| « Back to article | Print this article |

Averaging works only in a portfolio which is what SIP helps you do. Averaging does not work in case of a single scrip. Here's why

SIP creates wealth in the long run, however it gives no immediate gratification. Equity trading (what the common man thinks is investing) gives immediate gratification and does not create wealth for you. The broker wants you to trade so that his wealth goes up. So what is the solution?

Sell SIP in equities as a fantastic product. The call goes something like this: "Sir in volatile markets you should be investing in small lots instead of lumpsum, so we have an EQUITY SIP... it works like this. Every month you invest Rs 5,000 in a stock that we choose, thus you create a portfolio."

Some over enthusiastic 'investors' take it to the extreme and think that they can buy one share of a company per day (which means they will acquire about 200 shares of NTPC for about Rs 26,000 in a year. Sounds good? Well it is not.

Averaging works only in a portfolio -- rupee (dollar) cost averaging -- which is what SIP helps you do. Averaging does not work in case of a single scrip.

Imagine if you had bought Silverline at Rs 1300 and you are still averaging. In this case you would have been wiped out.

In case of a large cap mutual fund, the ups and downs are not so steep, so you can do an SIP.

Imagine what would have happened in case of IDBI Bank or a few shares that just went into oblivion. What about Lupin Laboratories?

I think it had a high of about 10x of its low. The question is WHEN would you have panicked and thrown in the towel?

Which broker in the world will allow you to do 20 transactions of say Rs 200 a day and not charge you minimum brokerage per transaction? Kotak? HDFC Securities? ICICI Direct? No way.

What about research costs? Who can afford to buy a research report if you are going to invest Rs 26000 in one share -- even assuming over 5 years you invest Rs 130,000 can you really afford a research report on NTPC -- if the report were to cost just a piddly Rs 50,000? No way the report cannot cost you 50 per cent of your investment amount! Also some advocates could do a back-testing over 3 years and come to a dramatic conclusion that SIP works.

It could completely fail if one back-tested it for four years. Also if one were to do an honest back-testing one has to pick up all shares of the Sensex from 1979 and see what kind of SIP works.

Does averaging over a three-year period work or a five-year period work? You have just finished putting in a lot of money and the market tanks say 30 per cent -- and wipes out all your gains. What will you do? Continue averaging?

I have not found too many contrarians in my life. And as a broker I have dealt with some of the finest investors in the country. Forget the small guy who buys 200 shares at a time -- I have seen guys buying 20,000 shares of RIL at a time, and they too do chicken out. It is not easy to buy with clock work precision -- it happens only and only in excel sheets and lab experiments.

The average cost of doing a transaction -- telephone call, minimum brokerage, demat transaction charges, etc -- does not allow you to do transactions as small as Rs 350 -- like buying one share of ITC.

I would be surprised by a broker who can afford such transactions -- print the contract, sign it and courier it. What about the administration costs? With a single scrip you can average, but requires tremendous amount of information, and skill. Do not fall for such sales pitches. You will be in red in three years time!

This actually reminds me of a Ben Graham quote: The individual investor should consistently act as an investor and not as a speculator.

Anyway the market is full of people who like to experiment. There is of course no law in the world which says that the equity markets should not be treated as a school. Sadly the bill is paid later. Much later. I was also amused by one person in an animated discussion about this. He has about 15 per cent of his money in equities. What difference in the world will a 1 per cent or 2 per cent greater return make in his life? Zilch.

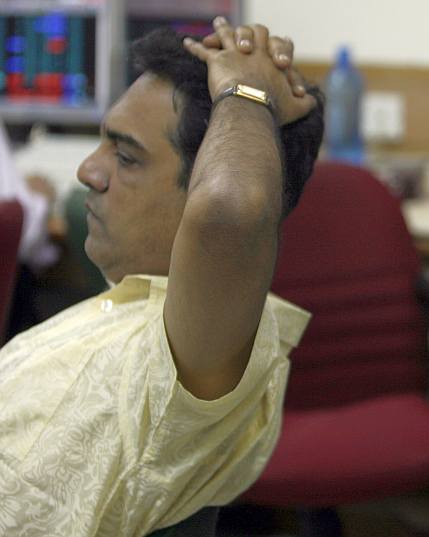

Photograph: Arko Datta/Reuters