| « Back to article | Print this article |

Dwaipayan Bose highlights the similarities and contrasts between ETFs and Index Funds.

What are Passive Funds?

Passive Funds invest in a basket of securities replicating a market benchmark index.

The weights of securities in the fund mirror the weights of the constituents in the index.

Unlike actively managed mutual funds, passive funds do not aim to beat the market.

There are two types of passive funds -- Exchange Traded Funds and Index Funds.

The passive funds trend, globally and in India

Passive investing has taken off in a big way since the outbreak of COVID-19.

As per the data provided by the Association of Mutual Funds in India (AMFI), passive assets under management (AUM) grew by nearly four times at a compound annual growth rate (CAGR) of nearly 40 per cent in the last four years (source: AMFI June 2023 data).

As on June 30, 2023, passive AUM stood at over Rs 7 lakh crore.

While institutional investors like the Employees' Provident Fund Organisation (EPFO) contribute a significant portion of the passive AUM in India, retail investors' interest in passive funds is also increasing.

Among passive funds, ETFs have the lion's share of AUM.

What are Exchange Traded Funds?

Exchange Traded Funds are passive schemes tracking market benchmark indices like Nifty, Sensex, etc.

ETFs do not aim to beat the market benchmark index they are tracking; they aim to give market returns.

ETFs are listed on stock exchanges and trade like shares of companies.

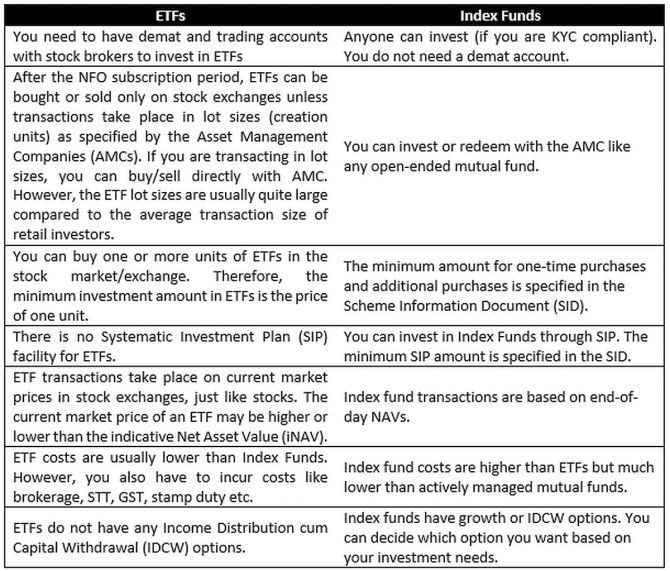

You need to have a demat and trading account to invest in ETFs.

What are Index Funds?

Index Funds are also passive mutual fund schemes that track market benchmark indices like Nifty 50, Sensex etc.

Index Funds are very similar to ETFs, but there is one major difference. They are like any other open-ended mutual fund scheme. You don't need a demat and trading account to invest in index funds.

ETFs versus Index Funds

Where should you invest -- ETFs or Index Funds?

Demat account: Like we mentioned earlier, you must have a demat and trading account to invest in ETFs. If you don't, then you can invest in Index Funds.

However, this should not be the only consideration. Let us discuss the other factors.

Cost: The cost of ETFs, including the transaction costs like brokerage, STT, GST, stamp duty, etc, are lower than Index Funds. Purely from a cost viewpoint, ETFs have an advantage over Index Funds.

Tracking error: The standard deviation of the differences in monthly returns of ETFs and Index Funds and the market benchmark index is defined as a tracking error.

There are various sources of tracking error -- fees and expenses of the scheme, cash balance held by the scheme due to dividends received, halt in trading on the stock exchange due to circuit filter rules, etc.

Tracking errors of ETFs are usually lower than that of index funds because of lower total expense ratios (TERs) and cash holdings.

Liquidity: This is a very important consideration because you can sell ETF units only on the stock exchange (unless you are redeeming in lot sizes, which are usually quite large).

Some ETFs are quite liquid, while others may not be so. You need to look at the average daily trading volumes of your ETF to get a sense of its liquidity.

Liquidity also depends on market conditions. This may require some investment experience.

Liquidity is not an issue with Index Funds because you can redeem them with the concerned asset management company.

Experience: If you have investment experience in the stock market, then investing in ETFs will be easier as they are similar to stocks.

You should know about different types of orders (market orders, limit orders, etc), understand bid/offer prices, trading data (price, volume data), etc, before investing in ETFs.

Index Funds, on the other hand, are like mutual funds.

As such, they have all the advantages associated with mutual funds -- convenience, flexibility, investing through SIP/STP, etc.

Do you have investment related questions? Ask rediff's Money Gurus HERE.

Disclaimer: This advisory is meant for information purposes only. This advisory and the information in it does not constitute distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products/investment products mentioned in this article or an attempt to influence the opinion or behaviour of the investors/recipients.

Any use of the information/any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.

Dwaipayan Bose leads content production and mutual fund research at