| « Back to article | Print this article |

A quarter of the stocks have been replaced since 2019, marking the evolution of India's economy.

The ancient Greeks argued a paradox: If the Ship of Theseus had all its wooden planks replaced one by one, in the end is it still the same ship?

Similarly, the S&P Sensex has had its constituents change over the years.

The churn has continued amid new all-time highs - a quarter of the stocks have been replaced since 2019.

The methodology to include stocks in the index has changed over time.

Earlier, the full value of listed shares was used. Since 2003, only the value of shares available in public hands is considered.

More than methodology, the ability of firms to keep up with a changing economy is said to have driven a significant proportion of the replacements.

The Sensex in 1986 included automobile manufacturer Premier and steel firms Zenith and Mukand.

They were blue chip stocks until the 1990s when Indian opened its economy to competitive forces.

The change in the markets accelerated after liberalisation, a study in the 2019-20 Economic Survey noted.

A Business Standard analysis based on data compiled from Capitaline shows there was almost no replacement in the 10 years since the index was first calculated in 1986.

There were 25 replacements in the 10 years that followed.

The pace of change increased significantly after liberalisation and persisted even amid the pandemic as seen in chart 1.

The gap between market constituents is now smaller as companies become more competitive in their own fields.

The largest company was 100 times the size of the smallest one in 1991. The ratio is down to 14 in 2024 (chart 2).

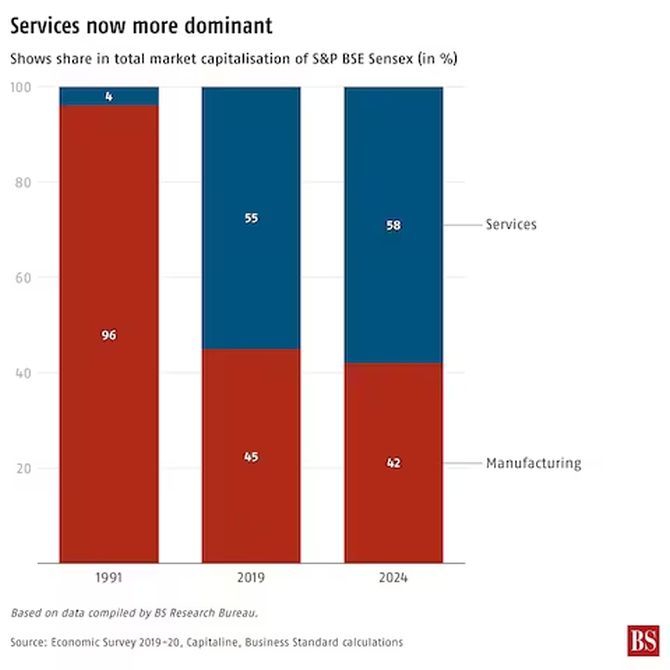

Manufacturing companies accounted for 96 per cent of the index in 1991 and dropped to 45 per cent by 2019. They are now at 42 per cent in 2024. The share of services is now close to 60 per cent, the largest (chart 3).

Feature Presentation: Aslam Hunani/Rediff.com