| « Back to article | Print this article |

The world is full of family businesses that withered away with the passing of generations, creating much bitterness and ill will.

Entire clans that used to be household names have become pale shadows of their once-mighty empires.

Last fortnight, the Supreme Court appointed two retired judges as mediators between Lalit Modi and his mother Bina.

Lalit, industrialist K K Modi's son, is better known as the man behind the Indian Premier League of cricket.

He and his mother have been at loggerheads since Modi Senior's death in November 2019.

It is a messy affair. Bina and her other two children Charu and Samir are on one side and Lalit on the other.

Lalit had started arbitration proceedings in Singapore.

Bina filed a lawsuit in India to stop the arbitration.

The route to mediation came through the usual course of high courts, single judges, and division benches.

You could look at it as yet another succession battle.

The world is full of family businesses that withered away with the passing of generations, creating much bitterness and ill will.

Entire clans that used to be household names have become pale shadows of their once-mighty empires.

K K Modi's group itself emerged from a long saga of family settlement in the Modi clan.

Except that at the heart of the dispute between Lalit and Bina is a trust deed.

This trust, according to submissions in the case, was executed in 2014 by Modi Senior as the settlor or managing trustee.

Bina, Lalit, Charu, and Samir were the trustees.

This should be a cautionary tale at a time business families are gravitating towards trusts to avoid succession battles.

Mortality alert

The most recent of these is the Shriram Group, the financial services major, which announced a board of management to run the Shriram Ownership Trust.

The promoter groups shareholding has been transferred to the trust and none of it is with any individual or family.

Days before Shriram's announcement, Bloomberg reported that Mukesh Ambani, the 64-year-old head of the Reliance group of companies, has prepared a blueprint for succession.

Ambani, who braved a bitter battle with his brother Anil in the aftermath of their father's death, is considering moving his family's shareholding into 'a trust-like structure', says Bloomberg.

Apparently, Ambani's model takes its inspiration from the Walton family, which controls about half of Walmart Inc through the Walton Family Holdings Trust and their chief investment vehicle, Walton Enterprises.

One theory going around is that many more heads of business families are consciously thinking of succession because the Covid pandemic has made them aware of their mortality.

Maybe mortality is something humans need to be reminded of, but business families need no reminder of their vulnerability to a change of generations.

As business families grow larger with the addition of sons and daughters and sons-in-law and daughters-in-law, they drift away and live in their own separate houses.

That happens with any family, except that in a business family there is a lot more at stake.

The trust route of succession has merit.

It cannot hold the family together, but it can keep the family's holding together in a way that provides more flexibility than a will.

Trusts do away with the need to transfer legal ownership as control passes from one generation to another and protect against hostile takeovers because no single member of the family can sell their holding.

However, are trusts truly the panacea for all succession troubles?

Each unhappy family...:

Succession battles in business families come in a wide array of disagreements, especially in India, where family dynamics are more complex than in the Western world.

There is the usual brother versus brother and there are inter-generation feuds (father versus son, mother versus son).

There are disputes because the women in the family feel marginalised.

And there are the oddities, such as a chartered accountant versus his clients family.

In one of the more high-profile cases, a retired patriarch managed to oust his own hand-picked successor.

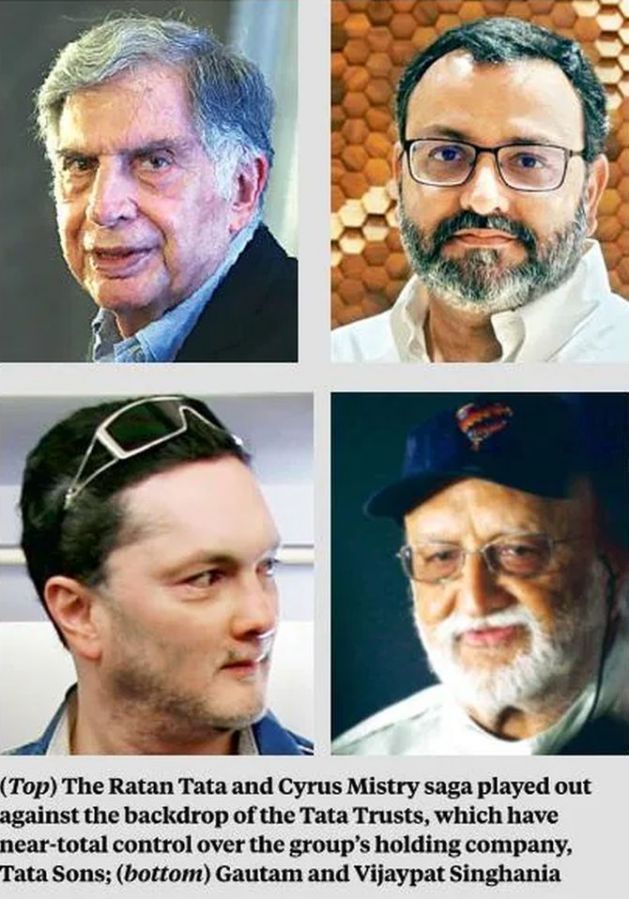

The last mentioned saga played out against the backdrop of the Tata Trusts, which have near-total control over the groups holding company, Tata Sons.

Ratan Tata chose Cyrus Mistry to succeed him as chairman 2011 after a global search.

Things turned sour when Mistry tried to reduce the group's debt by actions that were seen to be an undoing of Tata's legacy.

Tata, already into retirement but in control of the trusts, gave Mistry the option to resign.

Mistry, whose family held 18 per cent in Tata Sons, refused.

The trusts could not prevent the public spat that ensued, just as K K Modi's trust could not keep his wife and son together.

Lalit believed the family had reached a point, after his father's death, where the trust's assets should be sold because there was no unanimity among the four trustees about the path ahead.

Bina had other ideas. She chose to take up an active management role and became the president and managing director of Godfrey Phillips India Ltd, the group flagship known for its popular cigarette brands such as Four Square and Red and White.

Indeed, business families have bickered over every imaginable reason.

The most common, of course, is who gets how much of the family jewels.

But it can also be a disagreement over strategy, which was the issue in the Bajaj Auto family.

More specifically, it was whether to continue making scooters, the product that had built the empire.

The Singhania family behind Raymond disagreed over not only the control of their textiles business but also flats worth crores in Mumbai.

The Murugappa family was perceived to have managed its transition well, until Valli Arunachalam, the elder daughter of the late patriarch, M V Murugappa, termed the restructuring unfortunate, saying it marginalised the daughters and mentored only the sons for leadership roles.

In 2004, when the former chairman of Birla Corporation, Priyamvada Birla, died, a will emerged.

Dated 1999, it bequeathed her Rs 5,000 crore assets to co-chairman and well-known chartered accountant Rajendra Singh Lodha.

The rest, as they say, is a long court battle.

To distort Leo Tolstoy's opening line from Anna Karenina, each unhappy business family is unhappy in its own way.

Mutual trust will help them, trusts may or may not.