Photographs: Courtesy, NMIA.

A series of mega projects that have faced bottlenecks and which the Cabinet Committee on Investments has to clear.

Land acquisition delays may push Navi Mumbai airport take-off to 2017

Aneesh Phadnis in Mumbai

Due to inordinate delays in land acquisition and securing environment clearance, among others, the second airport in Mumbai, the Navi Mumbai International Airport (NMIA), may not take off before 2017, according to experts.

The first phase of the airport was supposed to be operational by end-2014 or early 2015.

More than the delays, it will be cost escalation that will hurt the project, said industry observers. The first phase of the project is pegged at about Rs 9,000 crore. Any further delays could push up the costs, experts warned.

While the project has got environment clearance - which took a good three years - it is still grappling with issues related to land acquisition.

Land preparation, planning and construction of phase-1 could require about 50 months, according to a report by the Observer Research Foundation, which quoted Ansgar Sickert, former India head of German airport company Fraport.

"The Navi Mumbai Airport is critical for the city and the Indian economy, but we do not seem to demonstrate the urgency required to complete it. The project is likely to be operational by 2017-18, subject to it being put on fast track," says Kapil Kaul of Centre for Asia Pacific Aviation.

Delay in land acquisition has also resulted in a lag in issuing request for qualification ( RFQ) to shortlist bidders.

...

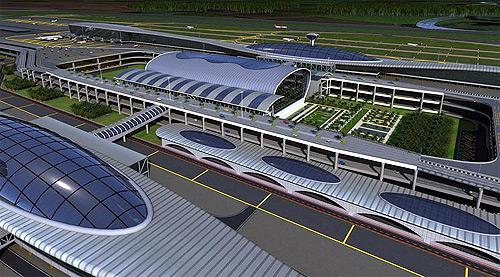

India's mega projects that face bottlenecks

Image: Navi Mumbai airport project.The City and Industrial Development Corporation of Maharashtra Ltd (Cidco), the nodal agency for the development of the airport, has said it will issue the RFQ only after the land acquisition issue is sorted out. A major hurdle is the large tracts of mangroves, which will need to be removed for the construction of the airport.

To do that, Cidco needs the approval of the Union forest ministry and the Bombay High Court. It can approach the high court only after getting a green signal from the Centre.

The shifting of power transmission towers about 5 km away from the airport site is pending. Plans for surface connectivity (by road and rail) to the new airport have also not been finalised.

"There is a lack of clarity and undue delay in the Navi Mumbai airport project. We have been talking with foreign companies for collaboration, but these companies too want to have a look at bid documents before taking any decision. They want some comfort,"' says a senior executive of a corporate house with interests in aviation. According to another executive, the bidding process and financial closure for the project could take up to an year.

The Navi Mumbai airport will be spread over 2,020 hectares and Cidco is yet to acquire 291 hectares, which are largely farm land. There is no agreement yet between Cidco and the land owners on compensation.

...

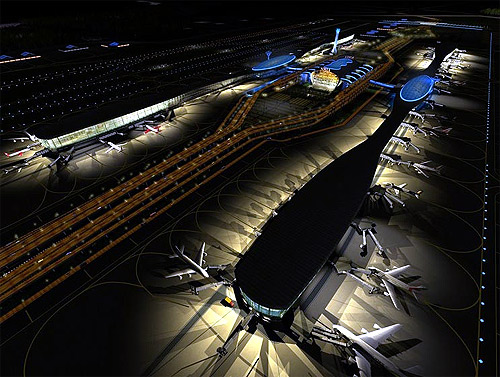

India's mega projects that face bottlenecks

Image: Navi Mumbai Airport project.Initially, the demand was for Rs 20 crore per acre, but that has now been given up.

"Cidco is offering 22 per cent of developed land in return, but some farmers are asking for 40 per cent land. They know the land is a gold mine," said a government official alluding to high returns the land can fetch. Cidco has large vacant land parcels which it can develop and allot to farmers in compensation. "We are amicably trying to settle the issue. A decision should be taken by February 2013," he said.

Maharashtra Chief Minister Prithviraj Chavan has conceded that the land acquisition process is 'painful' and 'slow'. He, however, refused to indicate a time frame for land acquisition or completion of phase I. He said the back channel negotiations are on going on. "We are working on alternate compensation models and will achieve results," he added.

The quest for second airport for Mumbai goes way back to 1969 when studies by the civil aviation ministry suggested expansion of existing facilities and creation of new second airport to cater to future growth. Actual planning began only in the 1990s. In 2001, Cidco prepared the techno feasibility report and the project received an in-principle approval from Union Cabinet in 2007.

Zurich Airport and US-based ADC & HAS Airports Worldwide (which has tied up with Essel Infrastructure) have shown interest in Navi Mumbai airport. Fraport, which is looking to exit from Delhi airport, too, may bid for it.

...

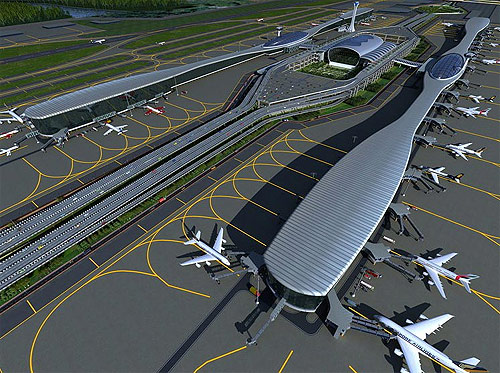

India's mega projects that face bottlenecks

Image: Navi Mumbai Airport project.According to Cidco estimates, pre-development work including land acquisition, rehabilitation of about 3,000 affected families, land reclamation, site preparation, and shifting of power transmission towers will cost about Rs 4,500 crore, half of the estimated cost of the first phase.

While Cidco will bear the pre development cost, there is no decision whether the same will be treated as Cidco's equity component in the project or will be passed on to the joint venture developing the project. Cidco also sought financial assistance from the Centre for pre-development costs, while developers, too, are requesting a viability gap funding for the project.

According to a Cidco official, unlike road projects that depend on toll collection, an airport will have various revenue streams and, hence, need not depend on viability gap funding.

However, in case the pre development cost is passed on to the joint venture, developers as yet do not know whether the selection criteria will be based on revenue-share to the government. "There is no information on funding options, but even if the cost of land acquisition is passed on to the developer, that cost will be recovered in form of higher tariffs,'' said a consultant.

...

India's mega projects that face bottlenecks

Image: Malana - 100MW Run-of-The-River Hydro Power Plant.Private equity firms' money stuck in Asian Genco projects

Singapore-based firm's projects here stuck in diverse controversies, cost overruns

Dev Chatterjee in Mumbai

In May 2010, Singapore-based Asian Genco Pte Ltd announced it had secured investments worth $425 million from a clutch of marquee private equity (PE) funds, to invest in the Indian power sector.

It was a big surprise. The funds included General Atlantic, Morgan Stanley, Norwest Partners, Everstone and Goldman Sachs, and not many had heard of Asian Genco.

The financing by the PE biggies was the biggest equity transaction in the power sector till 2010 and touted as endorsing the fundamentals of the sector in India. Today, all the marquee investors are wondering at the fate of their investments -- most projects of Asian Genco in India have been delayed considerably and face massive cost overruns.

The allegations of bending rules to get a power project from the government of Sikkim have further delayed commissioning. The company was reportedly close to Jagan Mohan Reddy, son of the late Andhra chief minister, Y S Rajasekhara Reddy, and former Union power secretary R V Shahi, helping it to bag projects. As Jagan fell out of favour, the fate of its projects, especially in Andhra, are also hanging in the balance.

...

India's mega projects that face bottlenecks

Image: Teesta - 1200MW Run-of-The-River Hydro Power Plant.The company's management, now operating from Hyderabad, has two big power projects in India under construction.

One is a 50 per cent stake in a 1,200 Mw hydro power project in Sikkim called Teesta Urja. The second is a 1,320 Mw thermal power project in Andhra Pradesh called East Coast Energy, to be set up with an investment of Rs 6,570 crore. It also operates a few small projects.

Work on East Coast Energy was suspended after police firing in February 2011, in which two people were killed, after locals protested against land acquisition. In an email, a spokesperson of Asian Genco said they were expecting to soon restart work at the site, in Srikakulam district.

The company said the cost overrun was on account of interest rate and forex rate fluctuations and it was difficult to put a number to it. Typically, these cost overruns are finalised in the quarter prior to the commissioing. The project cost is Rs 6,571 crore, with a debt/equity ratio of 3:1.

"The company was very aggressive in the initial stages and keen to complete by December 2014 (2x660 Mw configuration) but will now complete as per the original schedule of March 2015. The project has a contingency account, an industry-approved practice, that is around five per cent of the project cost and normally the cost overruns will be met from that fund," said the company.

...

India's mega projects that face bottlenecks

Image: Power Power House View of the Turbine Generator Set House View of the Turbine Generator Set.In its Sikkim project, the company had to offer 26 per cent stake to the state government for Rs 296 crore in July.

The project was marred by allegations that the local government allotted the projects to a company called Athena Projects Power Ltd, with no background in the sector, and later delayed offering the mandatory stake to the Sikkim government.

Athena later promoted a Special Purpose Vehicle called Teesta Urja to enter into the JV with the Sikkim government later and become eligible for the project.

The company blames an earthquake in 2011 for its woes and the dispute with the government over the allocation of shares.

...

India's mega projects that face bottlenecks

The project cost has shot up to Rs 8,600 crore from its original one of Rs 5,700 crore. It is now expecting to commission the project by December 2013, two years behind schedule.

A company statement says the sector is witnessing huge issues related to fuel supply, land acquisition, financing, policy hurdles at the state and Centre, environmental clearance and the protests against setting up of any power plant across the country.

"While alternative energy is a good alternative, there are issues in terms of capacity addition, cost of power generated from wind and solar, besides huge land tracts required. It will definitely work as a complement to the existing energy sources but will take a long time to become a viable alternative," the company says.

As for the PEs whch sunk millions of dollars into the project, they remain in a wait and watch mode.

...

India's mega projects that face bottlenecks

Image: NTPC project.NTPC-RIL dispute on Gujarat power plants stuck in HC

BS Reporter in Mumbai

For the past 29 months, the court case between NTPC and Reliance Industries (RIL) on two gas-based power plants in Gujarat has not come for hearing at the high court here.

NTPC took RIL to court in December 2005, after the latter would not sign a gas sale and purchase agreement (GSPA) because of a dispute over a clause relating to unlimited liability.

It contends expansion of its Kawas and Gandhar plants have been delayed indefinitely, thanks to RIL.

NTPC planned to expand these two gas-based plants, whose present capacity is 645 Mw by another 645 Mw each.

This was planned in 2002, when the cost of setting up each Mw was Rs 3.25 crore and would have cost NTPC a total of Rs 2,128 crore. In the past decade, the cost of setting up each Mw has gone up to Rs 4.5 crore and the total bill to nearly Rs 2,950 crore.

...

India's mega projects that face bottlenecks

Image: Project Kawas.An NTPC executive said the company requested the government for allocation of gas to the projects but this did not happen.

NTPC had invited a bid for supply of natural gas to these projects in October 2002 and RIL had emerged the sole successful bidder.

It won the right to supply 12 million standard cubic metres a day (mscmd) of gas to NTPC's projects in Gujarat at $2.34 for a million British thermal units (mBtu).

RIL had quoted the lowest price in 2004 in the bidding process and was subsequently issued a letter of intent (LoI). NTPC says it has a concluded contract but RIL that matters did not go beyond an LoI.

...

India's mega projects that face bottlenecks

Image: NTPC.NTPC generates power from coal and gas. It has an installed capacity of 39,674 Mw of which around 3,955 Mw is gas-based.

It has gas sales and transmission contracts ( GSTCs) with GAIL for supply of administered price mechanism ( APM) gas and Panna Mukta Tapti (PMT) gas to Anta, Auraiya, Dadri, Faridabad, Kawas & Gandhar for a combined quantity of 14.48 mscmd. The validity of the APM gas agreements are till July 2021, while the PMT gas agreements are valid till December 2019.

The Government of India allocated 4.46 mscmd of KG-D6 gas (from RIL's Krishna-Godavari basin field) for NTPC's stations at Anta, Auraiya, Dadri & Faridabad.

The company in its 2011-12 annual report said GSPAs were signed with RIL and its joint venture partners, Niko and BP, for supply of 2.3 mscmd, valid till March 2014. The ministry of petroleum and natural gas has directed RIL and its JV partners to sign a GSPA for the balance quantity of 2.16 mscmd.

...

India's mega projects that face bottlenecks

Vedanta Aluminium's trials with regulatory approvals continue

Abhineet Kumar in Mumbai

Early this month, billionaire Anil Agarwal-promoted Vedanta Group was forced to shut its one million tonnes per annum alumina refinery at Lanjigarh in Odisha's Kalahandi district due to unavailability of bauxite, 15 years after state-owned Orissa Mining Corporation signed over its rights to mine bauxite in the Niyamgiri Hills to the group firm.

The group has invested Rs 30,000 crore in six years to set up the aluminium business under Vedanta Aluminium, believing it would be able to get approvals for captive bauxite mines by the time the facilities get commissioned.

Eventually, it commissioned a 1 mtpa refiner, a 0.5 mtpa smelter and a 1,215 Mw captive power plant, but approval for bauxite mining did not come.

"In such a state of affairs, it would be difficult for the projects to come up," said Mukesh Kumar, CEO of Vedanta Aluminium over phone from Orissa. The company is looking at laying off a substantial number of its 550 direct employees under Section 5 of the Industrial Dispute Act. The closure of the plant has affected 2,500 contractual employees.

In September 2004, the ministry of environment and Forest (MoEF) granted environment clearance for the refinery and in October 2004, Vedanta Aluminum started the construction of the refinery. It was completed in early 2008 and alumina production was started soon after.

...

India's mega projects that face bottlenecks

The Supreme Court started hearing on the three petitions against bauxite mining at Niyamgiri and granted clearance with conditions on sustainable development.

Then, the MoEF granted an in-principle environment clearance for the mining project. In August 2010, it reversed its decision and rejected the forest clearance for the Niyamgiri Mines to OMC under protest from non-government organisations.

This way, Vedanta Aluminium lost its source of captive bauxite. OMC has appealed in the Supreme Court against the MoFE's rejection of forest approval and the next hearing is expected in January. The company struggled for over three months to ensure that sustainable supplies of bauxite from Gujarat and other states before the closure of the plant.

"We believe it is now extremely unlikely that the company will get access to the bauxite in Niyamgiri hills," said Abhijeet Naik, analyst with global brokerage firm CLSA in a recent report. "Given this setback, Vedanta Aluminium is pursuing the government of Orissa for allocation of an alternate source of bauxite for its alumina refinery," he said.

...

India's mega projects that face bottlenecks

Even if a bauxite mine allocation happens soon, it will have to spend years trying to get various clearances for the new mine, which will be followed by a mine development period.

"It seems there would not be any relief on the bauxite mining front over FY13-17," the report said, which added that FY18 is the earliest that the company might benefit from the availability of captive bauxite.

According to industry observers, the days of free mine allocations to the corporate sector are over. Once the mining Bill is passed, metal companies will have to participate in a bidding process to get access to mineral resources. In that case, Vedanta Aluminium will have to participate in a bidding process for any future bauxite mine allotment, which could substantially eat into the economic benefits of having captive bauxite.

This has led to deterioration of Vedanta Aluminium's financial position. According to analysts' estimates, the company is expected to register Ebitda (earnings before interest, tax, depreciation and amortization) of Rs 200- 450 crore over 2012-13 given its high cost structure. This is extremely low in the context of the high level of capital expenditure (Rs 30,000 crore) incurred on the commissioned and un-commissioned facility and the total net debt of Rs 29,500 crore.

| HOW IT UNFOLDED | |

| Date | Events |

| Apr-97 | OMC signed over its rights to mine bauxite in the Niyamgiri Hills to Vedanta Group. |

| Sep-04 | MoEF's environmental clearance for refinery. |

| Oct-04 | VAL begins construction of refinery |

| Nov-04 | Supreme Court (SC) starts hearings on three petitions against bauxite mining at Niyamgiri |

| Early 2008 | VAL starts alumina production. |

| Aug-08 | SC clearance to forest diversion proposal for mining, with conditions |

| Apr-09 | MoEF "in principle" environmental clearance for mining project |

| Aug-10 | MoEF rejects forest clearance for Niyamgiri mines to OMC |

| Oct-10 | OMC writ petition in SC against cancellation |

| Jul-11 | MoEF cancels environmental clearance for OMC |

| Aug-11 | OMC application in SC against cancellation |

| Source: Analyst Reports |

...

India's mega projects that face bottlenecks

Photographs: Courtesy, Hindalco.

Trouble brews for Utkal alumina project as locals raise new demands

Hrusikesh Mohanty and Dillip Satapathy in Bhubaneswar

Even after 20 years and investments of over Rs 5,000 crore, the 1.5-million-tonne alumina refinery project of Utkal Alumina International Ltd (UAIL), a subsidiary of the Kumar Mangalam Birla's Hindalco, is yet to see the light of the day.

As the company gears up to give a final push to complete the refinery work by the first quarter of 2013, renewed call of the project opponents to intensify their stir against the projects signals fresh troubles ahead for the company.

The war cry was given on Sunday, when several tribal people gathered at Maikanch, near the UAIL's project site in Rayagada to pay tribute to the three persons killed in police firing on agitators protesting against land acquisition for the plant 12 years ago.

Utkal Alumina was conceived in 1992 to tap huge deposits of bauxite in the area and produce alumina. The project, however, was in the line of fire of the environmentalists and project affected people, for which it was languishing for last two decades. The actual work on the project could only be taken up in 2008.

...

India's mega projects that face bottlenecks

Enthused by the Union government's closure of Vedanta refinery on environmental grounds, the project opponents vow to renew their second phase of agitation, with the target now shifting to excavation of bauxite at Baphilimali. This was the captive mine allotted to the company near the plant site. "We are opposed to bauxite mining in the area.

Once the mining starts, we will lose our livelihood," said Bhagaban Majhi, president of Prakutika Sampada Surakhya Parishad (PSSP), the organisation spearheading the anti-mining agitation. The group demanded infrastructure development of the affected villages before starting of the mining activity.

The protest comes at a bad time, as almost 90 per cent construction work of the 1.5-million-tonne-per-annum (tpa) capacity green field project at Doragurah, with a total estimated cost of Rs 7,500 crore, has already been completed.

"The pre-commissioning trial is expected in February, with the trial production scheduled from April 1, 2013," said senior vice-president of Utkal Alumina, Ramesh Kumar. Unlike the Niyamgiri deposits of Vedanta Aluminium's Lanjigarh refinery in Kalahandi, UAIL's mining proposal does not face any environment hurdles. But, the opposition of local tribals is expected to thwart the company's plant to start bauxite mining in near future.

...

India's mega projects that face bottlenecks

Photographs: Courtesy, Hindalco.

"Of course, there are some problems. But, we are here to solve those," quipped a company official. "We have no problem for bauxite mining, as we have got all the clearances in Baphilimali in 2000," he said.

Utkal Alumina got clearance for the mining of 8.5 million tonnes of bauxite at Baphilimali and Podingamali in Rayagada and Kalahandi districts, respectively. The bauxite reserves in these mines are estimated to be around 200 million tonnes. The company initially plans to raise 4.5 million tonnes of bauxite annually for its 1.5 mtpa plant.

Prafulla Samantara, a social activist who was involved in anti-mining agitation by the tribals in Lanjigarh and Kashipur, raised questions over the renewal of mining lease of UAIL. "The mining lease of UAIL expired during 2004-05, and the company could not start mining by that time. Without public hearing how can it be granted fresh lease?'' he asked.

Worried over the delay in implementation of the project, the two original joint venture partners, Tata Sons and Norsk Hydro, had earlier pulled out of the project, while another foreign partner, Alcan, had sold off its stake to Hindalco in 2007.

Hindlaco plans to send the alumina produced by Utkal Alumina to two of its upcoming smelter plants at Lapanga in Orissa's Sambalpur district and Mahan aluminium project in Madhya Pradesh.

article