However, independent economists are not as gung-ho as the finance ministry over the likelihood of deficit target being met this time around, says Indivjal Dhasmana.

If the past trend is anything to go by, the finance ministry should be able to contain the Centre's fiscal deficit in 2018-19.

The ministry has a successful record of reining in the fiscal record in two of the three pre-election years since the idea of the fiscal responsibility and budgetary management (FRBM) was mooted.

The FRBM Act was introduced in Parliament by the then finance minister, Yashwant Sinha, in 2000, but it got enacted only in July, 2004, when the United Progressive Alliance (UPA) government came to power. The FRBM Act mandated the fiscal deficit to be reduced every year until it came to three per cent of gross domestic product (GDP) in 2008-09.

So we took into account the fiscal consolidation exercise of the government since 2003-04, a pre-election year Budget of the National Democratic Alliance (NDA) regime in its first stint under Atal Bihari Vajpayee.

Since then, four pre-election Budgets have been presented -- in 2003-04, 2008-09, 2013-14 and 2018-19. Of these, the revised estimates of 2018-19 are yet to come out.

Of the remaining three Budgets, the finance ministry has been able to rein in fiscal deficit as budgeted in 2004-05 and 2013-14. It was only in 2008-09 that the fiscal deficit target was not met. But the main cause of the disruption was not elections but the global financial meltdown.

In 2004-05, the Budget had targeted the deficit to be at 5.6 per cent of the country's GDP, but the actual deficit came at about 4.5 per cent. Similarly, in 2013-14, the fiscal deficit, targeted at 4.8 per cent, ended up lower at 4.4 per cent.

It was only in 2008-09 that fiscal deficit was targeted at 2.5 per cent of GDP, but it came to be wider, in fact more than double, at six per cent. The hit on fiscal deficit was so much that FRBM targets went awry.

Since the enactment of the FRBM Act, the government had been maintaining the targets until 2007-08. The then finance minister, P Chidambaram, had even said in his Budget speech of 2007-08 that the fiscal deficit was estimated at Rs 1,509.48 billion, or 3.3 per cent of GDP. "I am happy to report that we are on course to achieve the FRBMA targets," he had asserted confidently.

A year later, he proved his point when the deficit was reduced to 3.1 per cent of GDP in 2007-08. "It is widely acknowledged that the fiscal position of the country has improved tremendously," he said.

Also, at the beginning of 2008-09, the government was confident that the fiscal deficit target would be met in line with the FRBM Act, if not in line with the Budget. Chidambaram had said in 2008-09 Budget, "... Not only will I achieve the target for fiscal deficit under the FRBM Act, I have also left for myself some headroom". This was so because the FRBM Act had mandated the fiscal deficit to be three per cent of GDP, but it was budgeted to be 2.5 per cent.

But, the year did not progress as it was expected by the government. The collapse of Lehman Brothers in September 2008 accentuated the financial meltdown. The global GDP growth averaged 3.7 per cent during 1997-2006. Growth further improved to 5.1 per cent in 2007, shored up by emerging Asian economies, particularly India and China. However, in the aftermath of the global financial meltdown, growth started decelerating in 2008 and the world output contracted in 2009. This had a ripple effect on India.

The government had to announce stimulus to perk up the economy. Meanwhile, there was change in guard at North Block. Chidambaram was shifted to the other corner of North Block -- home ministry -- in the aftermath of the 26/11 Mumbai terror attack in November 2008, and the finance ministry was taken by the then prime minister, Manmohan Singh. Later, Pranab Mukherjee became the finance minister.

To counter the ripple effect on India, fiscal and monetary policies were initiated. Two stimulus packages were announced on December 7, 2008, and January 2, 2009, and a third one in the interim Budget on February 16, 2009, in quick succession. The total size of the fiscal stimulus package was estimated at 3.5 per cent of GDP in 2008-09, amounting to Rs 1.86 trillion.

On the demand side, the government reduced excise duty rates by 6 percentage points in two phases and service tax by 2 percentage points.

States were provided financial assistance under the Jawaharlal Nehru National Urban Renewal Mission (JNNURM) for purchase of buses for urban transport system. These, together with frontloading of public expenditure on physical and social infrastructure, were aimed at stimulating domestic demand.

The government also took measures on the supply side -- an interest subvention of 2 per cent on pre- and post-shipment credit on labour-intensive industries attempted to reduce the cost of these export-dependent industries.

A refinancing facility of Rs 70 billion was provided initially, which was enhanced by another Rs 40 billion in 2009-10 to Small Industries Development Bank of India for supporting incremental lending to micro and small enterprises, either directly or through banks.

The government also provided back-up guarantee to Export Credit Guarantee Corporation to enable it to provide guarantees to exports.

All this led to a widening of the fiscal deficit to six per cent of GDP, as was cited above.

As such, 2008-09 was the only exception in two of the three pre-election year budgets, and that too because of exceptional a global financial situation.

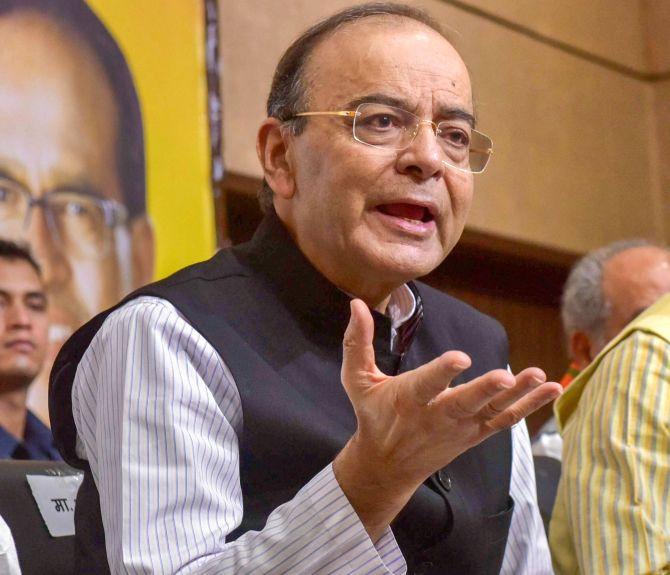

This time, there is no such extraordinary global situation, even though demand is taking time to recover. Finance Minister Arun Jaitley is confident that fiscal deficit would be reined in at 3.3 per cent of GDP, as was budgeted for 2018-19, even as the target was already breached till October 2018.

The fiscal deficit for April-October stood at Rs 6.49 trillion, more than the full-year target of Rs 6.24 trillion.

The confidence is also despite the fact that it is almost certain that goods and services tax (GST) are not giving the targeted revenues, even as Revenue Secretary A B Pandey has expressed confidence that GST targets will be achieved.

Overall, there could be a shortfall of Rs 700 billion to Rs one trillion in GST collections, against the target of almost Rs 13 trillion. All of this may not come only to the Centre, even if one assumes that states would meet the target due to a compensation cess, since 42 per cent of even central tax revenues are shared with states.

The issue is where the government will find resources to meet this shortfall. Jaitley has already said that capital expenditure would not be squeezed, even as fiscal deficit target would be adhered to.

It should be noted here that while fiscal deficit target in 2013-14 was met, it mainly came due to a huge 22 per cent cut in capital expenditure. Ironically, while there was stimulus in 2008-09, capex was reduced marginally even then. It was only in 2004-05 that capex was raised by a whopping 50 per cent, but then fiscal deficit targets were still achieved.

Independent economists are not as gung-ho as the finance ministry over the likelihood of deficit target being met this time around. For instance, India Ratings projected that fiscal deficit would be 3.5 per cent of GDP in 2018-19. And this would also be so due to robust direct tax collections and disinvestment proceeds, the rating agency's chief economist Devendra Pant said.

The government collected 48 per cent of the direct tax targets for this year by November. In absolute terms, collections stood at Rs 5.5 trillion against the target of Rs 11.5 trillion for the entire year.

Similarly, the government has garnered Rs 322 billion from disinvestment so far, against the target of Rs 800 billion. The acquisition of Power Finance Corporation by Rural Electrification Corporation, approved by the Union Cabinet recently, would give the government another Rs 140-150 billion.

The government is also working on another tranche of its successful Bharat 22 exchange-traded fund, and a few other deals, including the sale of Air India's ground-handling unit and NTPC taking over the Centre's 63.7 per cent stake in SJVN Ltd.

Had it not been for direct tax collections and disinvestment, fiscal deficit would have surpassed even 3.5 per cent, Pant said.

Even as fiscal deficit target now is 3.5 per cent for 2018-19, it should be noted that the original projection by the fiscal consolidation road map was 3 per cent.

In 2008-09, the Budget Estimate of fiscal deficit at 2.5 per cent of GDP was lower than the FRBM target of three per cent, but then it actually turned out to be six per cent ultimately.

After FRBM targets ended in 2008-09, the Vijay Kelkar committee was appointed. It gave a new road map for fiscal consolidation. According to that road map, the deficit was to be checked at 4.6 per cent of GDP in 2013-14. However, the Budget had estimated it to be 4.8 per cent. But, actually the deficit stood quite lower at 4.4 per cent.

This time around (2018-19), the original target of the fiscal consolidation road map has already given a pause.