| « Back to article | Print this article |

8 financial forecasts that went WRONG

Morningstar has compiled a series of predictions about the stock market and the economy by legendary stock market experts and economists that fell flat.

It's tough to make predictions, especially about the future," said the inimitable Yogi Berra. And history is replete with instances where commentators -- many of whom had otherwise illustrious careers -- made predictions that were later proved completely wide off the mark.

While the likes of the Titanic being unsinkable or, more recently, apocalyptic forecasts about the Y2K bug are the stuff of legend, financial history offers several examples of its own that are now considered epic.

And even as research such as the one conducted by psychologist Philip Tetlock, who studies forecasts, has suggested that experts, on average, get it only slightly better at getting right than -- in the professor's words -- "chimps throwing darts" or someone making random choices, investors continue to seek out talking heads in the financial media to know where the stock market, a particular stock or the economy will head.

Here we pick forecasts that have gone down in history books for the wrong reasons. A fact that stands out is many of the calls were made at a market or an economy's inflection point -- or just when it is about to top or bottom out -- which drives home the point that even the so-called pros are not immune to falling prey to mental behavioural biases.

Financial predictions that fell flat

1. Stocks have reached what looks like a permanently high plateau.

The greatest on the list of infamous predictions on the stock market came from Irving Fisher, the man whom legendary economist Milton Friedman called "the greatest economist the United States has ever produced".

Fisher, who made significant contributions to concepts such as utility theory and general equilibrium, said this three days before the Black Thursday crash in 1929 plunged America into the Great Depression.

8 financial forecasts that went WRONG

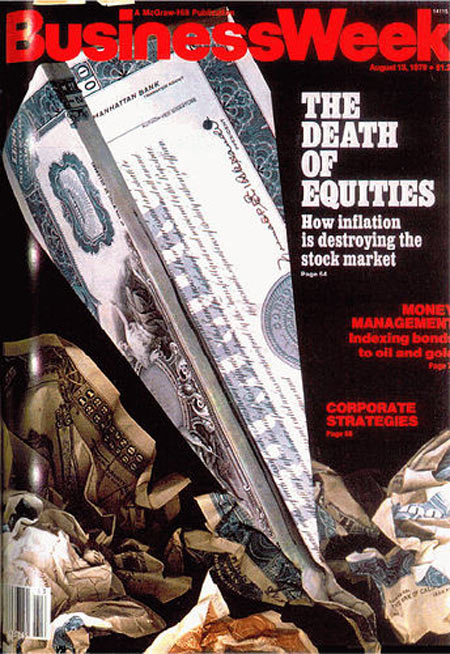

2. The Death of Equities: How Inflation is Destroying the Stock Market

A famous cover story run by Business Week magazine in August 1979, after the United States had struggled with about a decade of high inflation, low growth and poor stock market returns.

The story appeared three years before the market set off for an 18-year rally, a period in which stocks would multiply 15 times.

8 financial forecasts that went WRONG

3. The power behind the Japanese juggernaut is much greater than most Americans suspect, and the juggernaut cannot stop of its own volition, for Japan has created a kind of automatic wealth machine, perhaps the first since King Midas.

Clyde Prestowitz, an economist and a counselor to the Reagan administration, made this claim in his book, Trading Places, at the most inopportune time -- right when the country was about to reach the end pf its multi-decade economic boom in the late 80s.

8 financial forecasts that went WRONG

4. The Soviet economy is proof that, contrary to what many skeptics had earlier believed, a socialist command economy can function and even thrive.

Wrote Nobel-winning economist Paul Samuelson in the 13th edition of his best-selling textbook Economics published in 1989, two years before the Soviet Union collapsed. Samuelson would, however, go on to write in a later edition of the same book that Soviet communism was "a failed model".

8 financial forecasts that went WRONG

5.We're going to reach a point where stocks are correctly priced, and we think that's 36,000... it's not a bubble. Far from it. The stock market is undervalued.

James Glassman, author of the unfortunately-titled Dow 36000, made the bold call when the benchmark was at 11,500, in October 1999.

Ten years later, the Dow was still hovering around the 11,000 mark.

8 financial forecasts that went WRONG

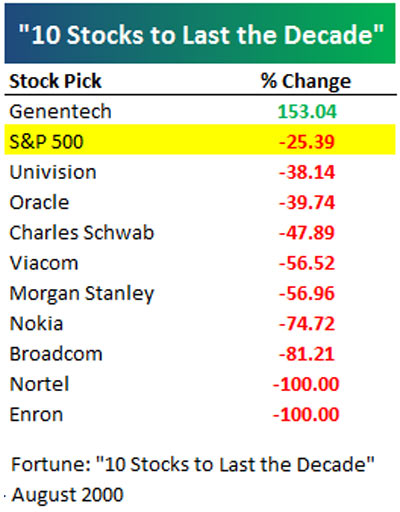

6. If you're a long-term investor, these ten (stocks) should put your retirement account in good stead and protect you from those recurring nightmares about the stocks that got away.

The August 2000 edition of the Fortune magazine ran a famous story picking 10 Stocks to Last a Decade.

Ten years later, a portfolio comprising the 10 stocks would have lost 70 per cent of its value, with only one stock posting a gain, while two firms on the list went bankrupt, one of them being Enron.

8 financial forecasts that went WRONG

7. I hope you will join me to pay down $2 trillion in debt during the next 10 years. At the end of those 10 years, we will have paid down all the debt that is available to retire. That is more debt repaid more quickly than has ever been repaid by any nation at any time in history.

Political posturing or not, the then US President George W Bush's expressed aim at his first State of the Union address in 2001 was way off when he foresaw a debt-free America in 10 years.

In 2012, the US gross debt stood at $16 trillion, or a little over 100 per cent of GDP.

8 financial forecasts that went WRONG

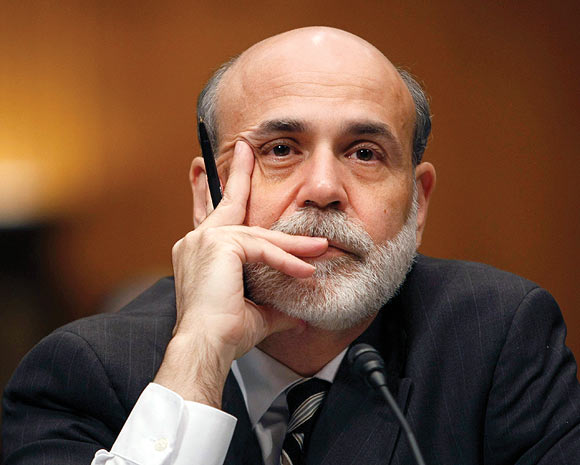

8. At this juncture, however, the impact on the broader economy and financial markets of the problems in the sub-prime market seems likely to be contained.

An epic failure comes from the Chairman of the Federal Reserve, Ben Bernanke, who in a testimony to the Congressional committee in March 2007 played down the impact of the sub-prime debt crisis that was just beginning to unfold.

Later in 2008, months before the US was hit by the greatest recession since the Great Depression, Bernanke went on record to say: The Federal Reserve is not currently forecasting a recession.