| « Back to article | Print this article |

Top 5 Online trading mistakes

There are some things you must be careful of while using online stock trading websites. Here are five common mistakes that you must not make.

With the advent of Electronic Trading, almost all investors and traders now use Online Stock Trading websites to Invest and Trade in Stocks. Online Stock Trading Websites offer Do-It-Yourself options to Buy and Sell stocks and are very popular among retail investors. Few retail investors actually pick-up the phone to call the broker's office to request trade on their behalf. It's much easier to login into Broker's online website, place the trade yourself, watch it getting executed and feel the excitement!

However, there are a few scenarios where Online Investors can make a costly mistake while trading or investing in stocks themselves. Most of the investors access their trading accounts only once in a while, maybe just before leaving for their office, and are often in a hurry to place an order. Occasional retail investor is not aware of all the options available in online websites and there are some unique situations where you can actually lose money even by placing an order to invest online. In this article, we look at Top 5 Online Trading Mistakes that investors commit Online and what should be the correct course of action for an amateur investor or trader.

StockFundoo.com provides insightful and in-depth capital markets analysis. Powered by fundamental deep value investing and technical analysis, we offer detailed stock analysis updated on a daily basis.

Top 5 Online trading mistakes

Ignoring the Limit Order Type

Imagine a situation, where you have just received a recommendation to buy or sell a stock and you login into your online broker to quickly place a trade. You see two Options or Order Types to place an order – Market Order and Limit Order. Retail investors do not appreciate the difference between these two order types and would leave the default option – Market Order – and place their trade. This is a costly mistake and can set your portfolio back by a good 1%-3% over a lifetime of investing. Let's look at the underlying mechanics of these order types to understand better:

|

A Market Order type quickly places your trade to the exchange and matches with the best available option available in the exchange order book. Simple speaking, if you want to buy 100 shares of Reliance, and place a market order, it will get matched at the exchange with the Seller offering the Reliance Shares at lowest price. So your order gets executed immediately, but what is happening behind the scenes is that you have no control over the price you get for your purchase. It gets executed at whatever is the best price available in the market.

A Limit Order gives you the power to control the price of your trade. When you select this option, you will also have to mention the Limit price for the trade you have placed. Let's take the earlier example of buying 100 shares of Reliance. If you select Limit Order as the Order type, you will have to enter the highest price for Reliance that you are willing to pay. If the stock is trading at Rs 800 per share, you can place a limit of Rs 800.5 to take an example and none of your purchase will happen over Rs 800.5. You can even mention 799.5 or any lower price for Reliance, and your purchase will happen only below this price. Thus during the intra-day volatility, you might get your shares at a lower price that the current market price.

The power of selecting Limit Order Option comes at a time, when you are buying Mid-caps or Small-caps and there is limited liquidity for these stocks. If you place a Market Order option, you might end up purchasing the stock at a much higher price than the current price because there may not be a seller available close to current market price. So you will not be even aware of the high price you paid for your purchase and over a lifetime of investing, just selecting the correct order type will save you anywhere from 1% to 3% of your investment corpus. Just remember, professionals never select Market Order type, they dictate their price to Buy and Sell and always prefer Limit Order Type for their investments.

Top 5 Online trading mistakes

Falling for BTST

BTST (Buy Today, Sell Tomorrow) is touted as a hot trading product by brokers and is often pushed to retail investors citing high profits and low risk method to trade. However, when you sign for BTST, you are asked to sign for a long list of Risk elements which covers the broker completely, but leaves you exposed. You as a retail investor might get trapped if there is an issue with the BTST trade. Let's look the risks involved in BTST.

When you purchase a stock, it takes minimum of 2 days for the stock to come to your Demat account. So doing a BTST, i.e. buying the Stock today and Selling it tomorrow is not a natural thing to do. You are actually selling something which is not yet in your possession. So why do brokerages allow this and actually push the product to you and encourage you to do it. Simply because they earn their commissions today, when you buy and another commission tomorrow when you sell. And also because you have already signed on risk papers, so all risk belongs to you and not to the brokerage house or the exchange, if anything goes wrong.

What all things can go wrong in a BTST? If the Seller party which promises to sell the stock to you defaults, then you will not get the stock in your account. But, by doing BTST, you have already sold the stock the next day and hence you are also in risk of doing a default now. So the brokerage house, would try to procure the stock during an auction process, and hence you may end up paying much higher for the stock you sold than the sale price you committed to. If unfortunately, the stock is caught up in consecutive upper circuits, and there are no sellers available for next few days, the penalties can be much higher for you.

BTST is anyways not a natural way to trade. If you like a stock, and think it will go up, there is no harm in waiting two days rather than one and then selling the stock, once you actually have the stock in your demat account. Online brokers try to limit to BTST to only highly liquid top 200 stocks, but if anything goes wrong, the entire risk is yours, so risk-reward is skewed against you in a BTST trade.

Top 5 Online trading mistakes

The Lure of Penny Stocks

Retail investors like to invest in Penny stocks or stocks that trade below Rs 10 per share, based on someone's recommendation or after receiving hot tips from subscription websites. Most of these Penny stocks remain illiquid round the year, and come into heavy trading volume action only after a synchronous effort on part of cartel of promoters and manipulators to suck in retail investors.

To clarify this further, a Penny stock is often trading below Rs 10 because all institutional investors and large investors have shunned the stock and are not interested in investing in this firm. Most probably, even the promoter has withdrawn all his assets and the stock is just running as a cover for a ghost company with miniscule assets and negligible operations. Because of lack of investor interest, most of these stocks are illiquid round the year.

To sell this worthless stock to retail investors, cartel of promoters and manipulators create a synchronous operation hands-in-gloves with Tips providing websites. This cartel aggressively markets the stock to retail investors. Because of low trading price of this stock and accompanying good news, lots of retail investors get attracted to the stock in hope of making a quick profit. The cartel starts buying their own shares and this stock starts topping the daily gainers list, along with carefully planted rumors of company starting an overseas operation, or a large deal won by the company or any such rumors.

After lot of retail investors have participated in this operation, cartel does a pump-and-dump to quickly sell the stock they have accumulated over the past few weeks. Stock now falls on a daily basis with lower circuit on a daily basis with heavy sell volumes providing no outlet to retail investors to exit. Thus, lot of retail investors remain stuck with worthless stocks in their portfolio, whereas large institutions have no participation and promoter and manipulator cartel having made their money by dumping the illiquid stock to common public. Stock remains illiquid after this operation for a period of 9-12 month before another pump-and-dump cycle comes into operation.

Top 5 Online trading mistakes

Trading the Morning Frenzy

Most retail investors place their order first thing in the morning, before leaving for their office or jobs. Hence, it is a well known fact on the Dalal Street that stock price reflecting in the morning often belongs to the amateur traders.

Another point to ponder is that early morning is the most volatile part of the trading day. Lot of over-night pending orders flood the exchange in the morning, all urgent exit trades flood the screens, lot of fresh news items are blasting through the news channels and lot of amateur in a hurry to reach their office, place a market order for Buy/Sell at the same time among all this volatility.

Compare this to last hour of the day, where all the news coming through the day has been analyzed and large players are trading large volumes in a clinical fashion. Last hour of the trading day belongs to the Large and Professional traders and volumes are highest at this point. The closing price of stock is the most important price point of the day, used for all calculations and records, whereas Open price is most often not used for any analytical calculation.

So, retail investors should not place their orders at the market open hour because their orders get affected by the price volatility and often get the worse price point of the day. Placing limit orders and trading towards last part of the day is the best strategy to get the right price point for your buy and sell orders.

Top 5 Online trading mistakes

Unaware of the Bid-Ask Spread

There are about 5000 listed stocks on BSE and about 2000 listed stocks on NSE. However, due to the institutional focus only on top 200 stocks and ongoing news coverage on only the large handful of companies, liquidity is very poor in most of small-cap and micro-cap stocks. Some of these companies might be fundamentally good companies and can be the next Infosys or Reliance, and retail investors might want to participate in their growth journey and rightfully so.

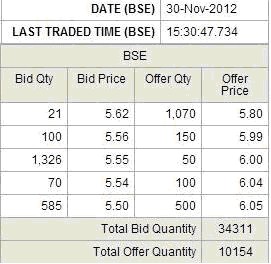

Only caution one should take is to be aware the bid-ask spread you are paying for trading or investing in these illiquid stock. Just to take an example, several stocks on bourses, are having severe spread or gap between the buy and sell price available at any instance. Have a look at the graphic below:

In the above live example, best Bid price for the stock is at Rs 5.62 per stock, i.e. if you want to sell your stock you stand to receive only Rs 5.62 per stock. However, the best Ask price is far away at Rs 5.8 per stock. Meaning if you need to buy at the same time, you need to pay Rs 5.8 per stock. Hence if you buy one share and sell it immediately at the same time, you stand to lose Rs 0.18 per stock.

This gap is known as bid-ask spread, and will affect your profitability significantly. In this case, seemingly small amount of Rs 0.18 is a whopping 3.1% points of loss for a retail investor. This is in addition to the brokerage, taxes etc that you pay for your transactions. Over a lifetime of investing and trading, this 3.1% spread will multiply and cause a large loss for a investor unaware of the bid-ask spread he is paying.

Thus the best strategy is to avoid illiquid stocks or only trade at time when the bid-ask spread narrows down and you get the best price for your investments. Remember, a penny saved is penny earned.