Photographs: Rediff Archives Dhanashri Rane, Fundsupermart.com

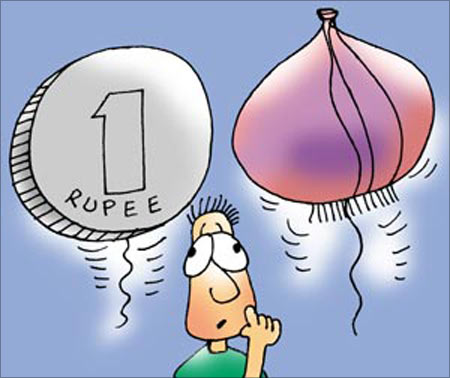

A pretty humorous but powerful way of defining inflation is, 'it happens when everything gets more valuable, except money!'

Inflation or simply, the consistent increase in the prices of basic goods and essential services squeezes out every bit of penny from the hands of common man. Especially in a high growth and developing economy like ours, inflation would continue to remain a worry for all.

In the past, we have had governments being given a pink slip owing to steep rise in onion prices and even a bandh this year to protest against inflation.

While efforts are made by the central bank and government alike to keep the price rise under check, we need to safeguard ourselves against the demon of inflation, which smartly keeps reducing the value of our savings.

It is never too early or too late to invest.

But if one starts to invest early in life, the magic of power of compounding would help you grow your net worth sizably. Even if you haven't started yet, a disciplined approach and regular investing would bring handsome gains.

Click NEXT to read about the 5 ways to tackle constant price rise

Disclaimer: This article is for information purpose only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products /investment products mentioned in this article or an attempt to influence the opinion or behavior of the investors /recipients.

Any use of the information /any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.

I. Why not deposits

In order to control inflationary pressures, the central bank (in India's case the Reserve Bank of India) hikes interest rates.

As a result, depositors enjoy higher interest rates on their fixed term deposits. But here lies a catch. Inflation reduces the real value of your money.

For example, you bought a food item at Rs 100 in 2009. Assuming an average food price inflation of 10 per cent, this food item will cost you Rs 110 today.

Thus, though your expenses are still the same, you are spending more. The same principle applies to your deposits which should yield you more returns.

In effect, your fixed deposit rate (say x) should be more than inflation (say y) to effectively beat the 10 per cent price increase.

Therefore, your real or actual return is (x minus y) should match or exceed the 'inflated' cost of living which is often not the case.2. New Pension System (NPS)

Today's generation wants to retire early, has limited or no post employment pension and intends to live a hedonistic life.

Building an adequate corpus to take care of expenses and a comfortable livelihood after retirement is important; moreover, because inflation erodes the corpus value.

Therefore, an extremely cheap annuity plan like NPS is a viable option.3. Diversify into equity asset class

As proven by the past market cycles, despite the fluctuations in the short-term, the returns generated from equities supersede other asset classes in the long term. Thus, the portfolio strategy to beat inflation is significantly aided by allocation to equities.

Plus, it is better to have a diversified portfolio of stocks or invest in a diversified equity fund without a sector or industry bias.

Contrary to the depositors, higher borrowing rates by banks deeply impacts the credit requirements of corporate and individuals. So sectors such as real estate, infrastructure and power, which require huge liquidity to supplement long gestation plans, are greatly affected.

Despite this, there are sectors which source raw materials such as food grains and industrial metals, and offer essentials like utilities, health and personal care on which individual and industry depends on, would continue to function the same way.

In fact, companies that produce these primary goods would benefit from the price rise.4. Alternate options: Commodity investing

Investing into agriculture-based funds is another option. There are also commodity funds, which invest in companies related to precious metals (read gold), energy stocks, metal and mining industry.

But commodities prices are highly cyclical and are subject to macro-economic policies, geo-political environment, and consumption demand.

In case of global commodity based funds, currency risk is also applicable. However, aggressive investors can include these funds in their supplementary portfolio.5. Gold: Traditional hedge

Indians are aware and have a significant allocation to gold albeit in jewellery form. With the emergence of ETFs and gold feeder funds, people are gradually looking at the yellow metal for investment.

It also serves as a hedging tool during uncertain times.

Presently, the steep rise in gold price is owing to the slow recovery in the developed markets. However, one has to bear in mind that gold does not generate interest income or pay dividends so it is more of the appreciation in value that would actually benefit your portfolio.

Comment

article