| « Back to article | Print this article |

Are you debating between buying physical gold and investing in paper gold schemes or ETFs? Anil Rego has the answer

Let us begin with a fundamental question. Why are you buying this gold?

As just an investment to bear returns in the future?

As jewellery, because you have a wedding or family occasion in the near future?

As jewellery, because you will need it in the not so near future?

You need to answer these questions before you proceed further.

In case you are looking to buy gold jewellery as you have a wedding or function soon, then you can safely buy physical gold: either as bars to be exchanged for jewellery or directly as jewellery.

Buying gold in the paper gold schemes or exchange traded funds is not really going to be of much help as your need for this gold is quite immediate.

If you are buying gold as an investment to bear returns in the future, you can surely explore both the options: of buying physical gold or investing in paper gold schemes.

In this case, investing in paper gold schemes such as Government gold schemes or gold ETFs launched by different fund houses is a great option. This is so because you need not worry about the safe storage or purity of gold.

You get a certificate for investment that you have made. You can redeem it once the investment tenure is over or you can trade it over the NSE or BSE.

Given that you are merely treating gold as an asset which can bear you decent returns on investments, you can reap the benefits. You will get returns based on the volatility of the gold prices and you will also get capital gains exemption if you stay invested for the minimum lock in period.

Additionally, gold ETFs can also be used to avail loans in times of need. So, go for it if you are not very keen on gold in physical form as such!

Now if you are investing in gold keeping future exchange of gold in lieu for jewellery, you can again invest in ETFs. Redeem your ETFs and use the money on redemption to buy jewellery.

If buying paper gold makes you feel insecure and uncomfortable, then go and buy gold bars or coins.

Of course, another scenario where you may have to buy physical gold directly is if your investment amount is below or above those stipulated for gold schemes and ETFs. Storage, safety, and purity should be taken care of when you buy physical gold. So, it surely is a hindrance for someone who is only looking at gold as an investment option.

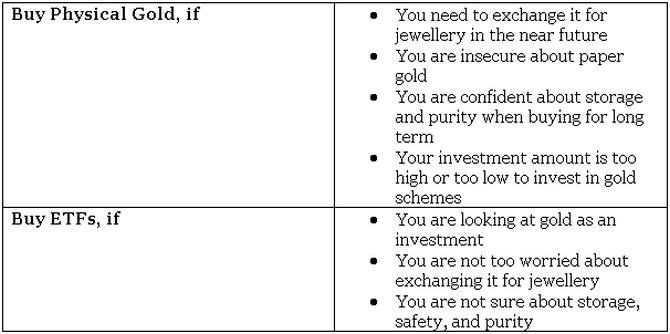

In a nutshell:

Photograph: David Jones/Creative Commons

Anil Rego is the founder and CEO of Right Horizons, an investment advisory and wealth management firm that focuses on providing financial solutions that are specific to customer needs.