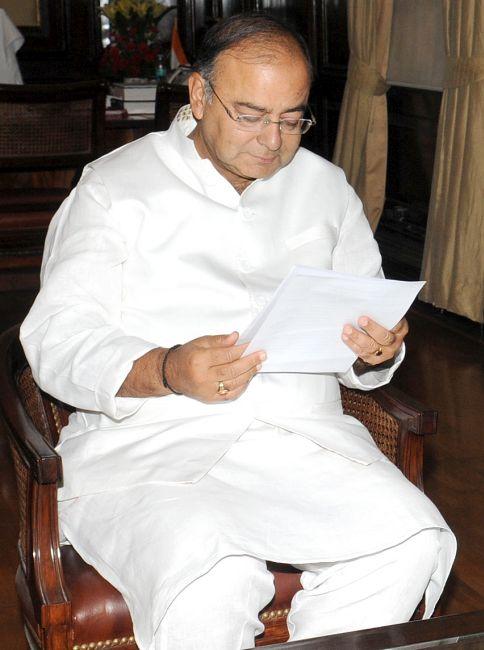

Photographs: Courtesy, PIB

Ahead of his maiden Budget, Finance Minister Arun Jaitley on Tuesday said the fiscal deficit needed to be maintained at an acceptable level through the expansion of economy and tax buoyancy rather than contracting expenditure.

Replying to supplementaries during Question Hour in the Rajya Sabha , he said fiscal prudence was required because if the deficit went out of control it would mean borrowing more to finance current expenditure.

“So, if we are borrowing more in order to finance the current expenditure, we are spending beyond our means. If we are spending beyond our means, we are going to leave behind a legacy of debt,” Jaitley said.

The fiscal deficit has to be “maintained at an acceptable level,” he said. “And, the current acceptable level, which is by the Fiscal Responsibility and Budget Management (FRBM ) Act, is that you have to move towards three per cent.”

“I would personally have been happier if the containment of fiscal deficit takes place by expansion of the economy, by greater tax buoyancy, by greater tax collection, rather than by contracting expenditure,” Jaitley added.

Please click NEXT for more...

Please click here for the Complete Coverage of Budget 2014 -15

Fiscal gap can be controlled through economic expansion: FM

Image: Fiscal deficit in 2013-14 was 4.5 per cent of the gross domestic product (GDP), down from 4.9 per cent in the previous year.Photographs: Reuters

Stating that fiscal deficit can be controlled by either collecting more revenues or by spending less, he said “When you spend less, you also tend to contract the expenditure and the economy.

Therefore, we will have to have a judicious mix of expenditure as well as revenue collections".

But in exceptional times like the 2008-09 global slowdown, fiscal deficit has to be put behind and come out with an economic stimulus, he said, adding that “these are circumstances where the fiscal deficit itself will rise”.

Fiscal deficit in 2013-14 was 4.5 per cent of the gross domestic product (GDP), down from 4.9 per cent in the previous year and 5.8 per cent in 2011-12, Jaitley said.

To reduce fiscal deficit below the desirable level and to improve macro-economic environment, the government has taken various measures for rationalisation of expenditure and optimisation of available resources.

Please click NEXT for more...

Please click here for the Complete Coverage of Budget 2014 -15

Fiscal gap can be controlled through economic expansion: FM

Photographs: Rupak De Chowdhuri/Reuters

The level of fiscal deficit during 2014-15 up to May is Rs 2,40,837 crore, 45.6 per cent of Budget Estimate of 2014-15, Jaitely said.

The government, he said, has adopted roadmap for fiscal consolidation following change to the FRBM Act, which provides for lowering fiscal deficit to three per cent of GDP.

“Despite several challenges, government has been steadfast in policy of fiscal rectitude. In the medium-term framework, the reduction in fiscal deficit has been designed with a judicious mix of reduction in total expenditure as percentage of GDP and improvement in gross tax revenue as percentage of GDP," Jaitley said.

Please click NEXT for more...

Please click here for the Complete Coverage of Budget 2014 -15

Fiscal gap can be controlled through economic expansion: FM

Image: The Government may focus on more revenue collection in the Budget.Photographs: Reuters

When P Rajeev (CPM) asked about Rs 5.01 lakh crore in uncollected taxes and another Rs 5.29 lakh crore (Rs 5.29 trillion) in revenue foregone by way of exemptions, the Finance Minister said tax collection drive will be intensified and there will be no laxity shown to those who owe taxes.

"As far as your other point is concerned about people from whom taxes are due and not collected, we certainly will intensify that action and I am one with you that those are the people to whom no laxity has to be shown," he said.

However, exemptions from payment of income tax to certain categories to give flip to industry were needed, he added.

Please click here for the Complete Coverage of Budget 2014 -15

article