| « Back to article | Print this article |

A financial plan to help you retire a crorepati

How should a family of five with a monthly income of Rs 82,000 today, plan to make a retirement corpus of Rs 7.5 crore? Vetapalem Sridhar, certified personal finance advisor and trainer does the number crunching.

Rajan Singh, 33, and Madhavi Singh, 30, have a daughter, Rajvi, who is 3 years old. A resident of Mumbai, Rajan’s current in hand income is Rs 55,000 per month. Madhavi Singh earns Rs 27,000 per month. There may be an annual bonus of up to Rs 75,000 based on Rajan’s performance.

Rajan’s parents stay with the couple. They are healthy with no specific medical issues. The parents are covered by CGHS (Central Government Health Scheme) for their medical needs.

Rajan has an outstanding housing loan of Rs 21 lakh with 152 EMIs outstanding. He pays an EMI of Rs 22,493. The value of their house now stands at Rs 42 lakh.

Rajan’s father, 62, had helped with the down payment of Rs 12 lakh. Their household expenses for 5 members work out to Rs 27,000 per month. In addition, the family incurs an annual expense of approximately Rs 72,000.

Rajan Singh’s investments:

- LIC Jeevan Anand, Rs 6 lakh sum assured. Annual premium: Rs 20,400; Tenure: 30 years. Policy start date: 2006

- Child ULIP policy: Rajan pays an annual premium of Rs 30,000 and the second installment was paid two months back.

- Started one-year recurring deposit of Rs 2,000, nine months ago.

- A systematic investment plan of Rs 6,000 per month amounting to equity mutual fund holdings of Rs 73,000 till date.

- An existing bank fixed deposit of Rs 1.5 lakh and savings bank balance of Rs 55,000.

- Rajan’s father earns a pension of Rs 13,500 from which he is investing Rs 1,500 per month in Rajvi’s name since last two years. He has cash of around Rs 7 lakh. Dad had helped Rajan with the down payment towards the home.

Goals List:

- Rajan wants to buy a car soon. Dad is willing to give around Rs 1 lakh for the purpose. The family also wants to upgrade their Kitchen for which the estimated budget is around Rs 60,000. Madhavi is due for her second child in around six months.

- The Singh family would need Rs 5 lakh at current cost for Rajvi’s education when she turns 18 and marriage fund of around Rs 10 lakh at current cost when she turns 24. Rajan would like a similar provision made for the second child.

- How much to save for retirement?

- They want to shift to a 3 bedroom-hall-kitchen flat in the next 5 to 7 years.

- They have not gone for a vacation in the last 3 years. They want to go for a vacation but are not sure if they can afford it.

- Madhavi Singh wants to evaluate if she can take a break from work till her second child starts school.

The author is a certified personal finance advisor and trainer. He runs http://www.finplan.in and can be reached at vetapalems@rediffmail.com.

Disclaimer: The suggestions provided above are based on comprehensive study of all material and relevant aspects of the particular case discussed. The names of individuals have been changed to protect their identity. The intention of this case is to make people aware of what areas a financial plan should cover. The suggestions provided in the case above are not applicable to you. Please consult a qualified Financial Planner or Advisor for your individual needs.

A financial plan to help you retire a crorepati

The plan for the Singhs

Emergency fund: An emergency fund equal to 6 months of expenses is recommended. That works out to around Rs 3.4 lakh. However this can be relaxed somewhat keeping in mind that Rajan’s father has fixed deposits of Rs 7 lakh.

Risk planning: Assuming that Madhavi will work till the age of 50, Rajan will need to take an insurance cover of 1.2 crore for the next 20 years. An online Term Cover bought over the internet should cost around Rs 12,000 annually. It is advisable that Madhavi too take Rs 50-lakh insurance cover for 20 years which would cost her around Rs 4,500 per annum.

You can check for the online term covers offered by Bharti Axa eProtect, Aegon Religare iTerm, Kotak ePreferred, SBI eShield, PNB MetProtect, ICICI iCare, Aviva iLife, etc.

Currently they have a company offered medical cover of Rs 3 lakh for the husband, wife and child. The family should consider taking a separate medical cover in 2 years time. For the time being we suggest the family go for a top-up medical cover of Rs 10 lakh (with Rs 3 lakh deductible -- the first 3 lakh for each treatment are to be paid by self) that comes at a premium of around Rs 5,000 per annum.

Bajaj Allianz Extra Care, ICICI Lombard Health Care Plus, Chola Top Up, Apollo Optima Plus are among the few top-up insurance products offered by the insurance companies.

Existing insurance: Stop LIC Jeevan Anand policy, but only after you have taken the term cover mentioned above. This money in future can be diverted to pay annual premium of the online term cover. Stopping further premiums will make the LIC policy paid up. The policy will remain active with a sum assured proportionate to the number of premiums paid out of total.

The family can continue with the child policy for another 5 years. The exit costs are high for lower premiums at the current stage and hence it is advised to continue for 5 years. At end of 5 years there are no exit costs. The cost structures in a child policy are pretty high. An evaluation should be done at the end of 5 years to see if this Child Plan should be continued or closed.

Cash flow analysis

The monthly family income is Rs 82,000 and an additional pension of Rs 12,000 that Rajan’s father gets every month.

Given the current cash flow position, it is advisable for Madhavi Singh to continue working.

Of the average monthly surplus of Rs 24,500, current monthly commitment towards investment is Rs 10,500. (A Rs 6,000 SIP, Rs 2,000 RD and average Rs 2,500 investment into the child policy). Other than child policy of Rs 2,500, the monthly surplus of Rs 22,000 should be used as explained later in this article.

The SIP and RD would undergo changes as mentioned earlier.

Assumptions for cash flow calculations:

- Longer term inflation: 7 per cent.

- Net investment returns: Average 10 per cent annually for first 20 years and 8 per cent after that.

- Income growth: 10 per cent annually for 15 years, 7 per cent for subsequent 7 years and 5 per cent after that till retirement.

A financial plan to help you retire a crorepati

Short-term goals:

1. Car purchase: Buying a car is a priority for the family. It would make sense to buy a pre-owned car with a budget of around Rs 3 lakh. The second hand car market is a buyers market and you can expect to get a good deal if you negotiate well. Rajan can borrow Rs 1 lakh from his father in addition to the Rs 1 lakh he is willing to contribute. He should repay this borrowed Rs 1 lakh back over time. From his FD of Rs 1.5 lakh he can allocate Rs 1 lakh towards car purchase. Cost of living should roughly go up Rs 3,500 per month after purchasing the car. So the monthly surplus from Rs 22,000 would reduce to Rs 18,500.

2. Emergency fund: On maturing the money from RD should be added to the Rs 50,000 left in the FD. This should be allocated to build the emergency fund. From the monthly surplus of Rs 18,500 allocated Rs 8,000 every month over the coming year towards increasing the Emergency Fund. The monthly surplus would thereby reduce to Rs 10,500.

3. Kitchen renovation: This should be postponed. An allocation can be made towards kitchen renovation only if the family gets the annual bonus.

4. Vacation: Currently priority is a car. Spending for a vacation is not advisable at this point in time. This can be evaluated after a year based on the situation at that point in time. By then your second child would be around six months old.

Medium term goals:

Bigger house: You should consider a bigger house after 7 to 8 years by when your incomes should have more or less doubled. At that stage you should sell your existing house and the money received from it should be used as down payment. You probably should be able to take a loan of around Rs 80 lakh at that time which would help you buy a bigger house.

A provision of Rs 12 lakh in current cost is made (Rs 20 lakh in 2020) for furnishing of your bigger house from your long-term investment portfolio in the year 2020.

Long-term goals:

For all long-term goals a common investment portfolio should be built as discussed in the investment strategy later.

1. Daughter’s needs: For Rajvi’s education fund you would roughly need around Rs 15 lakh in 2028 (assuming inflation of 7 per cent). The marriage fund to be built would roughly be around Rs 41 lakh in the year 2034.

2. Second child’s needs: For the second child’s education fund you would roughly need around Rs 19 lakh in 2032 (assuming inflation of 7 per cent). Similarly for Rajvi’s marriage you would need to build around Rs 60 lakh in 2038.

It is estimated that the expenses of the family will rise by an additional Rs 5,000 per month on the arrival of their second child in 2014.

3. Retirement needs: Cash flow projections estimate that the couple would need to work till 58. The retirement fund needed is around Rs 7.5 crore in 2039 at the age of 59 years. Assuming an average inflation of 7 per cent throughout, this fund would be able to sustain a lifestyle of Rs 43,000 per month in current terms for the retired couple till their age of 85 years.

Rajan’s grandparents lived till they reached 80. Madhavi’s grandfather and grandmother are currently aged 82 and 75 respectively. This indicates that Rajan and Madhavi may live beyond 80.

A financial plan to help you retire a crorepati

Investment strategy for long-term goals:

For the long term goals different investments need not be made specifically for each goal. An investment portfolio should be built with a mix of debt and equity. A strategic asset allocation of 65 per cent equity and 35 per cent debt is suggested. The targeted return for equity over the long term is 12 per cent CAGR. For debt the targeted post tax return over the long term is 7 per cent. Your may use tactical asset allocation to be overweight or underweight for up to additional 5 per cent in consultation with your investment advisor.

We can project cash flows into the future. However cash flow projections way into the future would seldom come true. But these projections can give the Singhs an understanding if they are way off course to meet their long-term goals.

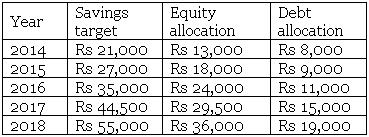

For this case the Singhs should focus on meeting the targets set for the coming 5 years. Cash flow analysis suggests that following should be the monthly savings that can happen during the next 5 years (see the table above):

In the first year the Rs 8,000 going into debt allocation is primarily being allocated towards emergency fund.

By the end of 2018, the value of investments should be around Rs 29 lakh assuming an annual growth of 10 per cent. However due to exposure to equity investment, the actual value may vary.

For the equity allocation, mutual fund SIPs maybe a suitable investment option. On the debt side a mix of recurring deposits and investment into PPF account is suggested.

The Singh couple must have a fresh review of their finances when their second child turns one.