| « Back to article | Print this article |

Buying a health insurance policy doesn't mean that you start getting cover from day one of the policy, says Harjot Singh Narula.

Illustration: Dominic Xavier/Rediff.com

Anupam Gupta bought a health insurance policy two days ago and was quite satisfied with his decision. He knew that his current lifestyle made him more prone to diseases and illnesses which could burn a deep hole in his pocket and that's why he bought a health insurance policy to cover health care cost.

But just after six days from the purchase of the policy, Anupam was diagnosed with a kidney stone and was advised to go for a Lithotripsy (surgery for removing stone). He wasn't bothered about the cost as he knew that he had a health insurance plan to cover the cost.

He got admitted and went for the surgery, but the big shock came when he was told that he hadn't completed the initial waiting period under his health policy and that's why his claim would not be accepted; the expenses will be borne by him.

Buying a health insurance policy doesn't mean that you start getting cover from day one of the policy. A health insurance policy comes with many clauses and one such clause is the waiting period clause under the policy.

Let us understand more about the waiting period under a health insurance policy in detail through this article.

What is waiting period?

It is the time span after the purchase of the policy during which you cannot claim any benefit from the insurer.

The terms and condition of waiting period vary from company to company and depends on various other factors.

In most or all of the cases of medical attention, you will not get any benefit from your health insurance policy during the waiting period.

Why it is there in the policy?

This clause is to avoid moral hazard (wrong intention of a person to claim benefit) and planned claims from the policyholder.

Imagine a situation where a person without any health insurance, was diagnosed with a specific disease and was suggested by the doctor to go for a surgery.

Looking at the skyrocketing price of the surgery, the person may buy a health insurance policy (if it has no waiting period) without disclosing the disease and get cover for the surgery just after the purchase.

So to avoid such unethical practices, the waiting period clause is conceptualised in a health insurance plan.

What are the types of waiting periods?

Initial waiting period

It is the first 30-90 days from the start of the policy during which you don't receive any claim benefit from your health insurance policy if you fall sick or get hospitalised. So you have to just wait for the waiting period to get over for receiving the benefits under your health policy.

Accidental claims are an exception to the initial waiting period clause and are paid for.

Pre-existing disease waiting period

There is a special waiting period for some specific diseases which are declared by the policyholder at the time of purchase of the policy. Such diseases are known as pre-existing diseases and waiting period for such diseases is known as pre-existing disease waiting period.

The pre-existing waiting period usually varies from 1 year to 4 years of continuous policy coverage. The time span for such waiting period depends on your medical condition and the insurer you choose.

Disease-specific waiting period

There is a specific waiting period ranging between one year and two years for certain ailments like tumor, ENT disorder, hernia, osteoporosis which are clearly mentioned in the policy details.

The lists of such diseases vary from company to company.

Maternity benefits waiting period

There are few health insurance companies which provide maternity benefits under the policy, but with a waiting period ranging from 9 months to 36 months.

Maternity benefits can't be claimed within the waiting period window.

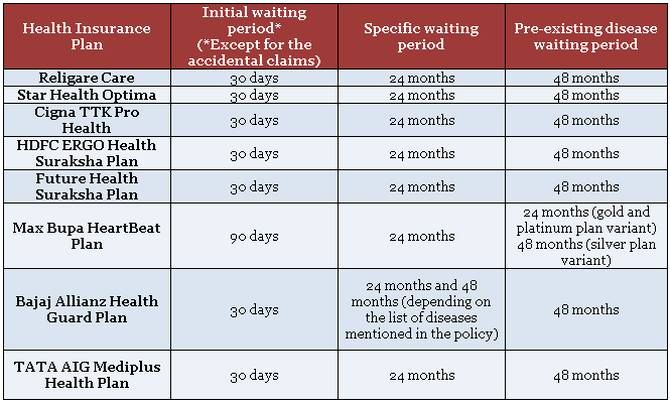

Waiting period snapshot of some of the insurance companies offering health insurance plans:

Important points related to the waiting period under health insurance:

The waiting period under your health insurance policy is affected by various factors like the type of health insurance (group health insurance, individual health insurance, family floater health insurance, etc.), medical history of the insured and the age of the buyer.

It is prudent to read the fine print of the policy waiting periods of a health insurance policy and choose the policy with lesser waiting period. It will allow you to avail the benefits of your health insurance policy as soon as possible instead of bearing medical expenses from your own pocket due to longer waiting period clause.

Harjot Singh Narula is founder and CEO, ComparePolicy.com