| « Back to article | Print this article |

Many insurers either do not cover consumables like PPE kits, gloves, etc at all or cover up to a certain limit, warns Amit Chhhabra, head-health insurance, Policybazaar.com.

It is time to accept that this is the new normal as coronavirus is here to stay.

In India, the number of COVID-19 positive cases continue to increase at a record high each passing day.

Currently, with more than 3.7 million confirmed cases, India continues to the be the 3rd worst affected country in the pinkest of health.

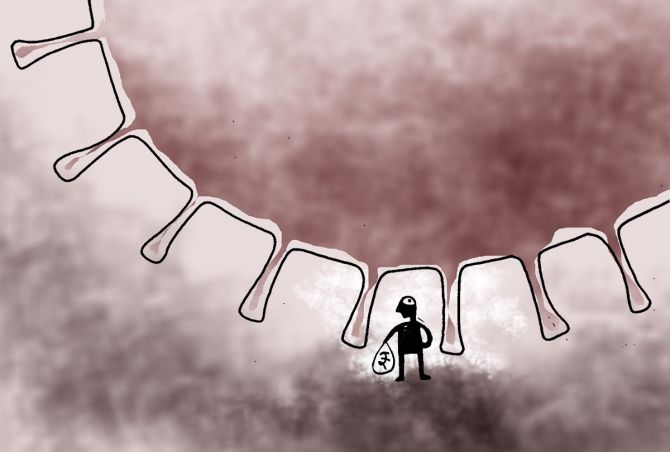

The coronavirus has not only brought to life a contagious virus, but also other repercussions such as financial instability.

This evidently means that there is an immediate need to not only protect yourself from the virus and other illnesses, but also ensure you are financially secure against an unforeseen medical expenses.

That is why, today more than ever before; getting a health insurance for COVID-19 is almost as necessary.

While there are many health insurance policies some existing ones have been customised to cover all illnesses including the coronavirus.

Similarly, the Corona Kavach and Corona Rakshak cover are specific to only covering treatments pertaining to the coronavirus.

If you are planning to buy a health insurance in recent times, here are some tips to consider:

1. Look for a comprehensive health insurance cover

While planning to buy a health insurance policy to cover treatment expenses related to COVID-19, you must buy a comprehensive health insurance plan that covers you for not only coronavirus but all other illnesses as well.

It should provide you adequate coverage in case of hospitalisation due to infection caused by the virus from day one.

Not just coronavirus, if a person is hospitalised due to a condition caused by a specific virus, the health insurance policy will pay for all the hospitalisation expenses and even expenses for in-patient treatment, pre-hospitalisation, post-hospitalisation, OPD and ambulance cover provided the policy covers you for the same.

A comprehensive health insurance policy comes with a waiting period of 30 days for all ailments and can be bought for as low as Rs 800 to Rs 1,000 for a 30-year-old individual with a sum insured up to Rs 1 crore.

However, if you cannot afford investing in a comprehensive health insurance policy, you may invest in one of the COVID-19 specific health insurance covers that are Corona Kavach -- an indemnity based policy or Corona Rakshak -- a fixed benefit based health insurance.

Both these plans come with a 15 days waiting period and can be bought for as low Rs 208 for a policy tenure of 3.5 months with Rs 50,000 sum insured.

2. Find out what all is covered

While buying a health insurance policy to cover COVID-19, you must make sure to check the various inclusions and exclusions of the health insurance cover.

Each of the plans offered by different insurers come with different set of inclusions and exclusions.

However, while buying a policy for coronavirus, you must check up to what extent will the insurer cover consumables during hospitalisation.

Many insurers either do not cover consumables like PPE kits, gloves, etc. at all or cover up to a certain limit.

The charges for consumables have to be paid by the policy holder during a claim.

During a usual hospitalisation, consumables make for 5 to 10 per cent of the hospitalisation expenses, while for hospitalisation due to COVID-19, the consumables run up to 30 to 40 per cent of the hospital bill.

3. Choose the right sum insured

Sum insured is one of the most important elements of a health insurance policy as the policy will cover your medical expenses only up to your sum insured.

When choosing the sum insured for your health insurance, you must not look at the average cost of treatment of one illness like COVID-19, but consider some major illness as well such as cancer, kidney ailment, health transplant, liver transplant, etc.

Your sum insured should also be enough to fight the medical inflation rate and provide you adequate coverage even after 10 to 15 years of buying the policy.