| « Back to article | Print this article |

Used prudently, plastic money is among the most useful, powerful and non-polluting kind of plastic invented. Be smart with it!

A credit/debit card is possibly the most valuable piece of plastic that we use today. The ATM-cum-debit card with the account opening kit that your bank gives you to create a bond between them and you is followed by a more powerful credit card when the customer’s relationship is established and financial status is found to be sound.

Debit cards are the safest plastic money from the perspective of keeping control on spending or security. Also called charge cards, they act as ATMs, except that they pay for purchases at a merchant’s sales point (shop) instead of dispensing cash.

Debit cards are excellent at providing a hassle free shopping experience without having to carry large sums in cash while spending what is available balance in the account. It is therefore not possible to spend more than what is available in the bank account. This way debit cards provide control on impulse spending.

Credit cards have a credit limit. There is no other way to control impulsive spending besides credit limit and a card holder’s self-control.

One can ask the card issuer to maintain a low credit limit. However, that would negate a major advantage of having a credit card – of it being a saviour at times of crisis and emergency.

Credit cards have some great advantages and ideally every person should have one.

As just mentioned, a credit card can be a big blessing in an emergency.

Imagine being stuck in a strange and faraway place, with limited cash. A credit card can keep you fed, sheltered and get you home, as it will pay the bills.

A major medical emergency, especially when there is little balance in the bank account can be handled with plastic money, reducing the financial stress you face in an already stressful situation.

Besides the utility of the card, whether debit or credit, there are the bonus, or money-for-jam benefits a card holder has.

Depending on the issuer and status of the card (silver, gold, platinum, titanium) the issuer passes on benefits of marketing tie-ups.

Often there are cash-back offers, frequently of 5 or 10% on using the card at a sale.

This is an automatic additional discount!

Some specials on restaurants, hotels and airlines are also sweeteners for the card user, while providing visibility and additional sales to the merchant.

Some of the best benefits for a regular and disciplined user of plastic money are the reward points on spending.

Every hundred rupees spent, gets the card holder points that are worth 0.3% to 1% of the amount spent. These points can be redeemed for a large variety of products, shopping vouchers or airline mileage points.

Credit card holders who are careful and sensible with their money use the card for every conceivable purchase to maximize their reward points. But they also ensure that they have money before they spend – and keep the money in a liquid mutual fund scheme till it is time to pay the card bill.

The benefits of carefully using other people’s money -- in this case your card issuers -- can be substantial.

Just ensure you do not get into the trap of spending more than you can afford to pay. Or not paying your dues in time.

Delaying or missing payments will bring the curse of the interest god upon you; the interest charges are heavy at 36-48% per annum, with penalties to boot.

Banks send payment alerts for your dues, but do not depend on them.

The onus for payment is entirely on you.

If you have ensured your credit card is connected to the right bank and have sufficient money to pay off the entire dues, you can keep the interest curse at bay.

Used prudently, plastic money is among the most useful, powerful and non-polluting kind of plastic invented!

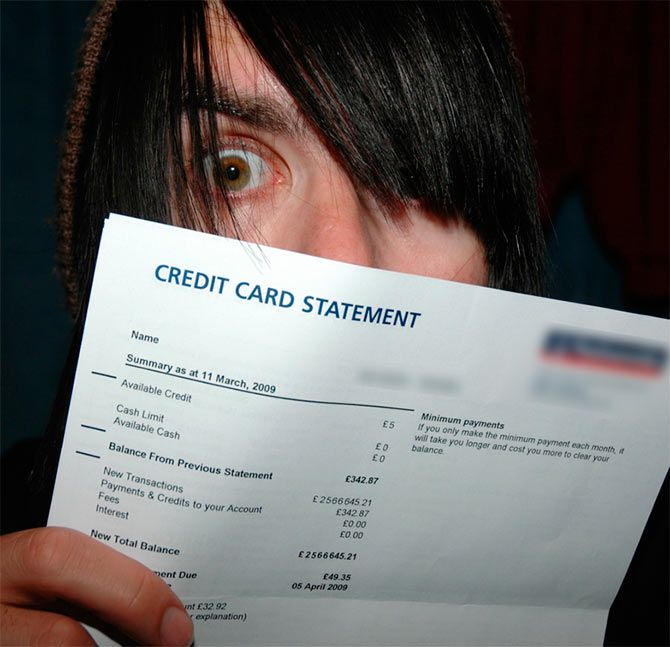

Lead image used for representational purposes only.

Photograph: Jason Rogers/ Creative Commons

P>

Anil Rego is the founder and CEO of Right Horizons, an investment advisory and wealth management firm that focuses on providing financial solutions that are specific to customer needs.