| « Back to article | Print this article |

Why these CEOs would grab the headlines next year

For many Indian corporate leaders, 2012 was the year of survival. While many corporate leaders such as Anil Ambani grappled with raising funds for his telecom company, others like A M Naik of Larsen & Toubro was busy fighting slowdown and falling orders.

This was also a year when Mukesh Ambani made more news for fighting the petroleum ministry and an aggressive Comptroller and Auditor General than for the actual performance of his company.

For quite a few telecom heads, 2012 was a nightmare, as they spent more time with the Central Bureau of Investigation than their respective corner rooms.

But things could be better in the new year, as corporate India is hoping that 2013 will bring in some good news, with an aggressive government now going full steam ahead with economic reforms. And, quite a few are expected to grab the headlines in 2013.

Ta-Ta, Ratan: Tribute to an iconic Indian

Click NEXT to read more...

Why these CEOs would grab the headlines next year

Cyrus Mistry is one. The younger son of construction czar Pallonji Mistry is taking over as chairman of the $100-billion Tata Group at the end of this year. As successor to Ratan Tata, his every move will be analysed by stakeholders, lenders and, of course, the media.

Mistry, 44, has the benefit of his predecessor's deft handling of the group but he faces challenges - making the slowdown-hit Corus profitable in Europe and reducing the huge debt taken by Tata Steel for the acquisition is just one of these.

Or taking a call on Indian Hotels' "hostile" bid for Orient-Express, which will cost the group another $1.8 billion. The Orient board has rejected the bid - should it be revised or dropped?

But these are secondary to the main, partly intangible, task - how to transform the massive group, run by CEOs far senior to him, to a new-age, agile, one.

And, while Ratan Tata has said he's determined to give a free hand to Mistry, the former continues to remain chairman of the Tata trusts, which own 66 per cent in Tata Sons, the main holding company of the Group.

Ta-Ta, Ratan: Tribute to an iconic Indian

Click NEXT to read more...

Why these CEOs would grab the headlines next year

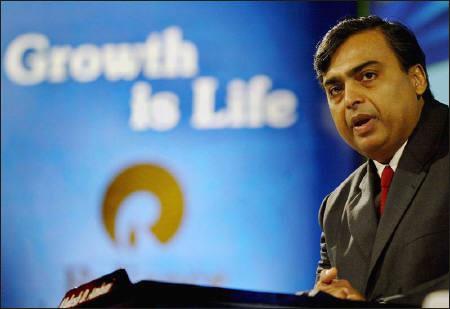

The country's 'richest man', Mukesh Ambani, 55, chairman of Reliance Industries, has been making news for a variety of not-so-pleasant reasons.

A refusal by the petroleum ministry to clear higher spending related to Reliance's Krishna-Godavari gas basin, plagued with sliding output, saw the minister departing - and renewed focus on RIL's alleged doings.

The Comptroller and Auditor General says Reliance showed inflated costs at the K-G basin to keep the government's share in profits down. Meanwhile, RIL continues to try hard to make a case for gas price increases.

Ambani will also launch his fourth-generation of wireless data services in 2013, in the backdrop of a growing buzz that the project has been delayed due to low demand of data services launched by competitors.

Ta-Ta, Ratan: Tribute to an iconic Indian

Click NEXT to read more...

Why these CEOs would grab the headlines next year

Among the corporate leaders, a financially bruised Vijay Mallya, 57, chairman of the UB Group, would certainly prefer to forget 2012. Once a media darling, its attention for several months has been to track the slow collapse of his debt-stricken airline, Kingfisher, with pilots and engineers striking work or quitting.

Several bankers whose money is stuck with his grounded wings, are waspish on the man and his plans. His staffers are owed back pay, fuel suppliers are owed much more and the income tax department is also keeping an eye on its charge.

Meanwhile, he's been the subject of queries on whether he's had to sell his 'family jewel', a majority stake in flagship United Spirits (stake to Diageo for $2 bn) to buffer his financial woes. Will he be able to pay and clear his name?

He has also submitted a plan to restart his airline, which the aviation ministry is still refusing to believe. The story will surely play out in 2013.

Ta-Ta, Ratan: Tribute to an iconic Indian

Click NEXT to read more...

Why these CEOs would grab the headlines next year

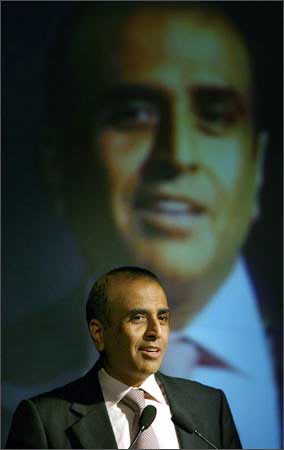

While Kingfisher was folding up, Sunil Mittal, 55, chairman of Bharti Airtel Ltd, launched the initial public offer (IPO) of Bharti Infratel, their telecom tower arm.

The IPO failed to get a good response from retail investors but Mittal has a bigger problem in his hand - a mountain of debt worth Rs 69,000 crore (Rs 690 billion) and falling profits.

Having made an ambitious takeover of the African assets of Zain for $9 billion in 2010, he's facing the same problem as others who acquired assets abroad - how to increase revenue to pay off the massive loans and also show the purchase made good sense.

Mittal will also be in the news for two other, tough, reasons. One, investigating agencies are probing if the group's 2006 joint venture with Walmart flouted the foreign direct investment norms.

Two, a Delhi court will hear the Central Bureau of Investigation chargesheet against the company for getting telecom spectrum in 2002 at a suspiciously low rate from the then government, allegedly at a huge loss to the treasury.

Ta-Ta, Ratan: Tribute to an iconic Indian

Click NEXT to read more...

Why these CEOs would grab the headlines next year

Some others will be watched for the acquisition moves they make in the new year - like one of corporate India's most successful fourth-generation entrepreneurs, Kumar Mangalam Birla, 45.

He's currently negotiating with the Jaypee group to buy its Gujarat cement units for Rs 4,390 crore (Rs 43.90 billion) and has made a series of acquisitions this year.

In April, Birla bought Pantaloon Retail from Kishore Biyani for Rs 1,600 crore (Rs 16 billion) and in May, a 27.5 per cent stake in Living Media, better known as the India Today publications group.

In July, he acquired Canadian pulp mill Terrace Bay for $110 million (Rs 600-crore) and announced he would be investing $250 mn (Rs 1,370 crore) more.

Birla is also looking for more assets abroad, especially in mining and cement. And, gradually taking over companies run by his grandfather, B K Birla, including Century Textiles.

Birla also withdrew an offer to buy Northern Iron in October as its asking price was too high. Next year, get set for more big-ticket announcements from his group.