A growth scheme not only leads to lower tax payments than the dividend option, but also allows any income that is not withdrawn to compound, explains Harsh Roongta.

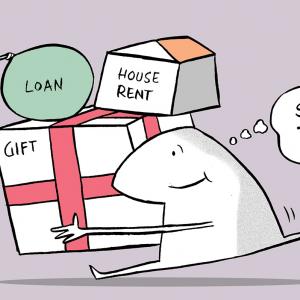

My friend Taresh wanted to invest Rs 1 crore in a secure debenture instrument that would yield an annual return of Rs 6 lakh and return the principal after 30 years.

He wanted to create a passive income source that would pay a fixed amount periodically during retirement.

I recommended investing in a mutual fund that invests in similar debentures, as it would offer superior risk management, liquidity, and return.

Risk would decrease due to diversification across multiple instruments.

Liquidity would be better since the fund house would allow daily redemption at net asset value (NAV).

Choosing a fund's growth option and withdrawing Rs 6 lakh annually would lead to lower tax payments than receiving it as a dividend.

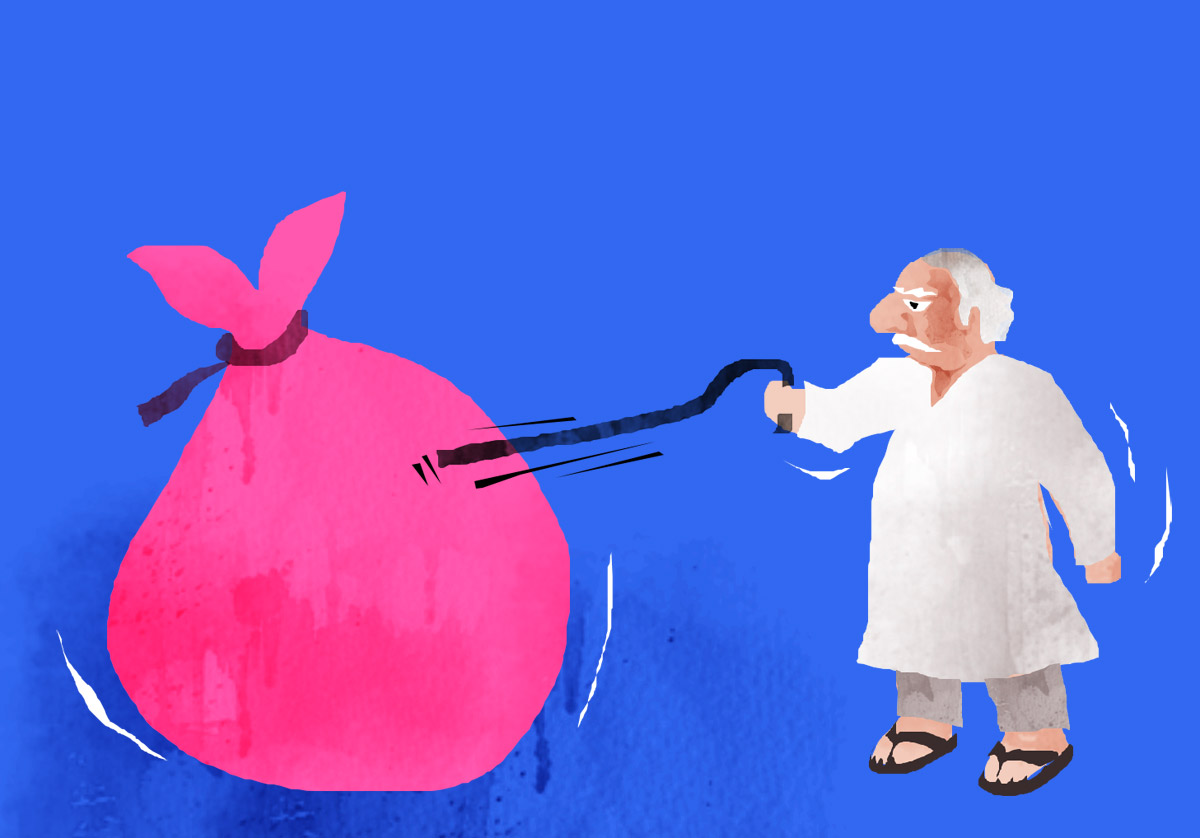

Taresh was surprised by the tax advantage, believing the concessional tax rate for debt funds had been revoked.

I clarified that the tax benefit inherent in a growth fund's structure remained.

I explained the concept using the analogy of a 100,000 litre water tank representing his mutual fund investment and 6,000 litres of water supplied annually by the municipal authorities as the income generated by the fund.

Taresh could either have the 6,000 litres of municipal water delivered directly to his home, which would be akin to the fund's dividend option.

Alternatively, he could add the 6,000 litres to the tank (similar to the growth option) and then withdraw from it.

The tank would now contain 106,000 litres. When in future he withdraws 6,000 litres from the tank, 94.34 per cent (100,000/106,000) would be his own water while 5.66 per cent (6,000/106,000) would be municipal water.

If he chooses the dividend option, he would need to pay tax immediately on the 6,000 litres of municipal water delivered to his home.

If he chooses the growth option and withdraws 6,000 litres from the tank that contains a mix of his own and municipal water, only 340 litres (or 5.66 per cent of 6,000 litres) would be municipal water on which he would have to pay tax.

The remaining 5,660 litres (94.34 per cent of 6,000 litres) would be his own water on which he would not have to pay tax.

This means he would pay tax on only a fraction of the water he consumes, even though the amount consumed would be the same as in the dividend option.

The amount of water remaining in the tank would also be the same at 100,000 litres.

Earlier the tax rate charged on this fraction was also lower than the normal tax rate.

That concession has been withdrawn. But the structural benefit of a growth scheme -- of tax being charged on a lower amount -- persists.

This will allow investors to benefit from lower tax payments indefinitely, as long as the withdrawals are equal to or less than the income added during the year.

Initially, Taresh was hesitant to mix passive income with the original capital amount.

However, I managed to persuade him with the above reasoning.

I highlighted that this reluctance to mix capital and income often results in suboptimal investment choices, like real estate, for the generation of passive income.

Aspiring retirees, including those in the Financial Independence, Retire Early (FIRE) movement, should note that withdrawing money from a growth scheme not only leads to lower tax payments but also allows any income that is not withdrawn to compound.

It also provides the flexibility to create diversified investment portfolios with varying percentages of equity and debt.

Truth be told, blending capital and income and drawing from the common pool is a superior strategy to withdrawing passive income separately and gradually nibbling away at the capital when that passive income proves insufficient.

This approach also alleviates retirees' concerns about their ability to make their money last throughout their lifetime.

Harsh Roongta heads Fee-Only Investment Advisors LLP, a Sebi-registered investment advisor.

Disclaimer: This article is meant for information purposes only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products/investment products mentioned in this article to influence the opinion or behaviour of the investors/recipients.

Any use of the information/any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.