| « Back to article | Print this article |

Are credit card loans better than personal loans?

Instant approval, no due diligence, conversion to easy-to-pay EMIs, nominal processing fees are some of the reasons why credit card loans are better, feels Rajiv Raj.

Tushar Kerkar, a Mumbai-based investment banker with a Cibil score of 802, had a few purchases to make to enhance his house interiors. He was eligible for a personal loan at 14.5 per cent interest rate. (The current interest rate on personal loan ranges between 14 and 19 per cent depending on the profile of the borrower, the tenure and size of the loan).

He also had a credit card, which had a sizeable credit limit and the option to convert it to interest free equitable monthly installments (EMI).

After weighing the pros and cons of both kinds of loans he opted for the credit card loan.

Here's why...

The author is a credit expert with 10 years of experience in personal finance and consumer banking industry and another 7 years in credit bureau sector. Rajiv was instrumental in setting up India's first credit bureau, Credit Information Bureau (India) Limited (CIBIL). He has also worked with Citibank, Canara Bank, HDFC Bank, IDBI Bank and Experian in various capacities.

Are credit card loans better than personal loans?

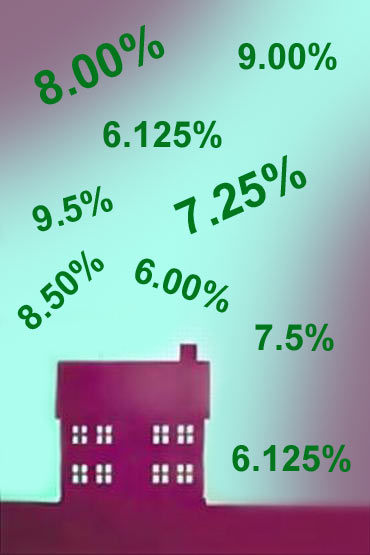

Interest rates

A lot fo credit cards these days come with interest free EMIs at select merchant establishments.

For peronal loans they range between 14 to 19 per cent.

Are credit card loans better than personal loans?

Size of the loan

Most credit card loans are smaller in size. The maximum could be up to Rs 2 lakh or even higher if your credit limit is higher.

Banks offer personal loans up to Rs 15 lakh

Are credit card loans better than personal loans?

Processing fee

Credit cards charge a nominal fee.

Personal loan borrowers may have to pay processing fees that is equal to all other loans. It may range between Rs 5,000 and Rs 10,000.

Are credit card loans better than personal loans?

Foreclosure

Most credit card loans do not charge any penal interest on foreclosure of loan.

Many banks do charge foreclosure penalty on personal loan.

Are credit card loans better than personal loans?

Time to grant loan

Credit card loans are instant. Many a time it will be converted into an EMI at the merchant establishment or you can call customer care for conversion after you have swiped your card.

It takes about a couple of weeks to a month to grant loan.

Are credit card loans better than personal loans?

Due diligence

Credit card lenders do not do due diligence every time your require to borrow.

It is done every time you apply for a personal loan.

While the above-mentioned pointers are the differences in both kinds of loans, it is important to understand that both kinds of loans are unsecured and serve different purposes. So it is imperative for you to read between the lines mentioned in the terms and conditions before you make a right decision.