| « Back to article | Print this article |

Market experts on why the bulls will be on the rampage first thing on Monday after the scrapping of enhanced surcharge on FPIs and other measures to ease the systemic liquidity squeeze and boost demand.

Prasanna D Zore reports.

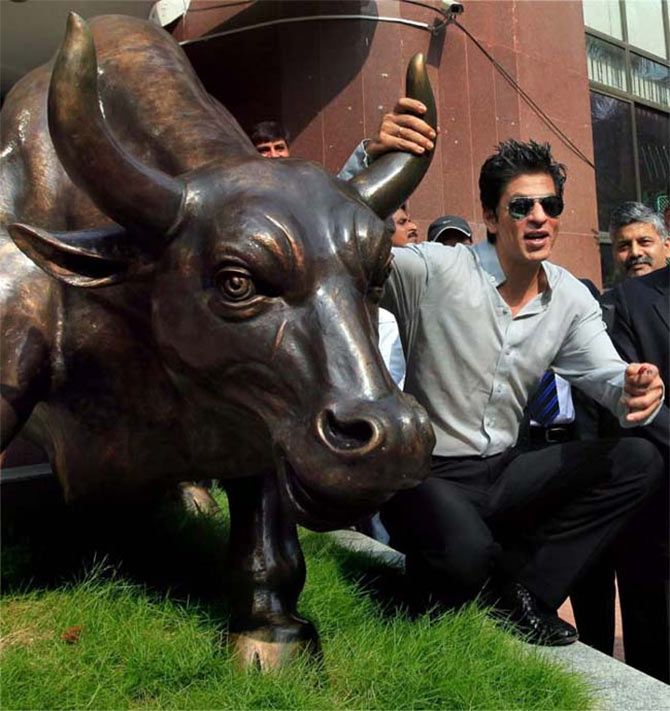

The bulls will be on the rampage, firing fresh salvos at the bears, come Monday, said market experts soon after Finance Minister Nirmala Sitharaman announced a rollback of the enhanced surcharge on foreign portfolio investors and domestic investors after trading closed Friday.

Also known as the super rich tax, the increase in surcharge on FPIs announced by the finance minister in her maiden budget on July 5 had sent shockwaves across Indian equity markets as foreign institutional investors dumped stocks worth Rs 30,000 crore till August 23, leading to huge dollar outflows and the sinking of the Indian rupee to an eight-month low of 72 against the greenback.

Come Monday, market mavens believe that the trend of FIIs' selling spree will reverse with the scrapping of the enhanced surcharge on the FPIs, despite the trade war escalation between the US and China resulting in a major global crash.

As if on cue, the same evening that Indian finance minister announced a slew of measures to reverse the FII outflows and boost the sagging consumption and automobile demand in India, US President Donald Trump asked Chinese companies to look for 'alternatives' soon after China imposed new tariffs on US goods worth $75 billion that resulted in major US indices like the S&P 500 and Dow sinking 2.59 per cent and 2.37 per cent respectively, and taking down technology-heavy NASDAQ 100 by almost 3.15 per cent.

Gap up opening, Monday morning

"The US-China trade war will continue to roil the markets for some time and we need to be extra careful on that front. But that does not mean that the consumer (demand) on the ground (in India) will be affected," says Deven Choksey of K R Choksey, who is confident of a gap up opening when Indian markets open for trade Monday, August 26.

Talking about the positives of the trade war between the two economies whose combined worth stands at US $ 30 trillion, Choksey says, "Because of that worry we are getting oil at a cheaper price, a huge advantage for an oil-importing country like India."

Crude oil closed trading at 53.95 dollars to a barrel, down 2.53 per cent, on August 23.

"Market will have a gap up Monday and will attract buying from the FIIs and FPIs," says Choksey, notwithstanding the mayhem in the US markets.

And Choksey is not alone in predicting happier days for the Indian markets.

"I think Monday morning open could be the best day of 2019 for Indian markets," says independent investment advisor Ambareesh Baliga about the impact of the announcements made by the finance minister.

"I won't say a huge gap up but 100 point-plus on Nifty toh pucca hai," says S P Tulsian, another independent investment advisor.

While Deepak Jasani of HDFC Securities and Umesh Mehta of SAMCO Securities also believe that the stock market will open in the green Monday, they temper their exuberance with a dose of caution citing the growth concerns faced by the Indian economy.

"These measures will have a positive impact on the markets in the early part of the next week. But a major positive impact will wait till growth concerns are sorted out," cautions Jasani.

Says Mehta of SAMCO: "The markets will open gap up, no doubt, Monday morning. But in a falling market, gap ups are usually disappointing and they close with disappointment. We will witness euphoria when the markets open on Monday but will fizzle out in the course of the day."

"The steep fall in the market post-Budget was not just because of the super rich tax but also because the economy is not doing well," Mehta, who feels that the super rich tax was a little overblown, adds.

"The FPI surcharge issue was overblown by the market and the government has eventually responded to that. The structural negatives that impact the economy have still not been addressed," says Mehta.

The positives as the market sees it

Among a slew of measures, apart from the scrapping of FPI surcharge, which led to high-decibel protests in India and globally, the finance minister had announced that PSU banks will get Rs 70,000 crore upfront for their recapitalisation and release another Rs 5 lakh crore in a phased manner to open the clogged wheels of liquidity, thereby aiding free flow of funds to drive consumption and boost demand in the auto and real estate sectors, two major growth engines for the economy.

"The upfront provision of Rs 70,000 crore for bank recapitalisation will smoothen the credit offtake as banks can leverage this liquidity to lend as much as Rs 5 lakh crore for productive purposes. This will put an end to the liquidity squeeze in the market," says Tulsian about how the credit wheel will spin in the days ahead.

"There was Rs 115,000 crore already in the system and an additional Rs 70,000 crore will lead to a jump in the lending capacity of the banks by Rs 5-7 lakh crore," adds Choksey.

The finance minister's clarification on the confusion over road-worthiness of BS IV vehicles and higher registration charges will also help boost demand for a sector that has been facing the most painful brunt of the current economic slowdown.

"By issuing a clarification that vehicles with BS IV registration will continue to ply on the roads for the life of the vehicle and buyers will not have to pay higher registration fee and higher one-time tax will clear the ambiguity in the mind of consumers. With the rate of interest coming closer to the repo rate, if somebody is getting auto financing at 8 per cent is a fantastic move giving a significant leg-up to the auto sector," says Choksey.

Baliga explains the impact of higher depreciation provisioning announced by the finance minister on autos. "Increasing the depreciation to 30 per cent from 15 per cent one enjoys currently is a major push from the point of businesses who were looking to buy vehicles but had deferred it," he says.

"And, she (the finance minister) is not depending on the public to kickstart these purchases but has asked the government departments to do that. That will be the immediate booster to clear the inventories. Basically, the auto and infrastructure sector will get a boost because of the announcements made today," he says.

But Choksey and Tulsian are more gung-ho about the systemic changes that the government has undertaken to improve trust within the banking system.

When asked why the bankers were reluctant to lend despite the system being awash with liquidity, Choksey says, "There were bankers reluctant to lend because of the issues haunting them about the loans given earlier. Now, the measure that takes care of this is they will not be haunted but on the contrary the (automatic) system will track if there is any mala fide intention."

"This is a fundamental shift in the mindset. This is a huge systemic change and the government must be complimented for it. This will infuse huge confidence in the minds of bankers lending money to businesses," he says.

According to Tulsian more than any measure, the government taking a firm stand by addressing the concerns raised by those affected by the increase in surcharge will bring more confidence into the market.

"The government has clearly spelt out its intention that it is open to doing what needs to be done for the betterment of markets and economy."

But here are the niggles

While Jasani is happy with the announcements made by the finance minister, he feels that the government needs to come out with more clarification about its divestment in the public sector undertakings.

He feels that with the scrapping of FPI surcharge the government may have addressed some irritants and those will no doubt help boost market sentiment, but will not be a huge sentiment booster.

"We would be happier if the finance minister gives clarity about structuring of the public sector undertakings. That nothing is happening on this front is a cause for concern," he says.

"Till growth concerns are taken care of, the measures announced will have a positive market impact only for a week or two," are Jasani's words of caution for market participants who feel that all is hunky-dory with the markets and the economy.

Mehta feels that the government must also address structural concerns plaguing the economy.

"Government opening its purse-strings and spending on infrastructure and building productive capacities can help smoothen structural imbalances which the government is not doing currently," he says.

"How does the government look to boost consumer sentiment now that they have done their best to boost stock market sentiment? Once that is taken care of, the markets will rise gradually but sustainably. The government will then be able to meet its disinvestment targets and have more resources for boosting capital expenditure," he says.

Too much, too late?

The 50-stock bellwether Nifty, which had scaled the 12,100-mark June 3 closed around 10,830 August 23, a whopping 10 per cent fall from its all-time high.

Most market participants have attributed this fall, apart from the severe economic slowdown that India is witnessing right now, to the imposition of enhanced surcharge of 25 per cent, up from 15 per cent, on individuals earning between Rs 2-5 crore per annum and 37 per cent on those individuals earning more than Rs 5 crore. This was on top of the applicable income tax levied levied on these individuals, mostly FPIs but Indians too, effectively taxing these two sets of entities to 39 per cent and 42.74 per cent respectively.

"For a paltry sum of Rs 1400 crore (the income the government would have earned from these surcharges), they washed out the entire market. This (withdrawal of this enhanced surcharge on FPIs and domestic investors) was badly required; it was a mistake that they knew they had committed and could have reversed this a long time back. They shouldn't have waited for distress and panic to set in the market," says Choksey about the government's measures that addresses the concerns of the FPIs.

"The announcements are welcome though they could have come a little early," says Jasani, echoing Choksey about the delay by the government in scrapping the surcharge.

Ask Tulsian the same question and he quips, "Better late than never," but quickly adds, "The announcements will prove to be a U-turn for market sentiments."

Baliga, however, feels that the finance minister is not done yet with her stimulus package for the economy in general.

"There are two more such announcements expected over the next 10 days. And I think she will talk about real estate and a couple of other things that were not covered on August 23," he says.

The final word

Talking about the bullish sentiments unleashed by the finance minister's announcements in the context of the investors losing wealth worth Rs 14.7 lakh crore and markets tanking almost 10 per cent from their peak, Choksey shows the silver lining to the dark cloud hovering over the market.

"There is every reason to believe that the lows of the last two days could be a sign of bottom formation and I have been saying from the last few days that our stock market is in a state of capitulation. And bottoms are formed mostly in a state of capitulation," says Choksey.

Note: Except Deven Choksey, all other experts who expressed their opinions for this story spoke to this correspondent before the US-China trade war spat turned ugly late Friday evening India time.