| « Back to article | Print this article |

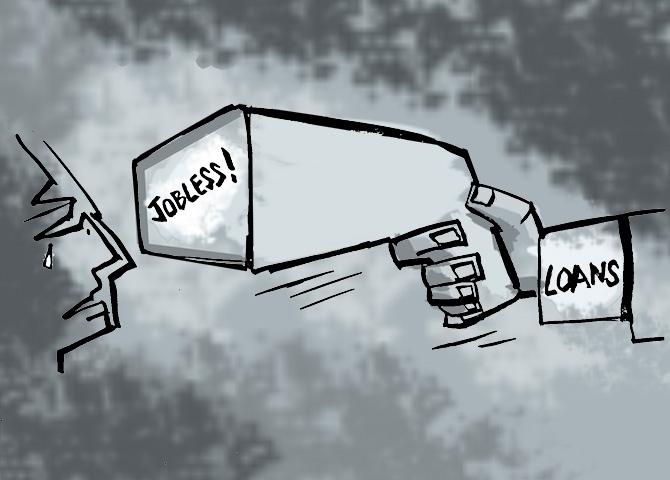

Due to the prevailing uncertainty, the risk of loans going bad has certainly increased.

This may result in lenders following risk-based pricing more diligently, notes Naveen Kukreja, CEO and co-founder, Paisabazaar.com.

Illustration: Dominic Xavier/Rediff.com

As the country grapples with the COVID-19 pandemic, it is clear that this crisis will not end anytime soon, at least not for the next few months.

It will have a deep impact on the economy and almost all industries.

Lending is among the sectors that have been hit the hardest.

It has come almost to a standstill since the last week of March due to a couple of significant limitations.

Lenders caught off-guard:

The lending industry, including large banks and non-banking financial companies, was largely underprepared to tackle a situation where there would be restrictions on physical movement.

Other financial sectors like insurance have been much less affected as they have already created a robust digital infrastructure.

Even during the lockdown, consumers have been able to buy term, health and auto insurance policies online quite easily.

This has been made possible by innovative digital processes and tele solutions that include tele-medicals.

The entire purchase process can be carried out without any physical interface, except in the case of high-ticket term and health insurance policies, where physical health check-ups become necessary.

Second, the banking sector regulator needs to bring in provisions that support end-to-end digital lending.

Currently, the regulations mandate physical meetings between the borrower and the lender, at least for loans of over Rs 60,000, to either verify original KYC (know your customer) and other documents or to get wet signatures on the loan application, agreement, etc.

While this may have been a slight inconvenience for customers earlier, in the current scenario it has brought the entire lending industry to a halt.

Lenders to turn cautious:

Even without the digital constraints, lending would have been limited due to the uncertainties around income, jobs and economic stability.

These recent developments will make risk assessment difficult for banks.

But owing to the limitations mentioned earlier, the industry has ground to a halt.

Only select large banks are offering pre-approved loans to their existing customers.

Even when the lockdown is lifted gradually, most lenders are likely to be extremely conservative in giving out new loans.

Over the next few months, they are likely to play the wait-and-watch game before opening their credit lines up slowly.

The degree of cautiousness followed by lenders will also depend on how their existing borrowers, who have opted for the moratorium, behave vis-a-vis their repayment obligations from September onward.

All this means that customers looking for new loans over the next few months are likely to be affected in three ways:

Unsecured loans may become harder to get:

For the next few months, most lenders may lend primarily to a select group, who are either their existing customers with good financial track record, or belong to the salaried super-prime segment, with a fixed annual salary of at least Rs 5 lakh and an excellent credit score of over 750.

In addition, salaried professionals employed with sectors impacted significantly by the lockdown, like travel, entertainment, hospitality, etc., may find it hard to get a loan.

Lenders will be wary that job loss and salary cuts may make it difficult for workers in these sectors to repay.

Borrowers likely to be denied access to unsecured loans should turn to secured loans if they need capital urgently.

Gold loan and loan against property are two types of loans via which they may find it easier to raise money.

Loan eligibility may decrease:

Another way lenders may exercise caution is by reducing the loan amount that prospective borrowers are eligible for.

While a certain segment of consumers, who have a long relationship with their lender, may continue to be given loans, even they may see their loan eligibility decline.

For instance, if a salaried professional earning Rs 70,000 a month would have received approval for a personal loan of Rs 10 lakh in the pre-crisis period, he may get a sanction for only Rs 6 lakh to Rs 7 lakh now.

Higher interest rates:

Due to the prevailing uncertainty, the risk of loans going bad has certainly increased.

This may result in lenders following risk-based pricing more diligently.

Hence, if a lender perceives that a new borrower carries higher risk, the price of that risk will be passed on to the latter in the form of higher interest rates.

In the current scenario, a significant segment of customers could be perceived as high-risk and may be offered loans at a much higher rate of interest.

Borrowers to benefit from shift to digital:

While there will definitely be challenges for borrowers in the short-term, the industry and the regulator need to learn from this experience and work on creating a stronger ecosystem for the future.

The big lacuna of not having end-to-end digitised processes needs to be addressed, to ensure that restrictions on physical movement do not bring the industry to a halt again in the future.

Hopefully, the regulator will take a relook at the existing regulations and alter them so that lending can be completely digital.

This could prove to be pathbreaking over the long-term in several ways.

By going completely digital, lenders will be able to lower their cost of operations.

The benefit accruing from this can be eventually passed on to customers in the form of lower charges, fees, interest rates, etc.

Digitisation should lead to better quality data becoming available to lenders.

The more agile among them will be able to use it to offer better and more customised products to their customers.

Digitisation will also enable borrowers from remote towns and cities to get access to credit from banks and other large lenders.

One roadblock in the path of financial inclusion for credit products has been the need to be physically present to service borrowers.

With digitisation, lenders with the right risk appetite and risk models will have the reach to deliver their products without the need to have branches and employees in specific locations.

This could prove to be a turning point in bringing a significant part of the population under the umbrella of formal credit.

Collections, too, could be digitised.

Until now there has been a tendency to use "workforce in physical location" as the primary means to collect.

The infrastructure is available or can be created.

Consumer acceptance of digital processes is growing.

Hopefully, the experience of the past few months will provide the much-needed push for the industry to go completely digital.

Feature Production: Aslam Hunani/Rediff.com