| « Back to article | Print this article |

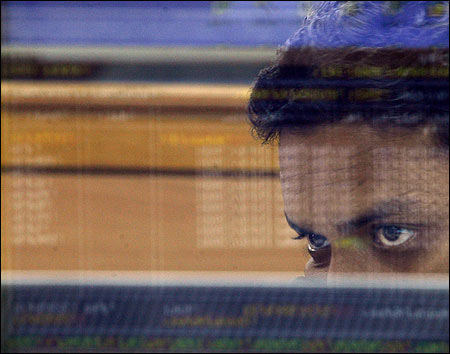

What it takes to be an investment banker

Ridham Desai, Managing Director, Research, Morgan Stanley tells us what the industry has to offer for aspiring investment banking professionals. Read on

How would you describe investment banking to b-school students?

Students join the industry with the perception of what the industry was like in the 90's.

While this may not be wrong, it is important to understand that one must not join the industry for the glamour quotient.

Students read about stocks on the front page of the newspapers and get attracted to the industry but what they must realise is that the glamour on the surface has nothing to do with the reality and if that is what has attracted you in the first place -- then beware - don't come in.

Students must be clear that they are interested in being a banker, research analyst or a trader.

And that is to be verified separately. They must not come in for just fame.

Salaries have declined post the financial crisis?

The industry's compensation structure has changed post the financial crisis.

While firms were earlier making over 30 per cent returns on equity, compensation towards employees were equally high compared to others, today the trend is reverting.

Post the Lehman crisis, two new concepts have emerged. First is that the fixed salary has increased as a share of total salary and, second, that a large part of the bonus is deferred.

This essentially means that the days when you could do well in one year and collect a lot of money and walk away has changed.

Today you cannot do just well in one year, you have to follow that with another year and another year after that as well to collect the salary of the earlier year.

Employment contract entitles the firm to hold back part of the bonus component.

Please click NEXT to continue reading...

'There is a big difference between aspirations and reality'

What is your advice to students keen on this industry?

One should get in this industry only if you are keen on making a career for the next 20-30 years. Don't have a one or two year horizon as that will not help you in your career.

Verify why you want to do and what you want to do. A SWOT analysis will help.

Students join and then realise that this is not what they wanted to do. In fact if you adjust it for stress and hard work, then are you really better off than other places.

Also remember to factor in the level of uncertainty as there is a chance that you may not have your job.

Why has Morgan Stanley not been recruiting from b-school for a few years now?

We have not gone to b-schools in the last four years in the area of research, and have recently preferred laterals than fresh hires.

There is a big difference between aspirations and reality. You must have love for stock markets, corporate advisory.

You must be some one who on a Sunday evening is looking forward to going to work the next day.

You hired from b-schools before?

Yes, some very successful hires, others not so.

I ran into students earlier who had aspirations, but did not have the understanding of the job. And then we have hired people who proved to be very successful because of their focus and desire to learn.

Right now the hiring in the industry is slow due to excess capacity and slow growth. This could of course change in the coming 12-months.

'Many students get carried away with brand names or money'

During placements, should the goal just be a good package?

Twenty years ago, I got placed on Day Four as I wanted to get into an investment banking firm. Many students get carried away with brand names or money but that is not right way.

Understand what you want to do and move towards that. Don't fall for peer pressure.

What do you see in a resume?

I see what students say about themselves. So if a student has said that he knows a particular subject then he should expect to be thorough on that. If a student says he is meticulous then it should also apply to his personal grooming.

While former grades may speak in his/her favour, they are not the only points. But the grades do say something about you.

Also, the student has to realise that there is a lot of hard work especially in the early years of life.

Longevity is an important factor. Other factors are honesty, integrity, hard work and they all come out when we interview people based on the work they have done.

How would you compare the situation abroad to here?

In India, prospects remain excellent for the long run but in the short run capacity has to extinguish before we see a pick in jobs and salaries.

Students should also aspire to gain work experience before jumping into an MBA.

Regards the MBA programmes, a lot of schools have introduced courses about capital markets over the past 10 years so there is theoretical training in the subject.

An emerging subject is Behavioral Finance, which too I understand is making it to curriculum but more schools should introduce it given its wide applicability -- not just to finance.