Photographs: Rediff Archives Investment-mantra.in

Investing in mutual funds is all about following the basics, keeping it simple and persisting with your investments. In the last decade, mutual funds have been the single biggest vehicle of transporting retail investor's savings into stocks and debt instruments.

20 basic rules for investing in mutual funds:

1. Having an investment goal before investing is very significant. Investing without any goal doesn't help much. Be clear about objective what you are trying to achieve.

2. Don't start investment in mutual funds by investing in sectoral funds. Choose quality large cap mutual fund or a balanced fund like HDFC Balanced Fund as the starting point.

3. Choose index funds for hands-off investment and balanced fund to diversify across asset classes.

4. Large cap funds add stability to the portfolio while small cap funds can generate better risk-adjusted returns.

Courtesy: www.investment-mantra.in

20 mantras for successful MF investing

5. For retail investors, systematic investment plan is the way to go (investing in staggered manner). Don't try to time the market. Time spent in the market is more critical for your portfolio than timing the market.

6. Review progress of your mutual fund investment portfolio once every quarter. Additionally rebalance the portfolio to align it with your asset allocation once in 12 months. Look at the portfolio, look at the benchmark returns, and look at the peer returns and whether they are comparable. If there is something which is not in consonance with these benchmarks or the peer performances, you should certainly look at the fund more closely and find out why they are either, performing, under performing or outperforming.

7. Do not look at ratings only of a mutual fund as a sole criterion for selection: they tend to change very fast. Other points to consider while investing in a mutual fund could be: (a) How big is the fund? (b) How often does it buy or sell? (c) What are the risks involved? (d) What are the costs (e) Track the fund house record

8. The most significant aspect is to be able to start early even with small amounts. Compounding of returns will do wonders to your portfolio.20 mantras for successful MF investing

9. Since risk and return are two sides of same coin, inflation is eroding your wealth silently and hence its significant to outperform that through appropriate balance between risk and return.

10. Don't over-diversify your mutual fund portfolio. Don't choose so many funds which can make it difficult for you to manage them. Ideally don't have more than 5 funds in your portfolio.

11. Try to diversify your mutual fund investments across various asset management companies (AMCs) to de-risk your investments. Fund houses like HDFC, Franklin Templeton, Birla Sun Life are pretty creditable ones.

12. Don't panic during market downturn and don't stop your SIPs and don't sell your mutual funds unit. It will enable you to get more units at same SIP price.20 mantras for successful MF investing

13. Always evaluate tax liabilities before redeeming your mutual funds investments.

14. A fund size can have an impact on performance but a lot depends on actual investment pattern.

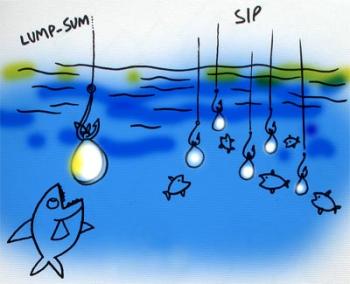

15. Avoid investing lump sum amount in mutual fund. Instead invest in a staggered manner using systematic investment plans. Withdrawing money systematically through systematic withdrawal plans is a good option as it ensures you minimise the chances of missing out on any market surge and reduce vulnerability to a sudden stop.

16. If you are investing in sectoral funds ideally you should understand sectoral cycles and understand the tenure before investing. Timely profit booking can be a good strategy.20 mantras for successful MF investing

17. Mutual funds give best returns in the long term if you don't churn (buy and/or sell) them regularly. Any transaction within one year of buying a fund also attracts short-term capital gains tax at 20 per cent

18. High risk doesn't always guarantee high returns.

19. Discipline and commitment are the buzzwords while investing in mutual funds through systematic investment plans (SIP).

20. If you are a savvy investor and are in a position to take risks, then get into equity funds. Otherwise don't get into equity funds.

Comment

article