| « Back to article | Print this article |

'Stick to FDs of shorter tenures, preferably one-two years.'

The temperature is falling in many parts of the country, but matters are beginning to heat up on the interest-rate front.

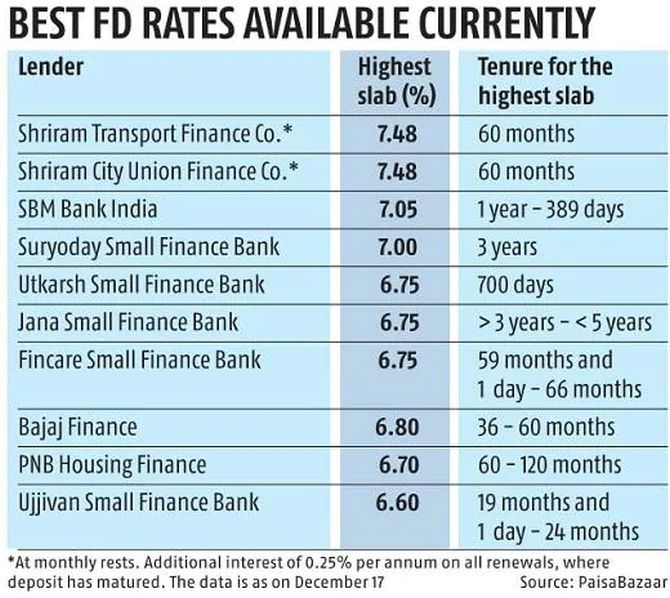

On December 1, HDFC Bank hiked the interest rates on its fixed deposits by up to 10 basis points (bps) or 0.1 per cent on select tenors.

Bajaj Finance, too, announced a hike on select tenors by up to 30 basis points (0.3 per cent) on deposits of up to Rs 5 crore.

State Bank of India, the country's largest lender, hiked its base rate, a benchmark lending rate, by 10 basis points (0.1 per cent).

Simultaneously, it raised the rate of interest on high-value deposits of over Rs 2 crore by 10 basis points (0.1 per cent).

High inflation driving rate upswing

Disruptions in global supply chains and sharp recovery in global economic growth and demand have led to inflation rates soaring across the globe.

"The major central banks are expected to roll back liquidity measures and increase their policy rates to tame inflation. The expectation of higher policy rates in the advanced economies has led to an increase in market interest rates in India too," says Naveen Kukreja, CEO and co-founder, Paisabazaar.com.

"The leading Indian banks are in turn increasing their FD rates."

They are doing so to pre-empt increased credit demand and lock depositors' money into FDs of longer tenures.

Will the trend continue?

Experts are optimistic about this trend continuing for some time.

"The FD rate hikes by some banks and deposit-taking non-banking finance companies may lead others to follow suit. This trend is expected to continue since inflation does not seem to be transitory," says M Barve, founder, MB Wealth Financial Solutions.

Interest rates will continue to rise until central banks manage to tame inflation, or the Omicron Covid variant's spread threatens global recovery.

Preserve capital for now

Bank FDs and high-yield savings accounts are among the lowest-risk instruments for retail customers.

The real returns from FDs is what they get after accounting for income tax and inflation.

Large banks are today offering one-year FD rates of 4-6 per cent.

Adhil Shetty, CEO, BankBazaar says, "The post-tax return for someone in the 30 per cent tax bracket on an FD paying 6 per cent will be 4.2 per cent. At 6 per cent inflation, your real return will be -1.8 per cent. For post-tax real return to be positive, an FD must pay at least 9 per cent."

He adds that only equity mutual funds are providing inflation-proof returns currently.

Should investors avoid FDs currently?

Kukreja says, "Stick to FDs of shorter tenures, preferably one-two years. The major central banks are expected to increase their policy rates next year.

"Opening shorter-tenures FDs will allow you to reinvest at higher rates later on, if the rising rate regime continues for a longer period."

"The sweet spot is a three-year tenor," says Jharna Agarwal, head-products at Anand Rathi Preferred.

While you should hunt for the best rates across banks and NBFCs, pay attention to the bank's viability and the bond/deposit's credit rating before investing.

Expand your search beyond bank FDs.

According to Agarwal, "Corporate FDs have become relatively attractive. Floating-rate bonds can also improve portfolio yields in a rising rate scenario."

Those who can bear a longer tenure plus lock-in may consider small-saving instruments from the Post Office also.

Investors in higher tax brackets may prefer debt funds.

They should stick to shorter-duration debt funds like ultra-short duration, low duration or short-duration funds.

Kukreja says, "As they invest in fixed-income instruments having shorter residual maturities, the adverse impact of a rising interest regime on their returns is lower than on longer-duration debt funds."

Target maturity funds, which enable you to almost fix returns and offer indexation benefit, are another good option.

Those having a longer investment horizon of more than five years should opt for equity funds, according to Barve.

Feature Presentation: Aslam Hunani/Rediff.com