| « Back to article | Print this article |

A glance back at some important events that occurred in 2018.

Kindly click on the image below to view the relevant story.

The press conference by the four judges set the wheels of change in motion, according to Justice Joseph.

Aashish Aryan reports.

On the bright sunny morning of January 12, four senior Supreme Court judges held an unprecedented press conference and expressed their concerns about the professional conduct of the then Chief Justice of India, Justice Dipak Misra, over the assignment of cases.

In the virtual revolt against the CJI, Justices J Chelameswar, Ranjan Gogoi, Madan B Lokur, and Kurien Joseph questioned the system and said that a skewed allocation of cases was impacting justice delivery adversely.

The four judges had then repeatedly said that despite their best efforts to reach out to Justice Misra, there had been no response from him, which left them with no option but to come face to face with the nation (via the press).

Of the four, Justice Chelameswar and Justice Joseph have already retired since, Justice Lokur will relinquish his post by the month end.

Justice Gogoi is the incumbent CJI.

The press conference by the four judges set the wheels of change in motion, according to Justice Joseph.

Addressing reporters after his retirement, Justice Joseph said he had no regrets about the press conference.

He also expected Justice Gogoi to steer the ship more effectively.

Some legislators thought the judicial rebels had done the right thing, raising issues that were critical to functioning of this vital institution of democracy.

How far the political dispensation will respect the spirit of that revolt is another question.

But the Supreme Court ruled that Aadhaar will continue to be mandatory for State-sponsored welfare schemes and will need to be linked to the permanent account numbers for income tax purposes.

Udit Misra reports.

After a nine-judge Bench of the Supreme Court unanimously ruled in 2017 that the Right to Privacy was indeed a Fundamental Right under the Indian Constitution, all eyes were on the five-judge Bench of the apex court adjudicating on not only the legal validity of Aadhaar but also its usage.

Indeed, it was the Aadhaar case that required clarity on the Right to Privacy in the first place.

The apex court delivered an interim order in March and a full one in September.

While the court upheld the validity of the Aadhaar Act, albeit by a four-to-one majority, it severely restricted the parameters for its use.

Thus, starkly in contrast to the coercive annoyance that Aadhaar had become over the years -- with it becoming a pre-condition for everything from mobile services to banking to health care to monthly food rations -- its use has now become voluntary.

But the court ruled that Aadhaar will continue to be mandatory for State-sponsored welfare schemes and will need to be linked to the permanent account numbers for income tax purposes.

2018 was a landmark year for the premier B-schools even as it ushered in a new era with the promulgation of the IIM Act.

Vinay Umarji reports.

Not since Infosys co-founder and former Indian Institute of Management- Ahmedabad board chairman N R Narayana Murthy took on then Union minister of human resource development Murli Manohar Joshi over the latter's decision to slash fees have IIMs seen such a prolonged fight for autonomy.

In that sense, 2018 was a landmark year for the premier B-schools even as it ushered in a new era with the promulgation of the IIM Act.

At first, IIMs welcomed the freedom to appoint chairpersons and directors in place of the earlier cumbersome process that required government approval.

However, the year saw IIMs raising other issues that not only threatened their autonomy but also increased administrative woes for them.

For instance, under the Act, IIMs can offer PhD as against the previous fellow doctoral programmes.

However, the government narrowed eligibility criteria by increasing the cut-off to 80 per cent from the 60 per cent for four-year undergraduate applicants.

IIMs say this would reduce the available pool of candidates, apart from reducing course work in doctoral programmes from two years to six months.

Further, the one-year post graduate programmes for executives with prior work experience of at least 5 to 7 years are set to be converted into two-year MBAs under the Act.

This too, IIMs believe, would lower standards and defeat the purpose of conducting one-year MBAs for working professionals.

The year ended with directors of all IIMs and the ministry discussing these issues via video conference in the second week of December 2018.

The ball now rests in the ministry's court.

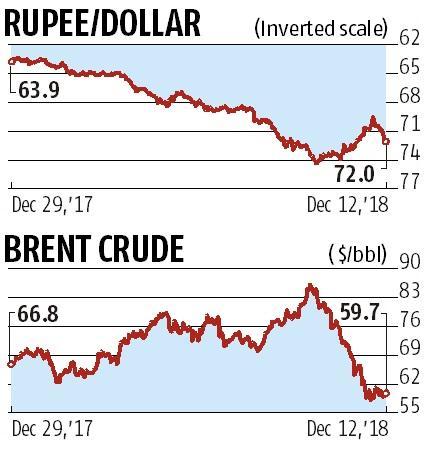

The rupee has now strengthened back to below 72 a dollar as oil eased to less than $60 a barrel.

Anup Roy reports.

2018 was a volatile one for the rupee as oil prices started rising and trade war concerns between US and China kept emerging market currencies on tenterhooks.

The partially convertible currency started the year at 63.7 a dollar, but trade war tensions, leading to currency war concerns, started pulling it down rapidly in the first half of the year.

The central bank tried to defend the currency till its previous record low of 68.85 a dollar.

However, once the currency crossed 70, the central bank maintained a hands-off approach to protect its reserves.

The movement accelerated in August when oil prices also started climbing up to cross $70 a barrel on concerns about US sanctions.

It was pretty evident after that that the central bank won't protect a level.

Two back-to-back rate hikes by the RBI by August, seen as a measure to protect the currency, were unable to stabilise the rupee, and by September, it had closed at its life-time low of 74.4 a dollar as oil crossed $85 a barrel.

The rupee has now strengthened back to below 72 a dollar, as oil eased to less than $60 a barrel.

But observers say the local currency's new level would continue to be 70 a dollar-plus.

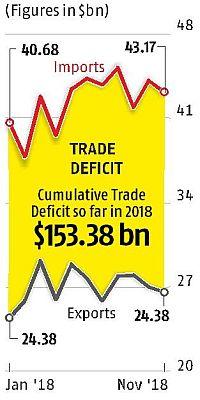

Despite reports of crippling capital inadequacy in the wake of the new Goods and Services Tax regime, double-digit export growth continued for half of the year.

Subhayan Chakraborty reports.

Despite a global trade war, India managed to grow its exports in 2018 but high crude prices and rising domestic demand continued to inflate the trade deficit at a faster rate.

The year started with monthly trade deficit soaring to a 56-month high.

By October, it had risen to more than $153 billion.

Despite reports of crippling capital inadequacy in the wake of the new Goods and Services Tax regime, double-digit export growth continued for half of the year.

On the other hand, imports also shot up as volatile crude prices made a comeback to haunt policymakers after a year of relative ease.

India's current account deficit is expected to triple to $19 billion to $21 billion in Q2 of FY19, or about 3 per cent of the GDP, from the modest $7 billion in Q2 last fiscal year, economists predict.

As a result, the government placed import restrictions and raised inbound duties on six separate occasions for hundreds of products including textile inputs, steel, mobile phones and solar panels, among others.

The move was strongly criticised for raising protectionist barriers at a time when economic growth was tepid.

But India managed to navigate through a field of tariff landmines as a trade war between the United States and China heated up throughout the year.

New Delhi countered threats by the Donald J Trump administration to cut market access for Indian goods by entering protracted negotiations with the US, that continue at the time of writing.

While monthly collections have crossed the Rs 1 trillion mark twice in the current year, they remain well below the desired monthly run rate.

Ishan Bakshi reports.

Even a year-and-a-half after its launch, the goods and service tax regime continues to pose grave problems for the central government's fiscal maths.

While monthly collections have crossed the Rs 1 trillion mark twice in the current year, they remain well below the desired monthly run rate.

This is despite the number of returns filed rising to 6.96 million in October, up from 6.75 million in September.

On its part, the government had hoped that compliance under the new indirect tax regime would improve with the introduction of the e-way bill.

However, data on Integrated GST domestic collections does not suggest a sustained increase in tax collections.

For the government to meet the budgeted indirect tax target, collections would have to rise to Rs 1.33 trillion per month for the rest of the current financial year, says a report by Kotak Institutional Equities.

Part of the shortfall could be plugged by distributing the unallocated portion of the GST compensation cess between the central and state governments.

Or, the Centre could hold onto IGST collections.

Despite this, the Centre is staring at a huge gap in indirect tax collections, which the report pegs at Rs 800 billion to Rs 900 billion.

It took collective pressure from all developing countries, including India, to ensure the rulebook adheres to the letter of the agreement even if it did not stay entirely loyal to its spirit.

Nitin Sethi reports.

India finalised a report noting that it was well on the way to meeting two of its three targets under the first phase of the Paris Agreement.

Soon after, the Katowice climate change negotiations ended with a rulebook to the Paris Agreement.

It took collective pressure from all developing countries, including India, to ensure the rulebook adheres to the letter of the agreement even if it did not stay entirely loyal to its spirit.

For instance, the rules eroded the difference between developing and developed countries to a layer deeper than the agreement had rendered.

With the Paris Agreement itself pared down to let countries largely self-determine how much heft they should put behind the collective fight against climate change, the rules were not expected to deliver more.

But Katowice did deliver a set of rules that will monitor countries deeply for their delivery against the nationally-determined actions, particularly on reducing greenhouse gas emissions.

Countries could not, however, agree to the rules for the operation of the global market for trading in greenhouse gas emissions under the Paris Agreement.

Developed countries wanted developing countries not to take credit for the emissions they trade in.

Developing countries wanted the rich nations not to get to harvest the low-hanging cheaper emission reduction targets only to their account, leaving the poorer nations with heavy bills for technology in emission reductions.

The rules for the market mechanism were deferred to 2019, or perhaps 2020, just before the Paris Agreement gets implemented, starting 2021.

Next year will also witness a summit organised by the UN Secretary General, who has put his weight behind pushing countries to enhance their targets even before the agreement kicks off.

The controversy over job creation data is becoming as serious an issue as job creation itself.

Somesh Jha reports.

Until last year, official and private estimates painted a grim picture of job creation -- a key election promise of Narendra Damodardas Modi on the campaign trail in 2014.

In January 2018, the government sought to change the narrative.

A study commissioned by its own think-tank showed that seven million jobs were created in 2017-18 -- closer to the government's promise of providing 10 million jobs.

The study by two independent researchers analysed provident fund data held by the Employees Provident Fund Organisation to map job creation in the private formal sector.

The study predictably drew much flak from various economists for lack of transparency in computing the numbers.

Nevertheless, the government decided to halt all the job surveys by the Labour Bureau and began rolling out the EPFO payroll data on a monthly basis instead.

This backfired.

The payroll numbers provided by the EPFO are dynamic in nature so the figures of job creation kept being revised downwards -- bringing to light another reason the January study was considered unreliable.

The controversy over job creation data is becoming as serious an issue as job creation itself.

But as we move on to 2019, the situation could improve with several official data-sets lined up from the NSSO and the Labour Bureau.

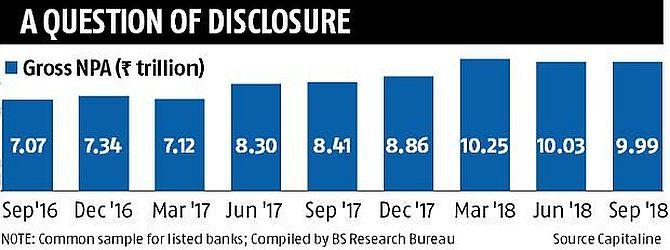

This surprised many observers, if not the bankers, as the true extent of bad debt was not evident before the Reserve Bank of India arm-twisted lenders to disclose whatever was hidden under the carpet.

Anup Roy reports.

In the March 2018 quarter, the gross non-performing assets of Indian banks surged past Rs 10 trillion.

This surprised many observers, if not the bankers, as the true extent of bad debt was not evident before the Reserve Bank of India arm-twisted lenders to disclose whatever was hidden under the carpet.

There are many economic reasons for this NPA pile-up, but the numbers ballooned after the central bank's February 12 circular.

The circular said if a loan is not serviced for 90 days, it is in default and recovery proceedings can be started against it.

Not surprisingly, the gross NPA of all listed banks jumped to Rs 10.25 trillion in the March quarter, from Rs 8.86 trillion in the December 2017 quarter.

The March level was roughly 11.5% of the total loan book.

Adding restructured, and loans suspected to be falling into NPA, the share could be 13% to 14% of the loan book.

RBI's financial stability report says the gross NPA ratios of the banking system could reach 12.2% of the loan book by March 2019.

The good news is that the gross NPAs showed a downward trend in June and then in the September quarter.

This is largely because of the strict Insolvency and Bankruptcy Code, or the fear of it.

Bankers now believe the recognition part of NPA is over, and the recovery needs to begin.

Most of the big-ticket companies that were being forced to undergo a change in management as part of the law were part of the RBI-mandated list for debt resolution under IBC.

Ishita Ayan Dutt reports.

2018 was a watershed year for corporate India with some of its tycoons coming close to losing grip on their companies, courtesy the Insolvency and Bankruptcy Code.

Most of the big-ticket companies that were being forced to undergo a change in management as part of the law were part of the RBI-mandated list for debt resolution under IBC.

The RBI's first list comprised 12 large accounts with an outstanding claim of Rs 3.45 trillion.

The highest profile from that prized list is Ruia-owned Essar Steel.

Subsequently, the central bank came out with a second list of 27 NPAs that included the likes of Videocon.

The IBC was rolled out about two years ago with the objective of facilitating debt resolution.

Till September, in terms of recovery, financial creditors have realised Rs 584 billion against admitted claims of Rs 1.3 trillion.

Compared to a pre-IBC regime recovery rate of 26 per cent, the Code hasn't fared badly.

However, less than five per cent of the cases have been resolved so far (52 out of 1,198).

The resolution, which was to have been achieved within a maximum time limit of 270 days, has tripped on time-lines.

Of the 816 corporate insolvency resolution processes (CIRPs) underway, more than 29 per cent of the cases have breached the extended 270-day deadline within which resolutions were to be completed, and 19 per cent have crossed 180 days.

Yet bankers say these are but early problems of a revolutionary law that has changed the creditor-debtor relationship in significant ways.

Govt also pushed for RBI decision-making to be a more consultative process, meaning board members should have more say.

Kanika Datta reports.

After months of speculation RBI Governor Urjit R Patel submitted his resignation on December 10, the first incumbent to do so since economic liberalisation.

Tensions had been building for some time, especially from August, with the government appointing two loyalists to the RBI board -- maverick accountant and Swadeshi Jagran Manch co-convenor S Gurumurthy and cooperative banker and former Akhil Bharatiya Vidyarthi Parishad treasurer Satish Marathe.

Their induction was seen as disturbing the intricate relationship between the central bank and government.

It coincided with the RBI coming under pressure to part with a larger share of its capital reserves to shore up government finances and to ease lending restrictions on public sector banks under the Prompt Corrective Action regime, especially to the ailing small and medium enterprises sector.

The government also pushed for RBI decision-making to be a more consultative process, meaning board members should have more say.

Theb RBI interpreted this as a direct undermining of its central board.

With tensions mounting between Mint Road and Raisina Hill, Deputy Governor Viral Acharya delivered a speech outlining the case for the central bank's autonomy in the interests of long-term financial stability.

It was seen as a pointed message to the government.

There the issue rested in a miasma of rumour that the government would invoke the never-used Section 7 of the RBI Act -- which involves a direct order from the government to the RBI to carry out its wishes.

A day before the results of five state elections were to be declared and two days before a much-anticipated board meeting, Dr Patel officially put in his papers.

Two days later, former economic affairs secretary Shaktikanta Das, who had been the government's chief spokesman during demonetisation, was appointed as his successor.

The board meeting appeared to have gone off without incident, but this is only the beginning of a new story.

Creation: Ashish Narsale/Rediff.com