| « Back to article | Print this article |

Oil sector: Arbitrariness shakes investor confidence

Arbitrary decisions on the $8.48 billion Cairn-Vedanta deal and BP's $7.2 billion stake buy in Reliance Industries' oil and gas properties has shaken investor confidence in the world's third-largest energy consumer in an eventful year.

The way the government treated miner Vedanta Resources' proposal to buy majority of UK's Cairn Energy in Cairn India and RIL selling 30 per cent of its stake in 23 properties, including the prolific KG-D6 gas block to BP, goes to the heart of the mistrust between India Inc and United Progressive Alliance-2 in 2011.

Click NEXT to read further. . .

Oil sector: Arbitrariness shakes investor confidence

First the government arm-twisted Cairn and Vedanta into accepting to pay royalty and cess on the all-important Rajasthan oilfields for conclusion of the deal.

As it appeared that the 15-month long saga is over, Oil Ministry sent the proposal back to the Cabinet for approval citing bunch of red flags that Home Ministry, in its security clearance, had raised on alleged global and domestic 'transgressions' by Vedanta and its subsidiaries.

While Oil Ministry recommended allowing the share transaction as the concerns highlights had 'no bearing whatsoever on the security aspects', for two companies who had earlier this month concluded the deal after protracted wrangling with the government, lays potential legal danger if any of the Cabinet ministers were to object.

Click NEXT to read further. . .

Oil sector: Arbitrariness shakes investor confidence

Billed as the largest foreign direct investment in the country, RIL-BP deal should have gone through as a matter of routine but the Oil Ministry sent the proposal to Cabinet for approval.

But five months after the Cabinet approval, Europe's second largest oil firm is yet to get a finger in the pie as the ministry and its technical arm Directorate General of Hydrocarbons used whimsical reasons like absence of fax number of BP's India head to delay signing of an amendment to the Production Sharing Contract.

While BP inched to help check fall in output from KG-D6, the ministry went after RIL for output falling short of the target by seeking to disallow part of its already spent cost on the fields.

Click NEXT to read further. . .

Oil sector: Arbitrariness shakes investor confidence

RIL saw this has violation of the signed contract and slapped an arbitration notice.

Its cause was also not helped by the ministry and DGH sitting on approvals for development of other fields in the KG-D6 block for months and even delaying declaring finds commercial.

Not just in KG-D6, the ministry also blocked Cairn India from enhancing production from the Mangala oilfield in the Rajasthan block and starting output from other fields.

For a nation which is net energy importer, not allowing exploitation of its own resources came as a shock to the investor community.

Click NEXT to read further. . .

Oil sector: Arbitrariness shakes investor confidence

What was shocking for the investor community was the inept handling of issues at the Oil Ministry, which early in the year saw a change of guard in self-claimed socialist democrat S Jaipal Reddy replacing industrialist-turn-politician Murli Deora as the Minister for Petroleum and Natural Gas.

The ministry kept postponing decision on crucial issues and on occasions stood direct confrontation with the industry.

Using last year's Supreme Court verdict in a gas dispute between RIL and Reliance Natural Resources Ltd, the ministry stripped producers of all powers to allocate gas and cut supplies to steel plants when output from KG-D6 fields dropped by 30 per cent.

Click NEXT to read further. . .

Oil sector: Arbitrariness shakes investor confidence

The sector has already seen global giants like Petrobras of Brazil and Statoil of Norway exiting because of approvals for their participation in state-owned Oil and Natural Gas Corporation's gas blocks didn't come in time.

Eni of Italy, BG Group of UK and Santos of Australia also started winding up with exploration portfolio in the country.

BHP Billiton, which was the showpiece investor in the seventh licensing round a few years back, could not begin exploration due to lack of defence clearance.

Click NEXT to read further. . .

Oil sector: Arbitrariness shakes investor confidence

The highlight of the year was also the much awaited report of the Comptroller and Auditor General that was sharply critical of the oil ministry and DGH.

CAG in its September report sharply criticised the ministry for not exercising adequate oversight and control over procurements done by RIL and allowing the private firm to retain the entire 7,645 sq km KG-D6 block in the Bay of Bengal in violation of the contract.

The much anticipated fuel pricing reforms never happened.

Click NEXT to read further. . .

Oil sector: Arbitrariness shakes investor confidence

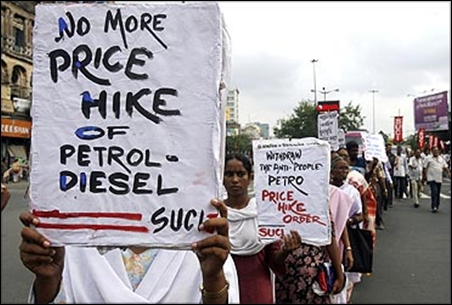

Though the government had in June, 2010 given state-owned oil firms freedom to fix petrol price, politics dictated rate fixing for most of the year.

Though towards the end of the year, there was some movement towards revising retail rates every fortnight in line with cost, it remains to be seen if the momentum can be kept keeping in mind the assembly election to crucial states like Uttar Pradesh.

The promised deregulation of diesel prices never happened and attempts to cut subsidy in kerosene and LPG couldn't go past the political muster.

Click NEXT to read further. . .

Oil sector: Arbitrariness shakes investor confidence

The government's attempts to sell part of its stake in ONGC and Indian Oil Corporation to raise money to fund budget deficit fell flat because of market volatility.

After brief lull, refining capacity expansions gained momentum with state-owned firm planning not just brown-field increase in capacity addition but also greenfield units particularly on the west coast.

But overseas acquisitions looked to have taken a backseat with no big-ticket acquisition being announced.