| « Back to article | Print this article |

Many investors, who have made money in the rising market of the recent past, are pulling out of equity funds, believing that they can earn more by investing directly, reports Sanjay Kumar Singh..

Investors redeemed Rs 12,917 crore from equity mutual funds November, and nearly Rs 23,000 crore has moved out over the past five months.

When is it okay to pull money out?

One, if you need the money.

"Many people have suffered salary cuts and job losses. When people have needs, they tend to pull money out, irrespective of the valuation level," says Rajeev Thakkar, chief investment officer, PPFAS Mutual Fund.

Two, you may pull money out and put it in a debt fund if your goal is due in a year or so.

And three, you may do so if after a massive bull run your portfolio has become heavily overweight on equities.

And when is it not alright?

Many investors, who have made money in the rising market of the recent past, are pulling out of equity funds, believing that they can earn more by investing directly.

"Most retail investors lack knowledge of company fundamentals. They may also not have the required skills or time to do in-depth research. Creating a diversified portfolio with a small corpus is also difficult," says Thakkar.

Financial planners agree.

"The Indian market is efficient. Indian MF managers are hard-working, competent, and driven, and have access to the best data and information. If, despite all this, they are finding it difficult to beat the market net of costs, what chance does an individual investor have of doing so consistently over a long span?" asks Avinash Luthria, a Sebi-registered investment advisor and founder of Fiduciaries.

Investors disappointed with the performance of their equity MFs, he suggests, should invest in a passive fund.

Since April 1, dividend from stocks has become taxable in the hands of investors at the slab rate.

"Investors in the higher tax brackets will be better off investing in the growth option of MFs, where they will have to pay 10 per cent on long-term capital gains," says Luthria.

Some investors have moved out of equity MFs and into cash because they believe the market has run ahead of fundamentals and is poised for correction.

"Timing the markets may look easy in hindsight, but is extremely difficult to pull off. Instead, investors should just stick to their asset allocation," says Thakkar.

Luthria suggests averaging out the purchase costs of fund units with systematic investment plans (SIPs).

Rebalance portfolio:

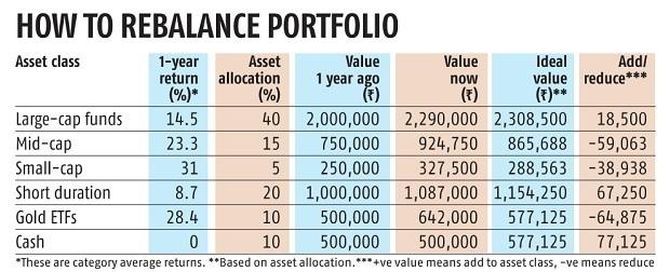

Investors may have become overweight on equities due to the run-up in the past few months.

Rebalancing by selling an asset class should be done only if the deviation from the original allocation is very high.

"If the overweight position in equities is marginal, correct the skew by directing future investments towards the asset classes where you are below target," says Luthria.

This approach will enable you to avoid both tax and exit load.

More active investors may adopt the target rate of return approach.

"Once the target rate of return is attained, the investor may book profits. Before doing so, he should review. If he sees an upside, he may revise the target rate of return upward and book profits once that is reached," says Joseph Thomas, head of research, Emkay Wealth Management.

Investors booking profits in equities should park the money in a liquid fund until they have identified the next best opportunity.