of the University through their network of alumni, current students and knowledge-base.

However, it has been noticed that banks don't disclose a checklist on this either, if they have one.

Well, ponder over the recent case of US-based Tri-Valley College. The college was on the UK Border Agency's (UKBA) list and was viewed as a "safe" college. The accepted premise being if UKBA has registered the college on its list, then the institution is genuine.

The chances of denial for UKBA-listed colleges are extremely thin. Unfortunately, the authenticity of UKBA-listed Tri-Valley proved to be a fallacy. Therefore, it is incumbent on the overseas-bound students to verify an institution on their own accord as well.

The advantage of the hard work? It keeps their academic history clean. Second, good education paves way for better job, competitive wages and eventually a smooth loan service. The resumes of Tri-Valley students stands smeared as on date.

Get your favourite degree. Cost no hurdle!

How much loan should you take?

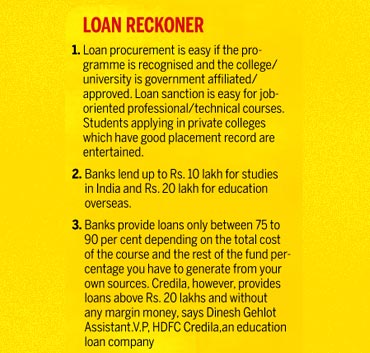

This question may haunt you if you don't do cost benefit analysis. (Refer Box: Fee Vs EMI). The maximum loan that lenders disburse for studies in India is Rs 10 lakh and for overseas, Rs 20 lakh. Credila provides loan above Rs 20 lakh.

The loan you should take would depend on the course fees and your capacity of generating the down payment (payment

from own pocket) towards it. For a loan above Rs 4 lakh, one has to generate minimum down-payment of 5 percent for studies in India and 15 percent for studies abroad. For a loan below Rs 4 lakh, one can get the entire fees as loan, as the banks claim. But you can pay the down payment or the margin money piecemeal.

Allahabad Bank, for instance, takes the margin money on year-to-year basis and disbursements are made on a pro-rata basis. Though a student may be eligible for uppermost loan limit s/he should exercise prudence while filling the loan amount.

If the course for which the loan is being taken enables better earnings then it may more than justify the loan, says Harsh.

Abhinav Chaturvedi, 25, student of PG Retail Management from FDDI, took a loan of Rs 3 lakh at the interest rate of

8.5 percent. Coming back to the question, how much amount should one take? Experts' advice is to study the placement record of the institution and roughly calculate the expected monthly income one is likely to draw as fresher. "For example, if a student reckons that EMI would be less than 50 percent of the expected salary, then ideally the student is in a comfortable position," says Harsh of apnapaisa.com.

Take a credit commitment which you can fulfil. "EMIs shouldn't be additional burden on your parents," says Vaibhav.

Take in to consideration the earning ability post studies and managing EMIs along with other day-to-day expenses.

Get your favourite degree. Cost no hurdle!

Collateral and other documents required by banks

Reserve Bank of India guidelines state that for a loan of Rs 4 lakh student need not provide security by way of a guarantor. However, amount of above Rs 4 lakh up to Rs 7.5 lakh, a third party guarantee and co-obligation of parents is required. Also necessary are guarantor's or co-obligator's original property papers covering its market value at least twice the loan amount as collateral security.

"The reason for a value double the loan amount is asked because the amount accumulates inclusive of interest when the repayment tenure commences," says a bank official.

If co-borrower is the father, then the father's annual income and other documents like bonds, shares and other financial assets are also asked for. "Though as per RBI guidelines, if the property value is sufficient to cover the entire amount, then these papers are not required," says the bank official adding that most of the rules and norms of RBI are flouted while granting study loan amounts. Margin money of 10 percent is asked for instead of stipulated 5 percent of the sanctioned loan component, he adds.

Get your favourite degree. Cost no hurdle!

Besides these papers, banks may also require an insurance policy to extend and/or grant the study loan. It may also ask to offer an existing policy as collateral or buy a policy if the student does not have a policy.

"We require past academic documents of student and financial documents of co-borrower which includes salary slip of

three months, Income Tax Returns (ITR) of two years, bank statement of eight months for secured loans," says Dinesh

Gehlot, Assistant VP of Credila.

Bank asking for documents of academic qualification is fine because every meritorious student should have access

to higher education, says the bank official. But as opposed to clear guidelines of RBI that such loans should be granted and promoted without undue influence, the process is usually not fair, emphasises the bank official.

"I had to show two year's full fee amount in his bank account in order to get the loan approval," says an amused Arun. "I submitted my academic documents and acceptance letter from Greenwich University, which was fine," he says.

Get your favourite degree. Cost no hurdle!

Loan application rejected?

Some loan applications are not considered by lending institutions. Arun Singh, a final-year PGDM student's loan was

rejected. A student of government recognised Fashion Design and Development Institute (FDDI), at Noida, he still ponders over the irony of the loan process. The 24-year-old student who completed his Class 10 from St. Paul school Lucknow gives his family background, "We had a small business in Lucknow and we suffered some financial losses." Our inability to show a regular source of income led to loan rejection, he shares.

"A weak financial position was all the more reason I needed an education loan so that I pursue good education and secure a well-paying job," says the BCom graduate of Lucknow University with six years of work experience, including a three-year stint in Genpact. "I was Process Developer in Collections," Arun speaks of his profile adding that while at Genpact he also completed Certificate Programme in General Management from IIM Lucknow. He approached ICICI bank, HDFC, OBC, PNB and SBI banks. "They all rejected my loan but were ready to lend personal loan."

Loan application rejected?

Arun, however, refused it as the interest rates were high. Funds somehow were generated from internal means and now Arun is getting lucrative campus offers.

Looking back, the bright boy feels that the whole purpose of lending education loan stands defeated if needy and genuine students like him are denied access. "If I could show enough liquidity in my bank account, why would I need loan in the first place," he questions.

If the course is approved by a regulatory body, the student has good academic record and has secure admission on merit, with loan application of Rs 4 lakh or less, then there is no reason that the loan should be rejected, says Harsh of apnapaisa,com. However, if one is faced with a situation like Arun, he suggests, "The student should complain to the higher official of the bank and should also try applying to other banks that may approve the loan." Specialised education loan institutes such as Credila can be approached, he further advises.

If the loan is rejected due to dubious quality of the educational institution or problems with the credit history of the guarantor, chances are that the loan application would be rejected across lenders.

Get your favourite degree. Cost no hurdle!

Default on repayments?

The repayment period is between five and seven years and it starts from one year after the course completion or six months after securing a job, whichever is earlier. But in case of Aparna Singh, the bank from which she took credit told her that repayment period starts within six months of course completion.

"I have to find a job with in this period," says a little stressed out Aparna. She is not taking up the campus placement as she possess four years of work experience and wants to be placed suitably. "So, I have to find a job myself in these 6 months," the clock will start ticking for her as soon as the course gets over in a month and a half.

Students too, must make these aspects clear with the bank because any default would smear their credit track record. In fact, defaults on repayments are hauntingly raw deal for bank businesses. And that is one of the reasons why student loan accounts for a very small share of bank's loan portfolio. Tracking down defaulters is an impossible task in India because tracking systems are not well-developed, says Karan of Parthenon Group.

Get your favourite degree. Cost no hurdle!

Banks can start using a unique identification number to decrease the risk and make loans accessible to more students," he offers. The US government was able to lower default rates by making educational institutions partly

responsible for the repayment behaviour of their students, Karan shares.

Considering that the default is unintentional, when a student foresees hiccups arising in loan servicing then he/she should request the lender to re-schedule the payoff beforehand. If the lender agrees -- as they did in quite a few cases in early 2009 when the employment markets was adversely hit -- then it is fine.

"Otherwise there is no real option," says Harsh of apnapaisa.

Get your favourite degree. Cost no hurdle!

In case the student is not able to pay the loan, the default will be reflected in his credit information report

says Harsh. Default gets reported in the Credit Information Bureau Limited (CIBIL) as well, which can affect the credit history of the student.

Legal proceedings take place in case of defaults. "Also, the collateral can be confiscated in case of the default," warns Dinesh of Credila. If students are regular in servicing the loan then access to future loans like auto loans, housing loans can be negotiated at competitive rates, based on the good credit history.

So, follow the golden rules and approach your dreams in good faith. Set off now.