| « Back to article | Print this article |

Steady performers: Top 5 mutual funds from LIC

These mutual funds from LIC have been steady performers since the last 5 years

It has been a long standing argument: Mutual fund vs Incomesurance. We all are well aware that incomesurance i.e. insurance products mixed with investment quotient have not generated great returns till date.

However, we somehow keep investing in these and back off from picking better yielding ones such as mutual funds.

Top mutual funds have been able to generate at least 15 per cent CAGR (compounded annual growth rate) in the past decade. This achievement is great despite the many ups and downs of global economy as a whole in this period.

The primary reason for not investing in products such as mutual funds has been trust. But if you trust brands like LIC then here are top 5 mutual funds from LIC along with their performance.

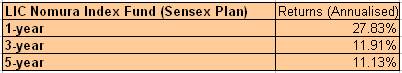

1. LIC Nomura Index Fund (Sensex Plan)

The objective of the scheme is to generate returns commensurate with the performance of BSE Sensex by investing in the index stocks, subject to tracking errors. It is a high risk product.

Please click NEXT to continue reading

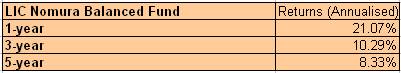

2. LIC Nomura Balanced Fund

It is an open ended income and growth scheme which seeks to provide regular returns and capital appreciation according to the selection of plan by investing in equities and debt.

Please click NEXT to continue reading

3. LIC Nomura Equity Fund

The objective is to obtain maximum possible growth consistent with reasonable levels of safety and security by investing mainly in equities.

Please click NEXT to continue reading

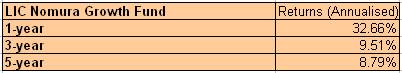

4. LIC Nomura Growth Fund

The scheme aims to provide capital growth by investing in a mix of equity instruments.

Please click NEXT to continue reading

5. LIC Nomura Sensex Advantage Plan

The scheme aims to generate returns by investing ninety per cent of its assets in the Sensex stocks and ten to twenty per cent in a basket of non-index stocks, subject to tracking errors.

Conclusion

There are many private funds competing with LIC in categories such as large cap, mid/small cap, index and so on. Compare funds from various AMCs before finalising on a fund.

Also keep your objectives and goals in mind before picking up a fund.