| « Back to article | Print this article |

5 HIDDEN GEMS for your mutual fund portfolio

These equity mutual funds may have fewer assets under management than their more known peers but are our analysts' favourites.

Mutual funds offer the perfect vehicle to gain access to an asset class. After a solid run in 2012, many investors may be looking to gain exposure to stocks.

Here we present five equity funds that may not be a hot favourite of investors -- as indicated by their relatively-small asset bases -- but enjoy our analysts' conviction in their ability to outperform peers over the long run (that is, carry a positive Analyst Rating of either Bronze, Silver or Gold).

Different from our quantitative, backward-looking Morningstar Ratings, the Analyst Ratings are our qualitative opinion on a fund's future potential.

The ratings are awarded after evaluating five -- what we believe are crucial -- factors that indicate a fund's potential, namely process, people, parent, performance and price. The ratings scale runs across three positive ratings (Bronze, Silver and Gold) -- implying varying conviction that the fund would outperform peers -- apart from Neutral and Negative.

While there isn't a clear rule as to what defines a "small" asset base, we have often in our previous articles considered anything less than Rs 500 crore in assets under management as being relatively lightweight in an industry where the biggest equity fund manages over Rs 10,000 crore.

But for the purpose of this screening, we have upped the threshold to Rs 700 crore in AuM (assets under management), following last year's powerful rally, which would have increased funds' asset bases considerably (assuming they did not witness significant outflows at the same time).

Here are five such worthy funds that we screened.

5 HIDDEN GEMS for your mutual fund portfolio

ICICI Prudential Top 100 Fund

Total Assets: Rs 4.2 billion

Analyst Rating: Star Bronze

The large-cap fund tops both its category average and the category benchmark by an impressive margin over one-, three-, five- and 10-year periods. But it is the return of fund manager Sankaran Naren last year, who had taken a year-long hiatus from management duty, which our analysts believe bolsters its prospects.

5 HIDDEN GEMS for your mutual fund portfolio

DSP BlackRock Micro-Cap Fund

Total Assets: Rs 4.4 billion

Analyst Rating: Star Bronze

A pure-play small- and micro-cap fund, DSP BlackRock Micro Cap looks to buy mis-priced growth and value stocks at the lower end of the market-cap range and is a good choice for risk-taking investors.

5 HIDDEN GEMS for your mutual fund portfolio

DSP BlackRock Opportunities Fund

Total Assets: Rs 5.8 billion

Analyst Rating: Star Silver

The large-cap fund saw a change of guard at the helm in July last and also had a rather ordinary 2011 but we retained our Silver Rating as we believe both factors have little bearing on its prospects. Over the long term, the fund has delivered above-average strong performance on the risk-adjusted returns front.

5 HIDDEN GEMS for your mutual fund portfolio

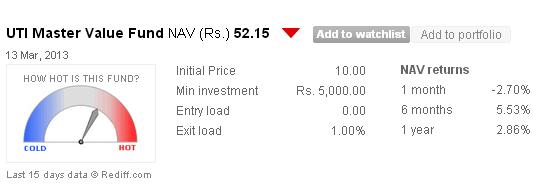

UTI Master Value Fund

Total Assets: Rs 6.3 billion

Analyst Rating: Star Bronze

Manager Anoop Bhaskar's presence is the one of the chief reasons why the fund merits our Bronze rating -- his skill at managing small/mid-cap funds has been noteworthy -- apart from other factors such as a stable investment team.

5 HIDDEN GEMS for your mutual fund portfolio

Templeton India Growth Fund

Total Assets: Rs 6.9 billion

Analyst Rating: Star Silver

A robust investment process led by Chetan Sehgal that operates under the guidance of emerging-markets guru Mark Mobius makes this a worthy value fund.