Photographs: Rediff Archives TaxMantra.com

Time is now. Don't wait for the last date to file your income tax return (July 31, 2012). In order to avoid late payment, interest and penalty know these things before filing income tax returns...

1. Collect the documents required for filing Income tax return

Every taxpayer should collate all income tax related documents for filing returns. So, here is a gist of the documents required:

- Abstract of bank statements

- Proof of investments and Form 16 (Salary certificate issued by the employer)

- Form 16A / TDS certificate

- Challan of tax payment made like advance tax or self assessment tax

- Proof of investments in propertyD

- Documents on purchase and sale of investments/assets

- Collect the TDS certificate and

- Collect home loan certificate

2. Select the IT return form

As per the source of income select the right type of income tax return form as it is the most important part in filing yoiur returns. Income tax department has prescribed different ITR forms to file the returns like ITR-1 (Sahaj), ITR-2, ITR-3, ITR-4, ITR-4S (Sugam). Assessees should choose the right form as required by them to file returns correctly.

DON'T MISS:

Want FASTER REFUND? File tax returns ONLINE

FAQs: Who is EXEMPTED from filing TAX RETURNS

8 STUPID MISTAKES to avoid while filing TAX return

Want to save more tax? Add NPS to your CTC

MUST READ: 10 things to know before filing tax return

Govt's latest tax-saver: Don't invest before reading this!

10 things to know while filing income tax returns

Photographs: Rediff Archives

3. Fill all the basic details

After selecting the income tax return form, fill the form with all the correct details as it is seen that most of the people ignore the correctness of basic details. Following details should be rechecked in your ITR Form:

- Personal details like name, date of birth, father's name

- Address

- Contact No. and e-mail address

- Jurisdiction of AO

- Tax Status and

- Details of bank account

4. Verify Form 26AS (Tax credit statement)

Income tax department has clearly specified to verify Form 26AS before filing ITR. So, one should check the tax paid on the income tax web site by verifying Form 26AS, which provides details of the income tax paid and the taxes deducted and deposited by the payer of income. If there is any mistake one needs to verify the same.

10 things to know while filing income tax returns

Photographs: Rediff Archives

5. Claim deductions and loss return

Claim all deductions and fill all relevant information as required at the time of filing return in income tax return form as missing out on any one can result in a higher tax liability.

The most common deductions in such respect fall under the section 80C, 80D, 80G and other housing loans.

If there is a loss return, it should be claimed and the return filing should be done within the due date as prescribed u/s 139(1), or else the loss under the specified head will not be carried forward.

6. Disclose exempt incomes

Exempt income should be disclosed in income tax return even though no tax is required to be paid on the same like dividends, PPF interest etc.

10 things to know while filing income tax returns

Photographs: Rediff Archives

7. Provide details of foreign assets

Assessee should provide details of all foreign assets held. Details in respect of following should be provided:

- Details of foreign bank accounts with the peak balance during the year

- Details of immovable property with total investment at cost

- Details of any other asset with total investment at cost

- Details of account(s) in which the person has signing authority and which has not been included above. Name of the institution in which the account is held, address of the institution, name mentioned in the account and peak balance/ investment during the year.

8. Timely filing and prefer online filing

Income tax returns filing should be done within the prescribed due date to avoid interest & penalty. Timely filing of returnss ensures faster processing of ITR and quick refunds if any.

Moreover, one should prefer online filing returns instead of manual filing to avail benefits of all the online facilities provided by the IT department.

In addition to this, following assessees are compulsorily required to file ITR online:

- Individuals and HUFs having total income exceeding Rs 10 lakh

- Individual/HUF who have foreign assets to report

10 things to know while filing income tax returns

Photographs: Rediff Archives

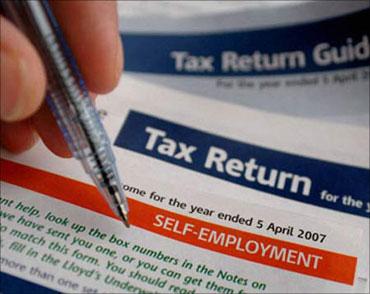

9. Signing of ITR acknowledgement

One may file ITR with or without digital signature and in case of filing returns without digital signature an ITR-Verification (ITR V) is generated after filing of ITR which should be signed and posted to the CPC.

10. Maintenance of documents as proof

As a proof of filing income tax returns in the income tax department, an ITR-V/ITR Acknowledgement and ITR-V receipt should be collected and retained for future use.

Comment

article