| « Back to article | Print this article |

Many CEOs said they plan to give special leave to women employees so as to encourage their participation in the workforce.

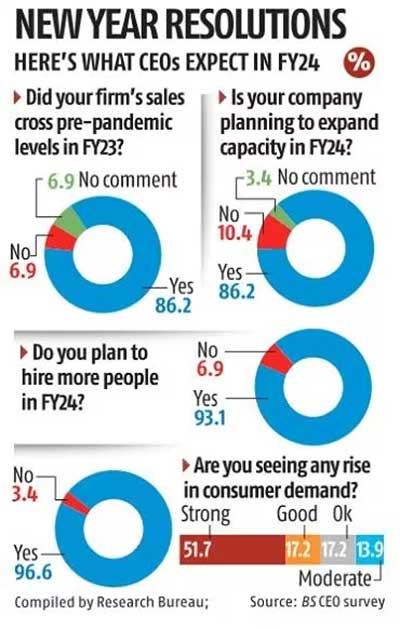

An overwhelming majority of Indian companies are planning to increase their capital expenditure and hire more in the new financial year, revealed a dipstick survey of top executives.

They also believe sales of their companies have crossed the pre-pandemic levels in 2022-2023.

Of the 29 CEOs surveyed across India by Business Standard, 86 per cent were looking at expanding capacity in the financial year 2023-2024 (FY24) as they expected better sales, which experienced a slowdown in FY21 and FY22.

Around 93 per cent of them were planning to hire more employees in FY24.

This positive sentiment among CEOs emanated from their observation (96.6 per cent of those surveyed) of a rise in consumer spending.

Almost 41.4 per cent of the respondents expected profit of their companies to jump by more than 20 per cent.

Asked about what may impede their plans, they cited a surge in input costs, geopolitical headwinds, instability in the rupee versus the dollar, and a rise in interest rates and liquidity constraints.

"Rising prices are a big concern and may reduce consumer spending, especially as inflationary pressure is higher on essential goods and services than that on luxury goods and services," said a chief executive.

"A direct threat to production is inadequate availability of raw materials, such as nickel, molybdenum, and stainless steel scrap required for the production of stainless steel.

"The high cost of logistics and capital in India is another major concern," said the top executive of a major steel company.

Surplus capacities of China and Indonesia remain a problem as these countries dump their subsidised goods in India, another CEO said.

A recent Fitch report stated that due to improved corporate and bank balance sheets, capital expenditure by India Inc over the medium term is expected to go up.

But the rating firm warned that potential cost and currency pressures, a weaker global economic outlook, and rising interest rates may present risks to investment plans.

'We expect the capex from Fitch-rated corporates in India to continue growing by 10-12 per cent a year over the financial year ended March 2023 to FY24. Capex was flat over FY19 to FY21 and grew 16 per cent in FY22,' it said.

Almost 55.2 per cent of the CEOs surveyed said they plan to raise money in the new financial year to fund their plans.

A majority (86.2 per cent) of the top executives said India would emerge as the most important market globally for international businesses this year.

Almost half the CEOs surveyed said politics does not come in the way of doing business in India, while 65.5 per cent said they expect a revival of animal spirits in terms of fresh investments.

ESG (environment, sustainability and governance), diversity, and inclusion are the focus areas for these CEOs in the coming year as most of them said they are taking several steps to increase the participation of women in their workforce.

"We are an equal opportunity employer and hire people irrespective of their background, beliefs, and regions they belong to. In fact, our board is one-third women, which in itself is a higher representation than in most boardrooms," said a CEO.

Many CEOs said they plan to give special leave to women employees so as to encourage their participation in the workforce.

According to Fitch statistics, for FY23 and FY24, Reliance Industries had plans to invest Rs 2.15 trillion in Jamnagar refinery's crude-to-chemical project, KG-D6 gas development project, Jio 5G, new energy business, and in retail for multi-location stores.

Adani Enterprises plans to invest Rs 18,200 crores (Rs 182 billion) across airports, data centres, and green hydrogen businesses.

The Tatas are investing Rs 32,300 crore (Rs 323 billion) in various projects, including at Kalinganagar and Neelachal Ispat Nigam, to nearly double India's steelmaking capacity to 40 mtpa by FY30.

JSW Steel has announced an expansion of capacity -- addition of 10 mtpa over the next three years - at an estimated outlay of Rs 48,000 crore (Rs 480 billion).

Bharti Airtel had plans to put in Rs 79,800 crore (Rs 798 billion) in 5G rollout, spectrum payments, broadband, and data centres in FY23 and FY24, according to Fitch.

BS Reporters: Dev Chatterjee with Sundar Sethuraman, Pratigya Yadav, Ishita Ayan Dutt, Abrar Peerzada, Shine Jacob and Sohini Das