| « Back to article | Print this article |

Returns in Systematic Transfer Plan are consistent as money invested in debt mutual fund schemes earns interest till the time the whole amount is fully transferred to equity fund, says Vishwajeet Parashar, Sr VP and Group Head -- Marketing, Bajaj Capital

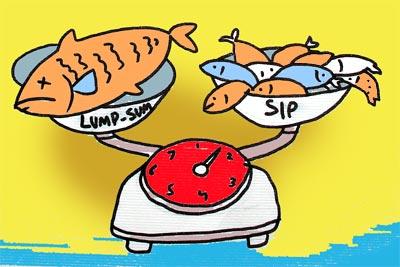

Illustration: Dominic Xavier/Rediff.com

Someone wisely said that one cannot and should not time the market. This is why investing through Systematic Investment Plan (SIPs) works.

Taking the SIP route takes away the risk to the larger extent, especially in the long term.

However, there is another option which suits those investors who wish to invest lump sum money into mutual funds, that is, Systematic Transfer Plan (STP).

What is Systematic Transfer Plan?

By opting for Systematic Transfer Plan, an investor is able to invest lump sum amount into mutual fund with the option of transferring the fixed or flexible amount into a different scheme.

It can also be termed as the extension of SIP as like in the case of SIPs you can invest in mutual funds in a small amount that is as low as Rs 500.

In the case of STP, you can typically park a lump sum amount in any debt mutual fund scheme, from which fixed or variable sum gets transferred into an equity oriented mutual scheme at a periodic interval.

It means that the unit equivalent to the transferred amount will be sold from primary debt mutual fund schemes and the same amount will be used to buy units of the chosen equity mutual fund scheme.

One can use the STP into several schemes at the same time.

Why is it useful?

STP helps in re-balancing the portfolio by helping an investor to switch investments from debt to equity or vice versa. If investment in equity-oriented schemes increases money can be reallocated to debt funds through systematic transfer plan and if investment in debt goes up money can be switched from debt to equity-oriented schemes.

Returns in Systematic Transfer Plan are consistent as money invested in debt mutual fund schemes earns interest till the time the whole amount is fully transferred to equity fund.

Also, returns in debt mutual fund schemes will be higher than the fixed interest of your savings bank account.

It is also useful for people whose cash is lying idle in the bank account as any lump sum amount invested in debt mutual scheme will fetch higher returns as compared to bank account interest.

What are the types of STPs?

STP is of two types: Fixed and flexible STP.

In fixed STP, the transferable amount will be fixed and preset by the investor at the time of investment and the same amount will be transferred every periodic interval.

In the case of Flexible STP, investor has a choice to transfer variable amount.

Transfer facility is available on a daily, weekly monthly and quarterly interval.

What to avoid?

In the case of STP, your choice is limited to the scheme of one Asset Management Company; so it is better to go with those fund houses which have many options to choose from debt mutual fund and equity mutual fund.

Conclusion

STP route is best for all those investors who wish to invest lump sum in mutual fund schemes because this way they get the dual benefits of comparative risk investment. Retired people who wish to invest for their grandchildren can also choose this option to get inflation-beating returns, rather than keeping their hard money in bank account at low interest rate.

STP can also work as Systematic Withdrawal Plan (SWP), where the invested amount will flow into debt mutual funds schemes of your choice to get better returns than your bank account.