| « Back to article | Print this article |

7 secrets of winning the stock market game

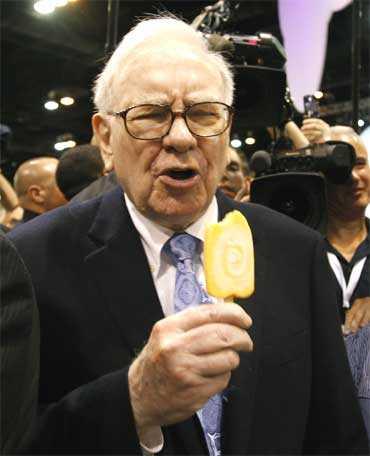

Humans have a natural tendency to follow the crowd. But when it comes to stock market investing, following the crowd often results in losses. Why replicate the mediocrity of the masses when you can clone the success of the world's greatest investor, Warren Buffet?

1. Look at quality businesses; not just the stocks

Warren Buffett said, "When I buy a stock, I think of it in terms of buying a whole company, just as if I were buying a store down the street." Most investors don't analyse the businesses they invest in. They simply follow the symbols or brands of successful corporate houses.

If you are buying a shop, you will analyse about the products dealt by the shop, overall sales, consistency of sales, competition for the shop, competition strength of the shop, how the shop will manage the change in customer trends and so on. We need to apply a similar logic before choosing a stock.

Don't think that you are only buying a few shares of that company. Will you buy the whole company if you had enough money?

Ramalingam K, an MBA (Finance) and certified financial planner, is founder & director of Holistic Investment Planners (P) Ltd (http://holisticinvestment.in).

2. Are you willing to own a stock for 10 years? If no, then don't own it even for 10 minutes

Only buy something that you'd be perfectly happy to hold if the market shuts down for 10 years tomorrow. In the short run, the market is like a voting machine -- tallying up which firms are popular and unpopular.

But in the long run, the market is like a weighing machine -- assessing the substance of a company. Looking at the short-term opportunities in the stock market will not be a long-term successful strategy.

If you don't feel comfortable owning something for 10 years, then don't own it even for 10 minutes.

3. Check thousands of stocks and look for very high bargains

Avoid investing based on the stock tips or recommendation. Do your own research. Analyse thousands of stocks before choosing the right stock to invest. Once you have chosen a right stock, wait till the share is available at a very high bargain price.

Buying a right stock at the right price is the key to investment success. Investors have the luxury of waiting for the 'fat pitch'.

It is really difficult for an individual investor to analyse thousands of stocks and finding out the right time to buy a stock.

If this is the case, you can outsource this portfolio management to a professional financial planner or wealth manager. But you need to be careful in choosing a professional who is capable and at the same time customer centric.

4. Scrutinise how well management is using the resources

Check how efficiently the management is using its resources like money, manpower and material. This management efficiency will in turn reflect in return on equity (RoE) and return on capital (RoC).

5. Always stay away from hot stocks

Hot stocks are those stocks which have some attention catching activity such as severe volatility in share prices, high trading volume or when the stock is in news. Stay away from these hot stocks.

Warren Buffett once said, "Most people get interested in stocks when everyone else is. The time to get interested is when no one else is. You can't buy what is popular and do well."

6. How much money you will make?

Before investing in a stock calculate 'how much money you will make' in this investment. Of course, you need to make a few assumptions to do this calculation. But do calculate.

Most often investors tend to ask the share is undervalued or overvalued. Identifying the intrinsic value of the stock is difficult and the various models available to calculate the intrinsic value are faulty.

Warren Buffett wrote in a report "Unless we see a very high probability of at least 10% pre-tax return, we will sit on the sidelines."

7. Get rid of the weeds and water the flowers -- not the other way around

People have this tendency of loss-aversion. They choose to wait when the share price has fallen by 50%. They convince themselves and others by saying 'the stock price will definitely rise'.

Also people will rush to book profit when their shares go up just by 10%.

In effect investors tend to keep loss making shares with themselves and offload profitable ones. Actually it needs to be the other way around.

These seven secrets properly applied in the stock market would be your roadmap to riches.