'If a taxpayer opts for the new tax regime once, he can only switch back to the old tax regime once in his lifetime.'

Several changes were made to the new income-tax regime in Budget 2023.

The old income-tax regime was not tinkered with and is still available.

Should taxpayers opt for the revamped version of the new tax regime or stick to the old one?

What happens in the old tax regime?

In the old tax regime, the assessee can claim a variety of deductions, exemptions, and allowances and thereby reduce his tax liability.

The tax-saving investments come with a lock-in and hence tie up the investor’s money. This regime can also get complicated.

Why was the new tax regime introduced?

The new tax regime came into force on April 1, 2020.

Both individuals and Hindu Undivided Families (HUFs) can avail of it.

It was introduced through Section 115BAC of the Income-Tax Act.

The central idea was to offer reduced tax rates and simplify the tax system.

The overall goal was to encourage greater tax compliance.

Maneet Pal Singh, partner, I.P. Pasricha & Co., says, "The new tax regime offers flexibility to taxpayers to invest their money as they prefer, as there is no mandatory requirement to invest in tax-saving schemes."

What were its key features when it was introduced?

The new tax regime is based on the 'lower tax rate but no deduction or exception' mantra.

It does not allow 70 deductions and exemptions allowed under the old tax regime.

What changes did Budget make?

The new tax regime did not find many takers, and hence was revamped in Budget 2023. Slab rates have been reduced.

The basic exemption limit has been increased from Rs 2.5 lakh to Rs 3 lakh.

A rebate under Section 87A has been introduced due to which individuals having taxable income up to Rs 7 lakh don't have to pay any tax.

A standard deduction of Rs 50,000 has been made available, which will result in overall savings of Rs 52,500 in tax outgo for a salaried person with income of Rs 15.5 lakh.

Finally, the surcharge rate has been reduced from 42.74 per cent to 39 per cent for total income above Rs 5 crore.

Which of the two regimes is better?

The answer is: It depends.

While the changes announced in the Budget definitely make the new tax regime more attractive than its previous avatar, it may not necessarily suit everyone.

Those who have a smaller income and don't avail of many deductions and exemptions will find the new tax regime more attractive.

Suresh Surana, founder, RSM India says, "On the other hand, an individual who claims deduction on interest paid on a housing loan and avails of other deductions such as Section 80C (life insurance premium, five-year fixed deposit, principal on housing loan, Employee Provident Fund, etc) and 80D (health insurance premium) may still prefer to continue with the old regime."

Those who don't have deductions to claim will find the new scheme better.

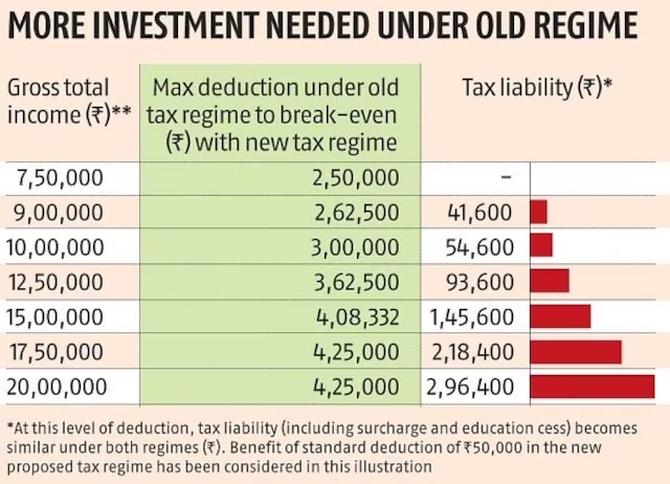

The bottomline is that each level of income will have its own break-even point.

The break-even point is the maximum deduction one must claim under the old tax regime to pay the same income tax under both the regimes.

Once this level of deduction is crossed, the old tax regime becomes more attractive.

Which one should you choose?

All experts say that each taxpayer needs to compare the two tax regimes before opting for one of them.

Finally, note that the new tax regime has now become the default tax regime.

A salaried individual can exercise this option every financial year.

Mayank Aggarwal, partner designate, Luthra and Luthra Law Offices India says: "However, if a taxpayer having income from business or profession opts for the new tax regime once, he can only switch back to the old tax regime once in his lifetime. He will then not be eligible to move back to the new tax regime again."

Feature Presentation: Rajesh Alva/Rediff.com