Photographs: Reuters Bibhu Ranjan Mishra in Bangalore

Wipro's decision to separate its information technology (IT) and non-IT businesses is meant to give a clear focus on the former in these challenging times - global IT spending is down, margins are under pressure, and Cognizant is fast emerging as a serious challenger to the big three (TCS, Infosys and Wipro).

The demerger is also expected to give a boost to the non-IT business. It will be housed in a new unlisted company, Wipro Enterprises.

At the moment, the Bangalore-headquartered company has three non-IT strategic business units: Wipro Consumer Care & Lighting (fast-moving consumer goods, lighting and furniture), Wipro Infrastructure Engineering and Wipro GE Healthcare Private Limited (in a strategic 49:51 venture with General Electric).

The reason for the demerger is that non-IT business has become large enough to demand a separate focus.

Wipro had started life in 1945 as a vegetable oil manufacturer in Amalner, Maharashtra. The company, at that time, was known as Western India Products Ltd, which was later shortened to Wipro.

Its main area of business was the production of sunflower vanaspati oil, and later on, soaps and other consumer care products.

When Azim Premji, the billionaire chairman of Wipro, took charge of the company in 1966, all he inherited was an oil mill, a solvent plant and the vanaspati business.

Most of the non-IT businesses of the company were built by him much before the company forayed into IT. Though IT may have put Wipro on the global map, the non-IT business is still close to Premji's heart.

Vineet Agarwal, president of Wipro Consumer Care & Lighting, says: "He is very passionate about it. He still goes to our factories; meets our customers. That's the business he has built over time. He understands it very well.

...

Why Wipro's demerger is good for investors

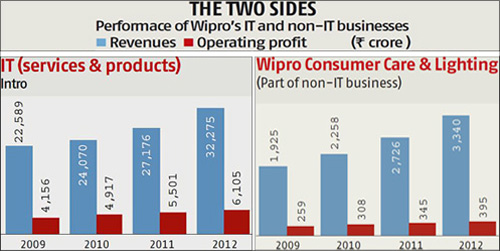

Image: Performance of Wipro's IT and non-IT businessesPhotographs: Business Standard

When the demerger was announced on November 1, N Vaghul, independent director on the Wipro board, had said the decision was triggered by "the fact that the non-IT businesses have now reached critical mass, and, if we wait for some more time, it will not be possible for us to segregate these businesses."

What the demerger really signifies is that Premji wants to grow this business, perhaps as a hedge against the hugely commoditised IT business, and could take the inorganic route for that.

Here's why. When it comes to acquisitions, IT companies come cheaper than, say FMCG companies, in terms of price/sale. Normally, an IT company is valued at 1 to 1.5 times its annual sales turnover, while an FMCG company costs two-three times, at times even seven-eight times.

This is because IT services is not a branded business like FMCG. Wipro, for instance, had acquired Singapore-based FMCG company Unza Holdings for about $246 million (approximately Rs 1,010 crore in 2007), roughly about 1.8 times of its then sales turnover.

Wipro shareholders, because they come with an IT mindset, are unlikely to take kindly to such high valuations. "Evaluation criteria are quite different. Now, we don't have to be captured by that," says Agarwal.

All the three non-IT business units generate enough cash in their balance sheets every year. This is the reason why once the separation is complete, Wipro Enterprises would be a debt-free company with healthy cash flows.

Based on the demerger scheme, the new entity (Wipro Enterprises) will have cash and cash equivalents of Rs 1492.2 crore, as of March 31, 2012.

"We were never a cash-sucking business for Wipro. We generate enough cash, which we have used for many of our inorganic activities and we will continue to do so," says Agarwal. "We want to be the fastest-growing from a top line perspective with a healthy margin."

...

Why Wipro's demerger is good for investors

Photographs: Reuters

However, because they were part of an IT giant, these businesses didn't get as much visibility as the other companies in their sectors enjoyed.

Now, with the separation from Wipro, the non-IT businesses, according to senior executives, will have greater autonomy with their own set of directors on the board, and the ability to reinvest back into the business for future growth.

An ostensible reason for the demerger was the low profitability of the non-IT business, which was a drag on Wipro's bottom line. It accounts for 14 per cent of the company's turnover but only 6 per cent of its operating profit.

Agarwal admits that the return on capital employed, or ROCE, for the IT and non-IT business is quite different. "For example, while Wipro Consumer Care & Lighting's ROCE is about 19 per cent, it is much higher in the case of IT."

Still, the company says that profit margins in the non-IT businesses are comparable with the industry. Premji had said, when the demerger was announced, that each of his businesses "is the best of breed in its respective industry."

Wipro Consumer Care & Lighting, which will be the largest part of Wipro Enterprises, posted an operating profit margin of 11.8 per cent in 2011-12, while in the previous year it was 12.7 per cent.

In the first half of the current financial year, the operating margin is 11.4 per cent, according to the company. Compared to this, Hindustan Unilever's operating margin in the first half of the year was 13.3 per cent, Marico's 10.7 per cent, Dabur's 15.3 per cent, and Procter & Gamble's 9.5 per cent.

Wipro's Santoor is the third-largest soap brand in India, commanding a market share of 8.8 per cent (in October 2012), behind Hindustan Unilever's Lifebuoy and Lux.

Overall, in the Rs 10,000-crore-per-annum soap market, Wipro stands third after Hindustan Unilever and Godrej Consumer Products.

...

Why Wipro's demerger is good for investors

Image: People walk in the Wipro campus in BangalorePhotographs: Punit Paranjpe/Reuters

In the indoor lighting business, the company claims to hold the number one position with Philips, while in the commercial lighting it ranks number three.

The furniture business, the newest offering of Wipro, has already reached the number two position in the market led by Godrej.

Wipro Consumer Care & Lighting has done a string of acquisitions in the last nine years: Glucovita in 2003, Chandrika soap in 2004, North-West switches in 2006, Unza in 2007 and Yardley in 2009.

The other businesses, too, are doing well. For example, Wipro Infrastructure Engineering is today the world's largest independent hydraulics cylinder manufacturer. "It's the little untold story of Wipro," says Pratik Kumar, the president of that business, which has a footprint in emerging as well as matured markets like China, Sweden and Brazil.

The second biggest part of Wipro Enterprises, Wipro Infrastructure Engineering supplies hydraulic cylinders to global original equipment manufacturers like Caterpillar, JCB, John Deere, Volvo and CNH Global.

It commands over 70 per cent market share in India where it derives about 55 per cent of its revenues, and has also been able to establish a base in Europe.

The next big market, says Kumar, is the US, being catered by the company from its factories in Brazil and India. In the next 10-18 months, Wipro Infrastructure Engineering is planning to establish a manufacturing presence in the US which could start "in a small way".

"From the long-term point of view, we remain very bullish and confident. Hence, we continue to invest in new markets and in building capacity, and, we make sure our products meet global benchmarks," says Kumar.

article