| « Back to article | Print this article |

Allotment could be low, and expected listing-day gains can quickly morph into losses if sentiment takes a turn for the worse, says Sanjay Kumar Singh.

Action within the primary market is becoming more frenzied with each passing day.

Ten initial public offerings (IPOs) have listed on the exchanges since the start of June.

In an event last witnessed 14 years earlier, four IPOs opened for subscription on the same day (August 4) and were lapped up by investors within hours.

The oversubscription numbers, ranging from 3.9 times to 93.4 times (since the start of June), are another pointer to the high investor appetite for debutant stocks.

The final icing on the cake is the listing day gains, which have ranged from 5.1 per cent to 113.5 per cent during this period.

Amid such overheated conditions, both high net worth individuals (HNIs) and retail investors need to tread with caution.

Risks in margin financing

According to media reports, non-banking finance companies (NBFCs) are providing massive amounts of funding to HNIs to bet in the IPO market.

Interest cost for such borrowings is in the range of 10-11 per cent.

Investors have to put in one per cent and the NBFC could finance as much as 99 per cent (this figure can vary).

By putting in large amounts, HNIs are able to ensure they get a good allotment even if the offering is heavily oversubscribed.

Most HNIs, who invest using leveraged money, enter on the last day of the IPO, by when there is a fair bit of clarity on the oversubscription numbers and the likelihood of listing gains.

Investing on the last day also enables them to reduce their interest cost on borrowed funds.

While investing using margin financing may look like a sure bet, a lot can go wrong.

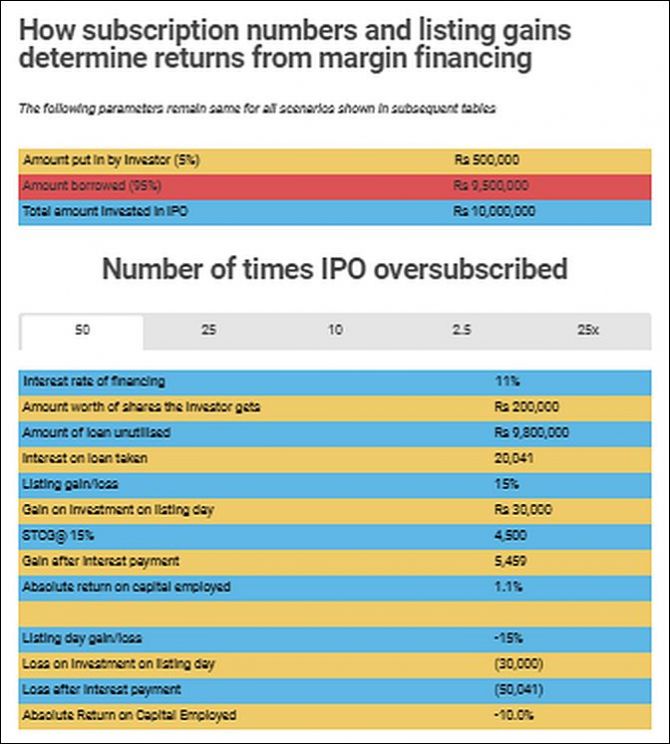

"The HNI's cost of fund is known. The outcome of his bet depends on two factors: how much allotment he gets, and the quantum of listing day gain," says Deepesh Raghaw, founder, PersonalFinancePlan, a Securities and Exchange Board of India-registered investment advisor.

He adds that leveraging is a double-edged sword—it can multiply your gains as well as your losses.

If instead of listing at a premium, the shares list at a discount, the investor gets hit by a double whammy.

This has been known to happen in the past. Market sentiment can turn for the worse between the closing of the IPO and the stock’s debut on the exchanges.

"Not only will the investor have to pay the interest cost, he will also have to bear the capital loss on the entire leveraged amount," says Ankur Kapur, managing partner, Plutus Capital, a Sebi-registered investment advisory firm.

Usually, the NBFC, which has a lien on the shares, sells them.

But if doing so is not adequate to meet the interest cost, the investor has to shell out more from his own pocket. (See table on how different levels of subscription and listing gain/loss have a bearing on investor's returns.)

A loaded dice

Margin financing is a game played mostly by HNIs.

However, the dice is loaded against the retail investor as well.

In the 1990s and early 2000s, when companies came out with an IPO, they did so because they required capital to fund their growth.

Nowadays, when start-ups require growth funding, they turn to private-equity (PE) investors.

"These days when companies come out with an IPO, they mostly do offer for sale (OFS), whose primary purpose is to provide an exit to early investors like PEs and enable promoters to monetise a part of their holdings," says Jatin Khemani, founder and chief executive officer, Stalwart Investment Advisors, a Sebi-registered independent equity research firm.

These stakeholders ensure they get the best possible price for offloading their stakes.

And how do they achieve this?

"They time their IPOs during the good phase of the market cycle – when sentiment is euphoric, liquidity is abundant, and there is a high probability of the issue being oversubscribed, irrespective of its valuation," says Khemani.

Promoters also carry out IPOs during the good part of the industry cycle, so that the last three years' performance numbers appear favourable.

Investors should be wary about extrapolating these numbers to gauge the long-term prospects of these companies.

To get a better estimate of the performance of IPOs, investors should look at longer-term rolling returns.

"Over the long term, 80-90 per cent of IPOs don’t do well.

"Either their prices are lower than the IPO price, or they have lagged the leading market benchmarks.

"Very few IPOs turn out to be winners in the long run and make money for investors," says Khemani.

Another issue that the retail investor faces in an IPO is the amount of allotment he can get.

If the quality of the company is good and the valuation is attractive, the IPO is likely to be heavily oversubscribed.

The chances of getting adequate allotment, which will have a meaningful impact on an investor's portfolio return, are quite low.

Retail investors who participate in IPOs in the hope of making a quick buck should remember they are engaging in speculative activity, wherein they could end up burning their fingers.

What should you do?

Irrespective of whether you are investing in the primary or the secondary market, your effort should be to engage in investment, and not in speculation.

This means you should do a careful study of the prospects of the investment, and then make a bet if you think the probability of making money over the long term is favourable.

"In most cases, equally good or even better-quality businesses from the same industry may be available at a similar or cheaper valuation in the secondary market," says Khemani.

If at all you decide to invest in an IPO, you must read the offer document (it is often of 400-600 pages and will hence require considerable effort).

But reading it will provide you with comprehensive knowledge about the company, its history, the background of its promoters, all the legal cases against the company, etc.

This will enable you to understand the risks of the investment and then decide whether you should invest in it.

Valuation is a major risk when you invest in an IPO.

So, compare the valuation of the IPO with that of peers from the same industry within the secondary market.

If the new company is asking for a premium valuation, compare its fundamentals with that of secondary-market peers–revenue and profit growth rates, margins, return ratios, growth prospects, etc.

Only if you find sufficient reason should you agree to pay the premium.

Alternatively, if you find that the new company is fundamentally attractive, you can play the waiting game.

"Often, you will find a good entry price in the same stock within the next 6-12 months, either because the hype has died down, or due to market gyrations," says Kapur.